Last Update 06 Sep 25

Fair value Decreased 0.84%Emerging Asian Markets Will Open New Horizons

Yakult Honsha Ltd's consensus revenue growth forecast has edged down slightly, prompting a marginal decrease in analyst price target from ