Key Takeaways

- Rapid gains in hybrid and electric vehicle sales, plus aggressive localization, could enable Hyundai to outperform revenue and margin expectations in electrified markets.

- Expansion into smart technologies and strategic alliances positions Hyundai for increased recurring revenue, stronger operating margins, and enhanced long-term growth potential.

- Rising competition, geopolitical risks, and evolving consumer preferences threaten Hyundai's sales growth, margins, and profitability despite ambitious EV expansion and ongoing operational challenges.

Catalysts

About Hyundai Motor- Manufactures and distributes motor vehicles and parts worldwide.

- While analyst consensus recognizes high growth in hybrid and electric vehicle sales, current momentum is actually accelerating faster than expected, with hybrid sales in the U.S. up 43 percent and European EV sales up 61 percent year-over-year, suggesting Hyundai could vastly outperform revenue projections via rapid penetration and dominant share in key electrified segments.

- Analysts broadly agree that Hyundai's localized production and efficient cost management will protect margins from tariff increases, but the aggressive expansion of North American capacity and accelerated localization initiatives are likely to structurally reduce manufacturing costs and logistics expenses, which could drive a step-change improvement in net margins and operational leverage above current forecasts.

- Hyundai's forthcoming Ulsan EV plant and increased global EV production capacity position it to capture surging electric vehicle demand in emerging markets, especially in Southeast Asia and India where the rising middle class seeks affordable, innovative vehicles, fueling long-term revenue and volume growth.

- The persistent push into smart, connected technologies and software-defined vehicles, paired with over-the-air feature offerings, opens up high-margin recurring revenue streams and significantly increases monetization potential beyond traditional vehicle sales, directly supporting higher operating margins and expanding earnings quality.

- Ongoing and deepening collaboration with global technology and industrial partners, such as the active GM partnership discussions, may catalyze major strategic alliances and shared product platforms, accelerating the rollout of innovative features and premium models, thereby lifting both revenue and profitability longer term.

