Key Takeaways

- Mounting regulatory and environmental pressures challenge Yakult's product claims, ingredients, and core packaging, threatening profitability and necessitating costly changes.

- Overdependence on its flagship drink and limited portfolio diversification amplify vulnerability to shifting consumer preferences and intensifying competition, risking future revenue stagnation.

- Global sales growth, health trends, and product innovation are driving Yakult's expanding revenues, helping offset domestic challenges and currency impacts for stable long-term performance.

Catalysts

About Yakult HonshaLtd- Manufactures and sells food and beverage products in Japan, the Americas, Asia, Oceania, and Europe.

- Increasing global scrutiny over health claims and sugar content in functional beverages poses a major threat to Yakult's business model; anticipated regulatory tightening could force costly product reformulations or limit marketing claims, leading to weaker consumer demand and directly suppressing both revenue growth and future net margins.

- Rising anti-plastic sentiment and expected environmental regulations threaten Yakult's core packaging strategy, with the iconic small plastic bottle likely to see heightened compliance costs and potential consumer backlash, translating into long-term margin pressure and elevated capital expenditure needs.

- Heavy reliance on the core Yakult probiotic drink, combined with only limited progress in diversifying the product portfolio, leaves the company uniquely vulnerable to shifting consumer tastes and competition, heightening the risk of stagnating revenues and declining operating profits over time.

- Population aging and shrinking in mature markets like Japan-already reflected in a 7 percent decline in domestic daily sales volume-foreshadow persistent erosion of Yakult's most profitable revenue base and portend continued top-line headwinds despite efforts to grow overseas.

- Intensifying competition from regional brands and alternative health beverages is set to drive aggressive price competition and dilute Yakult's brand premium, inevitably compressing gross margins and limiting the company's ability to sustain historical levels of earnings growth.

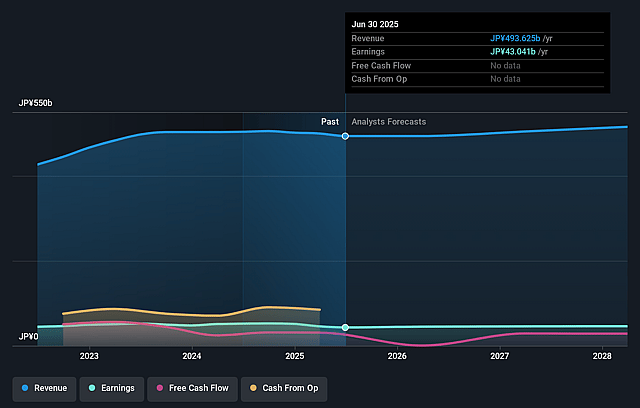

Yakult HonshaLtd Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Yakult HonshaLtd compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Yakult HonshaLtd's revenue will decrease by 0.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 8.7% today to 7.4% in 3 years time.

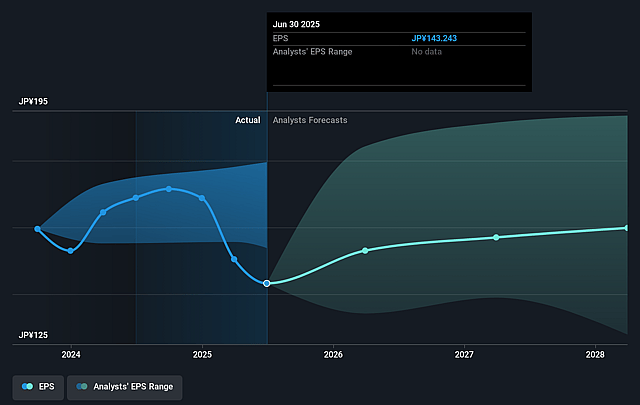

- The bearish analysts expect earnings to reach ¥36.6 billion (and earnings per share of ¥129.62) by about September 2028, down from ¥43.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, down from 16.8x today. This future PE is lower than the current PE for the JP Food industry at 17.0x.

- Analysts expect the number of shares outstanding to decline by 3.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.72%, as per the Simply Wall St company report.

Yakult HonshaLtd Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Overseas segments are experiencing steady growth in sales volume across all major regions, including significant double-digit growth in Vietnam, consistent gains in China and Guangzhou, and higher sales in Europe, which supports resilient ongoing revenues despite short-term exchange rate impacts.

- The long-term trend of expanding middle class populations in Asia and Latin America positions Yakult to increase sales volumes for premium health products, potentially offsetting domestic weakness and supporting robust top-line growth.

- The business is benefiting from growing global health consciousness and aging populations, fueling continued demand for probiotics and functional foods and expanding Yakult's addressable market, supporting sustained revenue opportunity.

- Investments in R&D, the ongoing global rollout of differentiated product lines such as the Yakult 1000 series, and localized supply chain strategies are likely to enhance operational efficiency and net margins over time through higher-margin product offerings.

- Increasing daily sales volumes and higher gross profits from international operations are expected to offset domestic cost pressures and foreign exchange fluctuations, supporting stable or improving overall earnings in future periods.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Yakult HonshaLtd is ¥1900.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Yakult HonshaLtd's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥3600.0, and the most bearish reporting a price target of just ¥1900.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ¥496.2 billion, earnings will come to ¥36.6 billion, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 4.7%.

- Given the current share price of ¥2462.5, the bearish analyst price target of ¥1900.0 is 29.6% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.