Key Takeaways

- Growing ESG pressure, export barriers, and demographic challenges threaten Hanwha Aerospace's capital access, cost structure, and overseas expansion prospects.

- Reliance on domestic defense contracts and lagging innovation exposes the company to policy risk, competitive disruption, and weaker profit potential.

- Geopolitical demand, strategic acquisitions, and investments in productivity and exports position Hanwha Aerospace for sustained growth, diversified revenues, and resilient profit margins.

Catalysts

About Hanwha Aerospace- Engages in the development, production, and maintenance of aircraft engines worldwide.

- Increasing global calls for sustainability and the growing momentum behind ESG-focused investment are expected to drive institutional divestment from defense companies like Hanwha Aerospace, potentially restricting access to capital markets and resulting in reduced valuation multiples, which will negatively affect both long-term earnings growth and share price stability.

- With tighter international export controls and the risk of rising geopolitical deglobalization, Hanwha Aerospace may face greater hurdles in winning overseas defense contracts, especially as governments implement stricter technology transfer requirements and sanctions, ultimately constraining the company's international revenue expansion and export growth trajectory.

- Persistent demographic challenges, particularly shrinking workforces in South Korea and key European markets, are likely to foster higher labor costs and intensify competition for skilled talent, eroding net margins and significantly impinging on the operational flexibility required for sustained innovation and production scale.

- The company's heavy reliance on volatile, large-scale South Korean government contracts exposes core revenue streams to the risk of abrupt policy shifts or defense spending cuts, which could sharply reduce order flow, pressure operating profit, and threaten future backlog stability.

- Rapid advancements by global competitors in unmanned, AI-enabled, and eco-friendly defense platforms could outpace Hanwha Aerospace's innovation efforts, creating the risk that its costly R&D initiatives may fail to translate into market share gains or enhanced margins, resulting in below-expectation returns on investment and deterioration of long-term earnings.

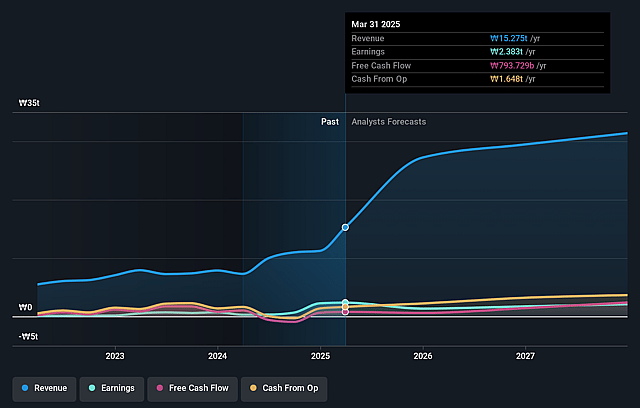

Hanwha Aerospace Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Hanwha Aerospace compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Hanwha Aerospace's revenue will grow by 18.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 12.7% today to 4.9% in 3 years time.

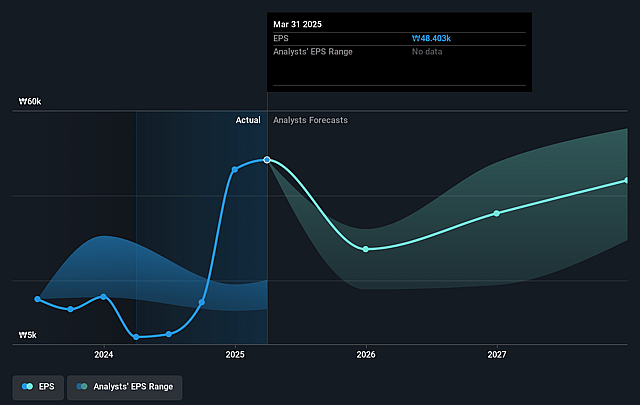

- The bearish analysts expect earnings to reach ₩1599.3 billion (and earnings per share of ₩30851.45) by about September 2028, down from ₩2441.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 47.8x on those 2028 earnings, up from 20.4x today. This future PE is greater than the current PE for the KR Aerospace & Defense industry at 26.7x.

- Analysts expect the number of shares outstanding to grow by 3.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.19%, as per the Simply Wall St company report.

Hanwha Aerospace Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's record revenue and profit growth, especially a 43 percent annual revenue increase and more than tripled operating profit, along with a historically high order backlog approaching 32.4 trillion KRW in Land Systems, positions Hanwha Aerospace to sustain earnings momentum, contradicting a bearish outlook for the share price.

- Persistent global geopolitical tensions and rising defense budgets across Europe, the Middle East, and Asia Pacific are expected to continue driving robust demand for Hanwha's weapon systems, supporting revenue stability and expansion in key export markets.

- Strategic acquisitions and full consolidation of Hanwha Ocean, coupled with expanded ownership and synergies in naval and defense shipbuilding, are expected to diversify revenues and enhance profit potential, with incremental enterprise value translating into increased earnings for shareholders.

- Long-term contracts for mass production and export of key platforms like the K9 Howitzer and Chunmoo MLRs to countries such as Poland, Australia, and Egypt, supported by sizable government orders and a diversified export pipeline, underpin strong visibility for both future revenues and operating profit.

- Ongoing investments in productivity, advanced R&D, and facility expansions-including Smart MCS modular charging system production and vertical integration-suggest efficiency gains and margin resilience, supporting the company's ability to maintain or improve net margins despite fluctuations in certain segments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Hanwha Aerospace is ₩1060013.01, which represents two standard deviations below the consensus price target of ₩1264250.0. This valuation is based on what can be assumed as the expectations of Hanwha Aerospace's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩1450000.0, and the most bearish reporting a price target of just ₩1000000.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₩32327.2 billion, earnings will come to ₩1599.3 billion, and it would be trading on a PE ratio of 47.8x, assuming you use a discount rate of 8.2%.

- Given the current share price of ₩967000.0, the bearish analyst price target of ₩1060013.01 is 8.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.