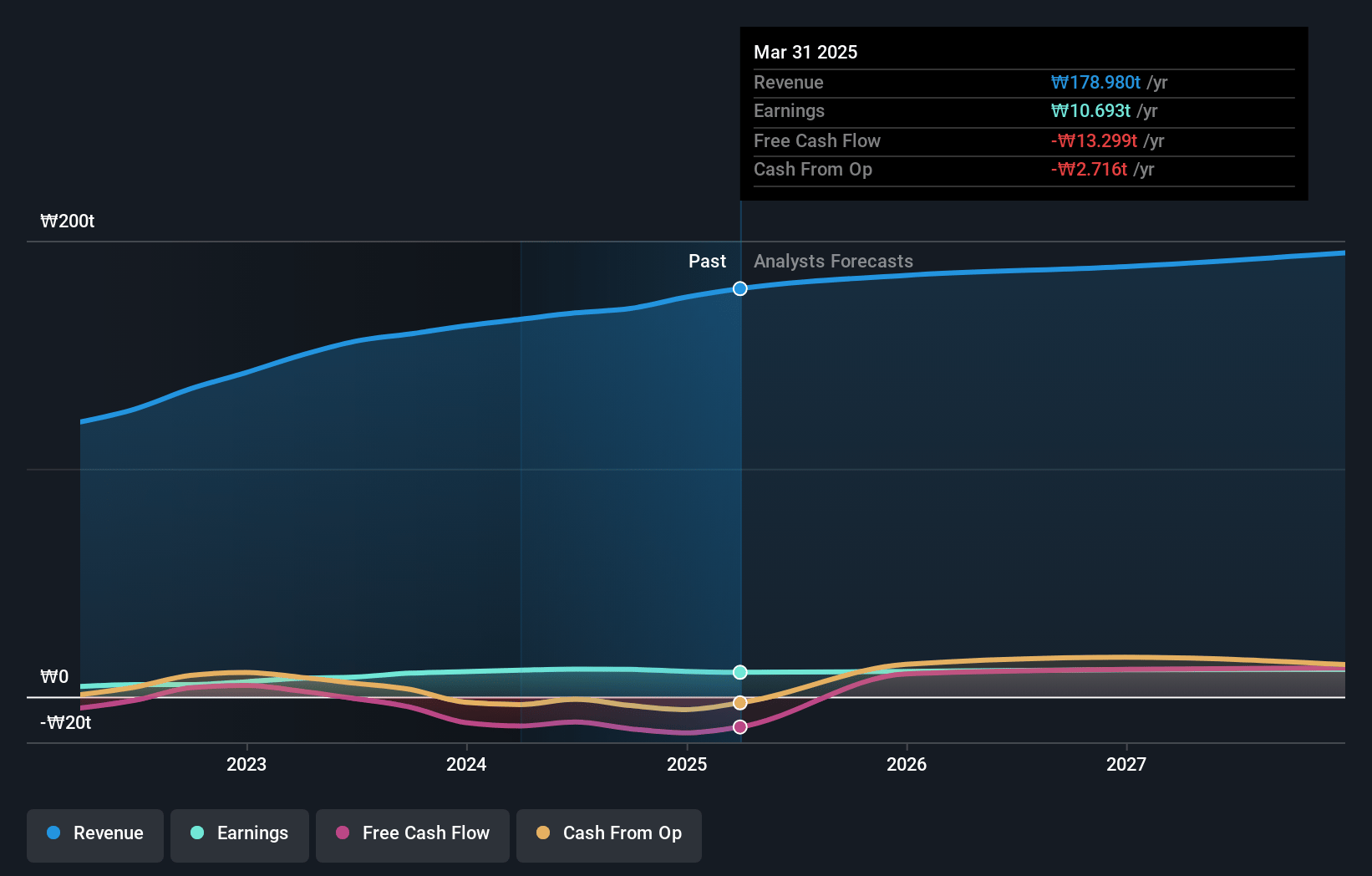

Hyundai Motor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Hyundai Motor compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Hyundai Motor's revenue will grow by 7.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.0% today to 7.3% in 3 years time.

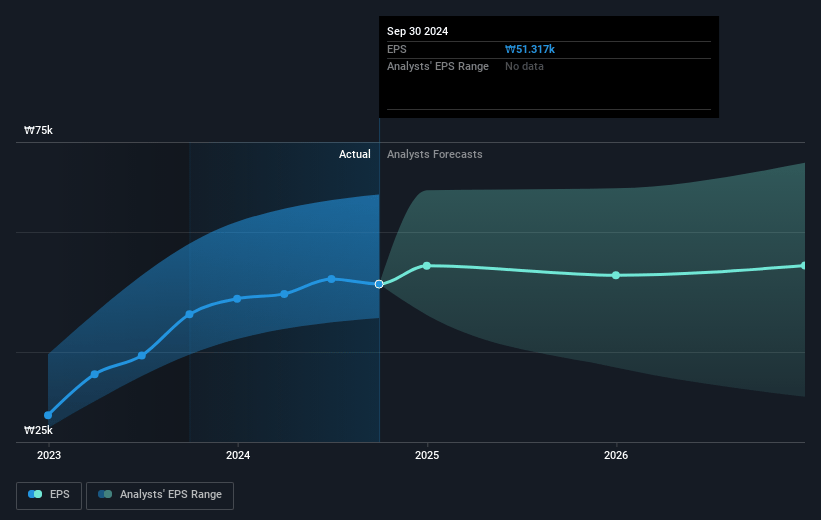

- The bullish analysts expect earnings to reach ₩16128.9 billion (and earnings per share of ₩72025.08) by about July 2028, up from ₩10692.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 8.8x on those 2028 earnings, up from 4.4x today. This future PE is greater than the current PE for the GB Auto industry at 4.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.78%, as per the Simply Wall St company report.

Hyundai Motor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global shift towards mobility-as-a-service and urbanization could reduce long-term demand for personal vehicle ownership, putting downward pressure on Hyundai's core unit sales, with knock-on effects for revenue growth and market share.

- Intensifying global competition from established and new players in the electric vehicle market, along with slower progress for Hyundai in premium and luxury segments, may erode pricing power and compress gross and operating margins over time.

- Heightened geopolitical tensions, particularly in light of US tariffs, are creating uncertainty and may increase supply chain risk, operating costs, and capital expenditures across Hyundai's value chain, ultimately impacting profitability and net income.

- Hyundai's rapid expansion of EV production capacity, including Metaplant, Ulsan, and Alabama, raises the risk of future overcapacity and underutilization if industry-wide EV adoption slows or is less robust than forecast, potentially leading to lower returns on invested capital and weaker earnings.

- Ongoing technical, regulatory, and labor-related challenges-such as delays in BEV and software development, rising compliance costs associated with global climate policy, and persistent labor cost pressures and union activity in Korea-have the potential to raise operating expenses and suppress net margin improvements.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Hyundai Motor is ₩361757.03, which represents two standard deviations above the consensus price target of ₩281784.2. This valuation is based on what can be assumed as the expectations of Hyundai Motor's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩380000.0, and the most bearish reporting a price target of just ₩200957.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₩219614.9 billion, earnings will come to ₩16128.9 billion, and it would be trading on a PE ratio of 8.8x, assuming you use a discount rate of 12.8%.

- Given the current share price of ₩208000.0, the bullish analyst price target of ₩361757.03 is 42.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.