Key Takeaways

- Aggressive expansion into blockchain gaming and new international markets is driving revenue diversification and supporting stronger recurring and high-margin earnings streams.

- Innovative monetization using WEMIX tokens and partnerships is boosting operating leverage while cloud technology enables global user growth and cost-efficient scaling.

- Heavy reliance on aging franchises, risky blockchain investments, and high costs threaten profitability amid regulatory, localization, and consumer preference challenges in global markets.

Catalysts

About WemadeLtd- Develops and publishes games in South Korea and internationally.

- The ongoing global proliferation of blockchain and Web3 technologies is expected to drive increased engagement and monetization in Wemade's expanding WEMIX ecosystem, especially as more blockchain games are onboarded in 2025 and advanced tokenomics are implemented (positive for topline revenue and transaction-based earnings).

- The rapid growth in digital entertainment consumption, particularly in emerging markets, underpins Wemade's aggressive push into China (with Mir M) and its tailored game development for Japan and North America, positioning the company for future international revenue diversification and overall earnings growth.

- Increased consumer appetite for digital assets and in-game purchases is fueling the success of newly launched titles (Legend of Ymir, Lost Sword), while the shift to innovative monetization models-such as direct utilization of WEMIX tokens in gameplay and marketplace interactions-should strengthen recurring revenue and improve margins.

- Advances in cloud gaming and digital infrastructure are enabling faster and broader onboarding of users globally, supporting Wemade's multi-title launch strategy and facilitating cost-efficient scaling, which is likely to enhance operating leverage and net margins over time.

- The steady expansion of licensing and strategic partnerships (especially through the WEMIX ecosystem and with Chinese developers) is expected to create incremental, higher-margin revenue streams and support more stable long-term earnings.

WemadeLtd Future Earnings and Revenue Growth

Assumptions

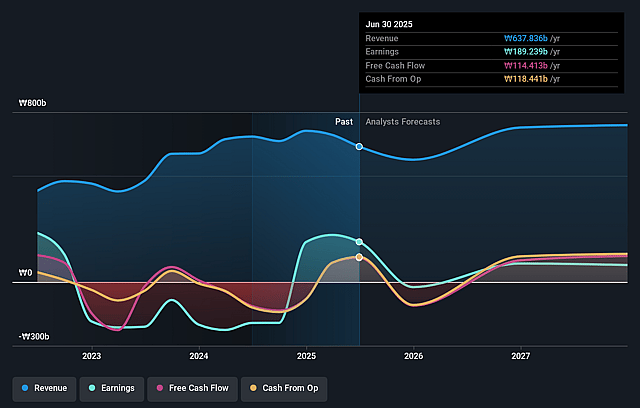

How have these above catalysts been quantified?- Analysts are assuming WemadeLtd's revenue will grow by 7.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 29.7% today to 6.8% in 3 years time.

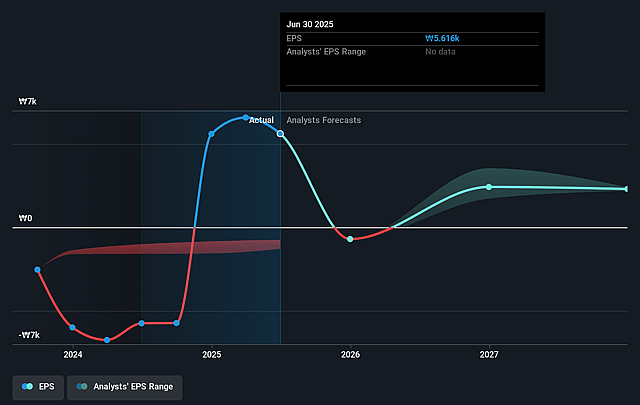

- Analysts expect earnings to reach ₩53.1 billion (and earnings per share of ₩2305.0) by about September 2028, down from ₩189.2 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.3x on those 2028 earnings, up from 4.9x today. This future PE is greater than the current PE for the KR Entertainment industry at 16.0x.

- Analysts expect the number of shares outstanding to grow by 0.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.75%, as per the Simply Wall St company report.

WemadeLtd Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Overreliance on flagship MMORPG franchises like Legend of Ymir and Mir IP exposes WemadeLtd to significant revenue concentration risk, as revenues from core titles are already showing signs of quarter-on-quarter and year-on-year declines when initial momentum fades or major updates subside, risking further stagnation if new titles fail to deliver similar success-adversely impacting long-term revenue and earnings growth.

- WemadeLtd's aggressive investments in blockchain integration (WEMIX, tokenomics, NFT functionalities) and the ongoing reorganization of its blockchain business elevate risks tied to evolving international and domestic regulatory scrutiny, as well as technological obsolescence; setbacks such as termination of WEMIX transaction support domestically or adverse regulatory decisions could materially compress net margins and impair the company's asset values.

- International expansion, particularly into highly regulated and competitive markets like China, Japan, and the U.S., faces substantial localization and regulatory hurdles-success is uncertain given the company's acknowledgment of underperformance in Korea for certain titles (e.g., Mir M), differing gamer preferences, and the lengthy process of acquiring necessary local approvals, all of which could dampen global revenue diversification efforts and limit future topline growth.

- Intensifying reliance on heavy marketing spend (with recent 22% Q-o-Q increases) and increased operating expenses from acquisitions (like MADNGINE) could erode profit margins if the lifetime value of newly acquired or retained users does not keep pace with growing costs, potentially undermining long-term earnings despite periodic revenue surges from new releases.

- Ongoing negative net income and operating losses (despite narrowing) highlight a precarious financial position; if secular trends such as tightening regulation on in-game monetization, a global shift in consumer discretionary spending, or increasing public scrutiny around blockchain gaming accelerate, multiple product lines may experience constrained revenues, rising compliance costs, and further margin compression.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩37000.0 for WemadeLtd based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩785.6 billion, earnings will come to ₩53.1 billion, and it would be trading on a PE ratio of 31.3x, assuming you use a discount rate of 9.7%.

- Given the current share price of ₩27300.0, the analyst price target of ₩37000.0 is 26.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.