Key Takeaways

- Overcapacity risks and uncertain EV demand could strain growth as new production plants come online amid rising regulatory and geopolitical pressures.

- Heightened R&D, marketing, and incentives are squeezing margins, while intensified competition and shifting market dynamics cast doubt on long-term revenue sustainability.

- Tariffs, rising costs, aggressive EV expansion, and regional weakness threaten Hyundai's margins and profits amid heavy investment and intensifying competition.

Catalysts

About Hyundai Motor- Manufactures and distributes motor vehicles and parts worldwide.

- While Hyundai is benefiting from robust growth in hybrid and electric vehicle sales, especially with hybrid sales up sharply in the U.S. and EV sales in Europe growing over 60 percent year-over-year, the company faces the risk of overcapacity and unproven demand as significant new EV production plants come online in both the U.S. and Korea. This could strain revenue growth if EV adoption does not accelerate as rapidly as anticipated.

- Although Hyundai is making aggressive moves to localize supply chains and ramp up production in key markets to counteract geopolitical risks and new U.S. tariffs, the evolving regulatory landscape and potential for further protectionist measures may disrupt global exports and require further costly adjustments, putting future net margins at risk.

- While the rapid adoption of advanced mobility and connected vehicle technologies is opening up new sources of revenue through software and data services, Hyundai's increased R&D and marketing expenses to stay competitive are already pressuring SG&A and could limit earnings growth if monetization of these technologies lags.

- The company is expanding in high-growth markets like India and Southeast Asia, where rapid urbanization is expected to drive increased passenger car demand, yet intensified local competition and pricing pressures in these regions have already caused declines in wholesale volumes, creating uncertainty for sustaining long-term revenue increases.

- Despite efforts to optimize production and implement flexible pricing and incentive strategies in response to U.S. tariffs, high and rising incentive levels in both the U.S. and Europe are eroding operating profit margins and could continue to undercut both top-line and bottom-line growth if the competitive environment fails to rationalize.

