Key Takeaways

- Strong international demand growth and innovative premium strategies position Yakult for sustainable topline and margin expansion beyond current market expectations.

- Structural health trends and enhanced shareholder returns support long-term profit growth and improved investor confidence.

- Demographic changes, cost pressures, shifting health trends, rising competition, and currency risks collectively threaten Yakult's profitability and long-term revenue growth across core and international markets.

Catalysts

About Yakult HonshaLtd- Manufactures and sells food and beverage products in Japan, the Americas, Asia, Oceania, and Europe.

- Analyst consensus already expects international growth, but the robust double-digit volume increases in key high-potential markets like Vietnam indicate broader, more sustainable demand acceleration than currently priced in, setting the stage for outsized, compounding topline growth as Yakult's addressable market expands rapidly.

- While analysts broadly recognize operating margin improvement potential from international expansion, they may be underestimating Yakult's ability to capture margin uplift as ongoing cost management and manufacturing scale, combined with localization in low-cost emerging markets, could drive much stronger-than-expected margin expansion and earnings leverage.

- Yakult's continued strategic investment in next-generation probiotic R&D positions the company to outpace peers in new product launches with premium pricing, enabling superior gross margin expansion and long-term profit growth through innovation-led premiumization.

- The growing global consumer shift toward daily health maintenance, especially in aging developed and urbanizing middle-income societies, presents Yakult with a structural tailwind for recurring demand; as distribution and DTC/subscription models mature, downcycle risks to both revenue and operating profit are reduced while lifetime value per customer is increased.

- Further buybacks and shareholder-return initiatives, supported by Yakult's strong balance sheet and steady global cash flows, could materially boost EPS and re-rate the stock higher as investor confidence in sustainable, long-term earnings visibility builds.

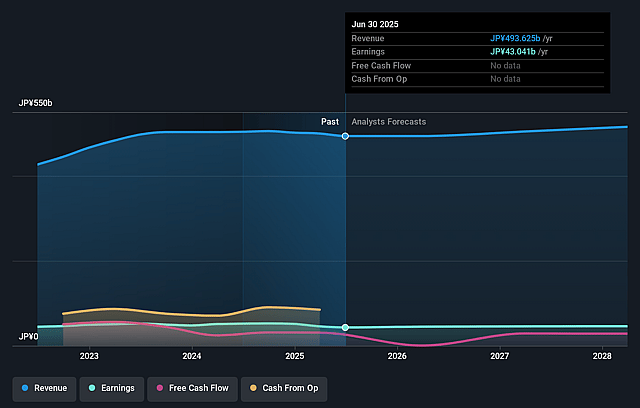

Yakult HonshaLtd Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Yakult HonshaLtd compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Yakult HonshaLtd's revenue will grow by 3.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.7% today to 10.4% in 3 years time.

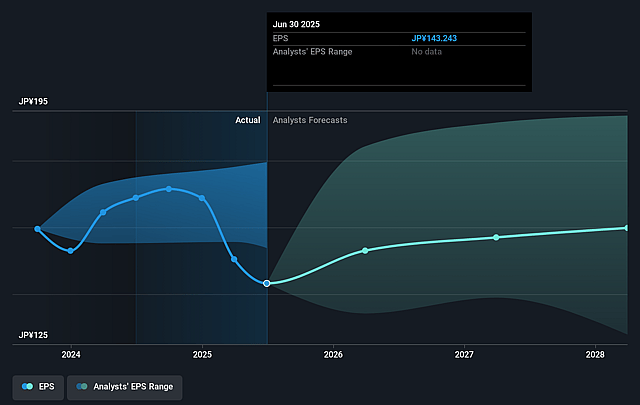

- The bullish analysts expect earnings to reach ¥56.5 billion (and earnings per share of ¥196.09) by about September 2028, up from ¥43.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 19.3x on those 2028 earnings, up from 16.8x today. This future PE is greater than the current PE for the JP Food industry at 17.0x.

- Analysts expect the number of shares outstanding to decline by 3.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.72%, as per the Simply Wall St company report.

Yakult HonshaLtd Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's core domestic market in Japan is experiencing declining sales volumes in dairy products due to a loss of existing customers and difficulty acquiring new ones, which may be further exacerbated by demographic shifts such as an aging and shrinking population; these trends threaten Yakult's long-term revenue prospects in its largest market.

- Rising raw material, labor, and energy costs have already led to increased expenses and lower gross profit across major regions, while the company's limited ability to raise prices or introduce higher-margin products could result in sustained net margin compression and reduced profitability in the years ahead.

- Global health trends and increasing consumer scrutiny over sugar content in beverages risk further eroding demand for Yakult's flagship probiotic drinks, especially as health-conscious consumers shift to lower-sugar or sugar-free alternatives, posing a long-term threat to both revenue growth and customer retention.

- Intensifying competition from both multinational conglomerates and nimble startups in the functional foods and probiotics sector may lead to greater price competition and marketing costs, potentially eroding Yakult's market share and squeezing future earnings.

- Currency fluctuations, especially a strong yen, have already driven significant decreases in overseas sales and profits despite higher local sales volumes, suggesting that Yakult's reliance on international operations exposes the company to ongoing foreign exchange risk, which may continue to adversely impact reported revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Yakult HonshaLtd is ¥3593.59, which represents two standard deviations above the consensus price target of ¥2608.89. This valuation is based on what can be assumed as the expectations of Yakult HonshaLtd's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥3600.0, and the most bearish reporting a price target of just ¥1900.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ¥545.2 billion, earnings will come to ¥56.5 billion, and it would be trading on a PE ratio of 19.3x, assuming you use a discount rate of 4.7%.

- Given the current share price of ¥2462.5, the bullish analyst price target of ¥3593.59 is 31.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.