Last Update 23 Nov 25

Fair value Decreased 0.51%9104: Dividend Increase And New Joint Ventures Will Drive Returns In 2025

Analysts have slightly lowered their price target for Mitsui O.S.K. Lines from ¥5,364 to ¥5,336. This change is due to modest adjustments to revenue growth expectations and profit margin forecasts.

What's in the News

- The Oil and Natural Gas Corporation Limited's board has approved entering two 50:50 joint ventures with Mitsui O.S.K. Lines. This move will expand into petroleum resource transport and ethane shipping, with investment up to USD 49.2 million. (Key Developments)

- Mitsui O.S.K. Lines has revised its guidance for the fiscal year 2025, increasing the year-end dividend forecast by ¥25.00 per share to ¥115.00. This raises the annual dividend to ¥200.00 per share. (Key Developments)

- The company has lowered its consolidated earnings guidance for the year ending March 31, 2026, with profit now expected at JPY 180.0 billion, down from JPY 200.0 billion previously. (Key Developments)

- The board of Mitsui O.S.K. Lines is set to meet on November 4, 2025, to consider a dividend payment. (Key Developments)

Valuation Changes

- Fair Value Estimate has decreased modestly, moving from ¥5,364 to ¥5,336.

- Discount Rate has increased slightly, rising from 7.50% to 7.65%.

- Revenue Growth forecasts have improved, with the expected decline narrowing from -1.36% to -0.78%.

- Net Profit Margin projections have edged down, dropping from 11.21% to 11.06%.

- Future P/E ratio has risen slightly, changing from 10.41x to 10.60x.

Key Takeaways

- Investments in greener technologies, energy logistics, and integrated supply chain services diversify revenue and position Mitsui O.S.K. Lines for resilient, high-quality earnings.

- Strong demand in vehicle transport, stable long-term contracts, and ongoing fleet optimization underpin margin stability and support outperformance amid industry changes.

- Weak market conditions, trade tensions, vessel oversupply, and high capital needs threaten profitability, margin expansion, and long-term earnings stability for Mitsui O.S.K. Lines.

Catalysts

About Mitsui O.S.K. Lines- Engages in the marine transportation business worldwide.

- Ongoing expansion and investment in energy logistics-including LNG dual-fuel VLCCs, long-term LNG charter contracts, and entry into offshore wind projects-poise Mitsui O.S.K. Lines to capture new high-margin revenue streams from the global transition to decarbonization and renewable energy, supporting long-term revenue growth and margin resilience.

- Robust global demand for vehicle transport and continued expansion in the vehicle transport business, as evidenced by upward revisions to shipping volumes and profits, position Mitsui O.S.K. Lines to benefit from increasing international trade flows and industrial growth, directly bolstering top-line revenues.

- Stable contributions from long-term contracts in the LNG, offshore, and FPSO businesses provide earnings visibility and margin stability even amid volatility in other shipping segments, underpinning reliable net income and supporting higher dividend payouts.

- Strategic acquisition of logistics assets (such as LBC Tank Terminals and terminal operations) and enhanced integrated logistics offerings diversify revenue, reinforcing Mitsui O.S.K. Lines' position as a technologically advanced, full-service supply chain partner and providing more stable and higher-quality earnings.

- Continued fleet optimization, investments in fuel-efficient and dual-fuel vessels, and early adoption of greener technologies prepare the company to outpace competitors as industry regulation tightens, potentially increasing market share and safeguarding net margins over the long run.

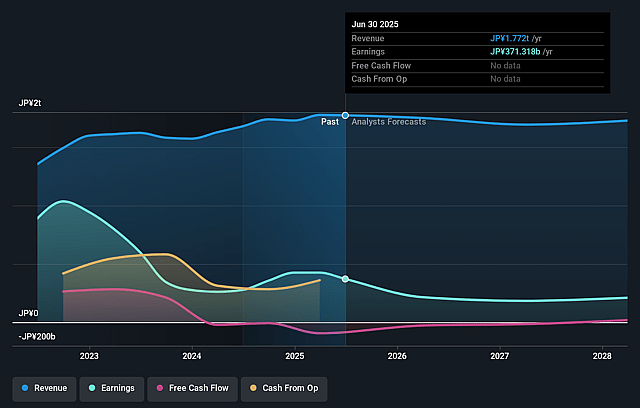

Mitsui O.S.K. Lines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Mitsui O.S.K. Lines's revenue will decrease by 0.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 21.0% today to 11.6% in 3 years time.

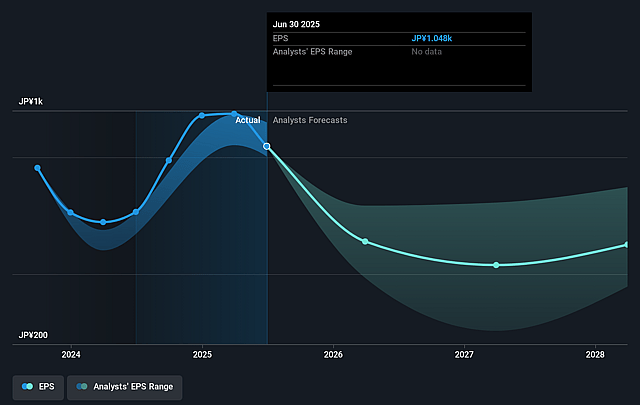

- Analysts expect earnings to reach ¥200.1 billion (and earnings per share of ¥593.51) by about September 2028, down from ¥371.3 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥269.9 billion in earnings, and the most bearish expecting ¥153.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.2x on those 2028 earnings, up from 4.4x today. This future PE is greater than the current PE for the JP Shipping industry at 6.6x.

- Analysts expect the number of shares outstanding to decline by 4.7% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.51%, as per the Simply Wall St company report.

Mitsui O.S.K. Lines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent economic slowdown and weak domestic demand in China, a key driver of global shipping volumes, are leading to depressed market rates for bulkers, tankers, and container vessels, which could continue to reduce revenues and net profit margins for Mitsui O.S.K. Lines over the long term.

- Ongoing global trade tensions, particularly between the U.S., China, and Europe-with additional tariffs and uncertainty about future tariff policy-are already negatively impacting demand for containerships and the logistics business, threatening long-term volume growth, revenue, and earnings stability.

- Significant pressure from vessel oversupply, as indicated by new vessel deliveries and pressure on freight rates, could keep industry pricing weak, limiting Mitsui O.S.K. Lines' ability to expand margins and improve overall profitability in the face of cyclical downturns.

- High capital expenditure requirements for fleet renewal, green retrofits, and environmental compliance may outpace cash flow generation, pressuring net margins and potentially leading to increased debt or equity dilution, negatively affecting long-term returns on equity.

- Dependence on earnings from volatile and highly cyclical segments-such as Bulk and Tanker shipping-exposes the company to sharp downside in revenues and earnings during commodity or economic downturns, making future profit growth and dividend sustainability less certain.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥5547.273 for Mitsui O.S.K. Lines based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥7000.0, and the most bearish reporting a price target of just ¥3920.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥1730.7 billion, earnings will come to ¥200.1 billion, and it would be trading on a PE ratio of 10.2x, assuming you use a discount rate of 7.5%.

- Given the current share price of ¥4729.0, the analyst price target of ¥5547.27 is 14.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.