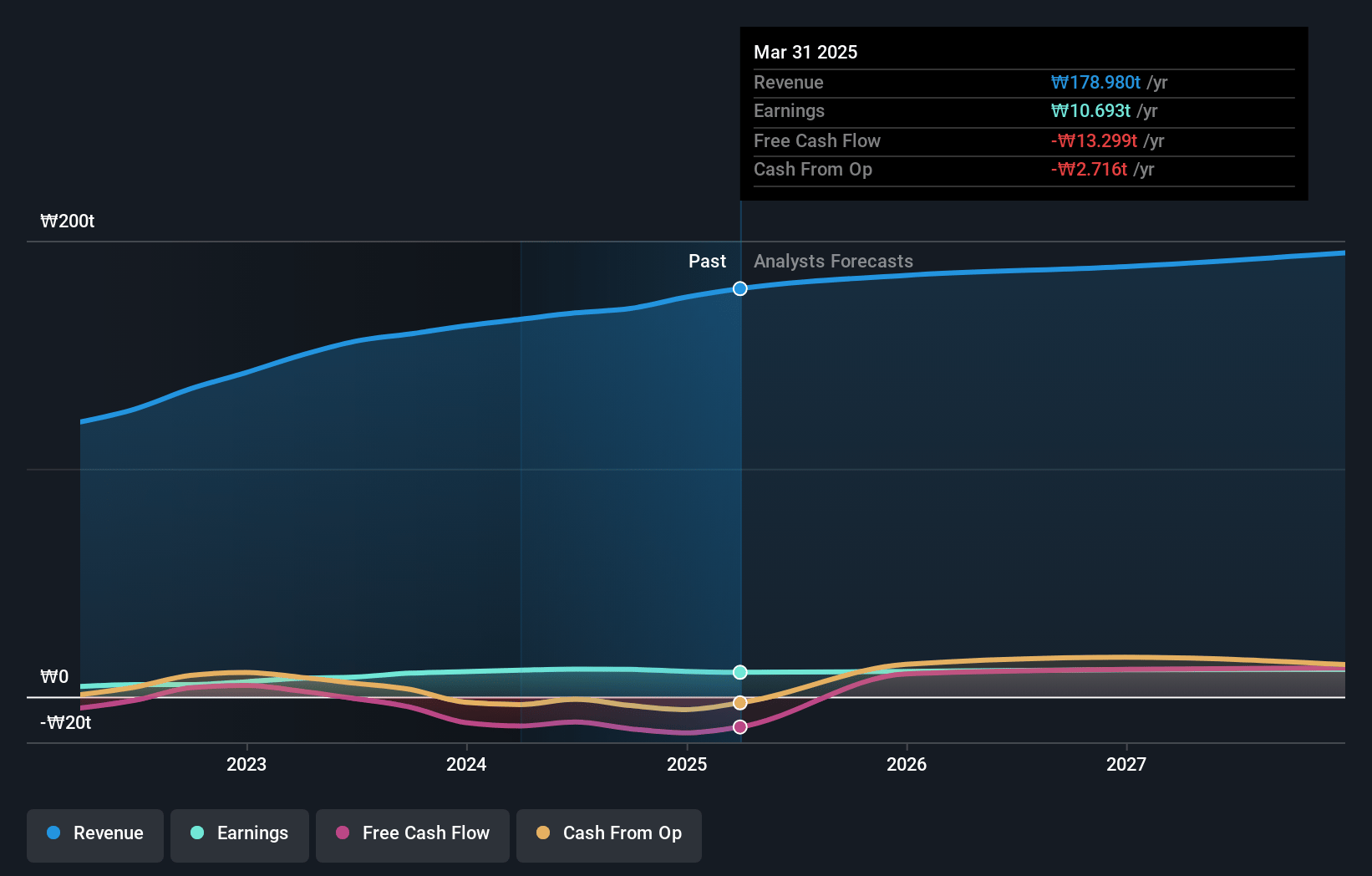

Hyundai Motor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Hyundai Motor compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Hyundai Motor's revenue will decrease by 0.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 6.0% today to 5.1% in 3 years time.

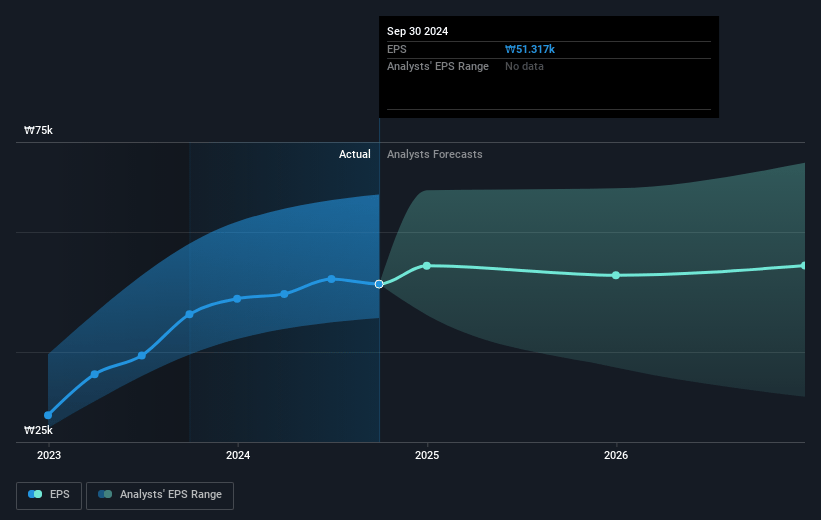

- The bearish analysts expect earnings to reach ₩8892.0 billion (and earnings per share of ₩32759.0) by about June 2028, down from ₩10692.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.9x on those 2028 earnings, up from 4.0x today. This future PE is greater than the current PE for the GB Auto industry at 3.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.78%, as per the Simply Wall St company report.

Hyundai Motor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistently high and uncertain U.S. tariffs on vehicles, parts, and raw materials like steel and aluminum threaten to raise Hyundai's cost base in its key growth market, potentially compressing net margins and reducing long-term earnings from North America.

- Intensified industry competition and incentive spending in both the U.S. and European markets have already led to higher selling expenses and declining operating profit in the core automotive segment, raising concerns about sustained pressure on profitability if these trends continue.

- Rapid expansion of EV and hybrid production capacity in global plants, including new facilities in Korea and the U.S., heightens the risk of overproduction should EV demand forecasts not materialize or should Hyundai lag behind in the fast-evolving EV market, putting downward pressure on revenue and operating margins.

- Sluggish recovery in certain regional markets, such as Europe-where sales volume declined due to weak industry demand-signals that Hyundai remains vulnerable to economic slowdowns in major regions, weighing on global revenue growth.

- Heavy ongoing investment in R&D, capacity expansion, and supply chain localization-while necessary to compete in electrification and regulatory environments-places strain on free cash flow and exposes Hyundai to risk of lower returns if technology bets or localization strategies fail to deliver, ultimately impacting net margins and overall earnings quality.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Hyundai Motor is ₩200957.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Hyundai Motor's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩380000.0, and the most bearish reporting a price target of just ₩200957.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₩175040.0 billion, earnings will come to ₩8892.0 billion, and it would be trading on a PE ratio of 8.9x, assuming you use a discount rate of 12.8%.

- Given the current share price of ₩189600.0, the bearish analyst price target of ₩200957.5 is 5.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.