Key Takeaways

- Expanding export deliveries, strategic acquisitions, and global naval project participation position Hanwha Aerospace for higher revenue, margin growth, and elevated long-term value.

- Investments in advanced propulsion, dual-use defense tech, and international expansion fuel recurring revenue, margin expansion, and enhanced technological leadership across key global markets.

- Dependence on government contracts and international expansion exposes Hanwha Aerospace to policy shifts, execution risks, financial strain, and intensified competition, threatening profitability and growth.

Catalysts

About Hanwha Aerospace- Engages in the development, production, and maintenance of aircraft engines worldwide.

- Analyst consensus projects approximately 20% revenue growth in Land Systems for 2025, but this may understate potential upside as robust export deliveries to Poland, Australia, and Egypt are set to materially exceed forecasts, especially with expanded order backlogs, likely resulting in both higher revenue and stronger net margins than currently anticipated.

- While analysts broadly agree that Hanwha Ocean's consolidation will boost synergies and control, the additional 7.3% stake acquisition positions Hanwha Aerospace to capitalize aggressively on the U.S. Navy and global naval defense programs, potentially elevating long-term earnings growth and enterprise value well above current expectations.

- Rapid fleet aging and the expected rebound in commercial aircraft deliveries will create sustained demand for new engines and MRO services, enabling the Aerospace division to capture market share and drive a structural uplift in long-term recurring revenue and profit streams.

- Hanwha Aerospace's focused R&D investments in next-generation, eco-friendly propulsion and dual-use defense technologies put it at the forefront of future defense procurement cycles, enabling margin expansion through premium product offerings and participation in green defense initiatives globally.

- The company's proactive internationalization strategy, with targeted regional expansion across Europe, the Middle East, and Asia-Pacific and its expanding capabilities in satellite, space, and autonomous systems, will drive top-line growth, diversify revenue risks, and support premium valuations through enhanced resilience and technological leadership.

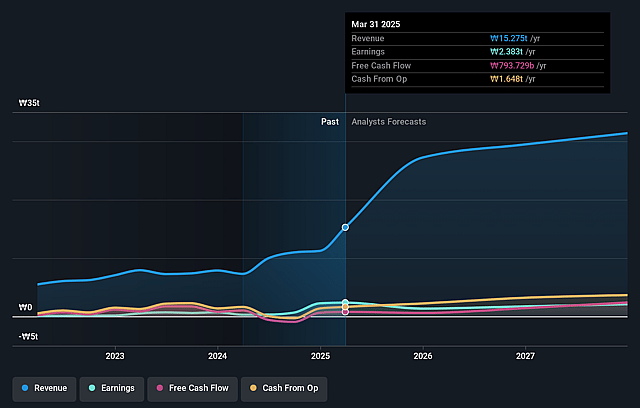

Hanwha Aerospace Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Hanwha Aerospace compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Hanwha Aerospace's revenue will grow by 25.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 12.7% today to 10.2% in 3 years time.

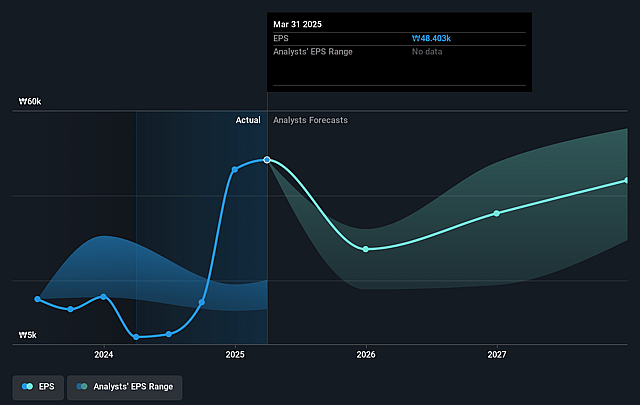

- The bullish analysts expect earnings to reach ₩3861.6 billion (and earnings per share of ₩77039.27) by about September 2028, up from ₩2441.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 27.1x on those 2028 earnings, up from 20.4x today. This future PE is greater than the current PE for the KR Aerospace & Defense industry at 26.7x.

- Analysts expect the number of shares outstanding to grow by 3.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.19%, as per the Simply Wall St company report.

Hanwha Aerospace Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increased global focus on environmental sustainability and emissions reduction, along with shifting social attitudes, could lead to reduced or restricted government funding for the defense sector, ultimately threatening Hanwha Aerospace's contract growth and resulting in slower revenue and suppressed profit margins over the long term.

- The company's heavy reliance on government defense contracts, particularly from South Korea and a small set of international clients, exposes it to policy and budget shifts that could directly pressure Hanwha Aerospace's top-line revenue and earnings stability if defense spending priorities or geopolitical alignments change.

- Efforts to expand internationally, including the acquisition of Hanwha Ocean and plans to enter the US shipbuilding market, heighten execution risk in the form of regulatory hurdles, unfamiliarity with overseas markets, and potential project overruns-factors that could undermine profitability and dilute net margins if not successfully managed.

- The aerospace division's persistent operating losses, notably related to the GTF RSP program and ongoing heavy R&D and capital expenditure requirements, risk outpacing operational cash flow and could strain free cash flow, pressuring the company's ability to sustain dividend payouts and reinvest in growth initiatives.

- Heightened global competition, particularly from low-cost producers or state-sponsored defense companies, as well as risks of supply chain disruptions in critical components, could erode Hanwha Aerospace's pricing power and reliability, leading to increased costs, negative impacts on net income, and potential market share loss.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Hanwha Aerospace is ₩1450000.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Hanwha Aerospace's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩1450000.0, and the most bearish reporting a price target of just ₩1000000.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₩37734.7 billion, earnings will come to ₩3861.6 billion, and it would be trading on a PE ratio of 27.1x, assuming you use a discount rate of 8.2%.

- Given the current share price of ₩967000.0, the bullish analyst price target of ₩1450000.0 is 33.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Hanwha Aerospace?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.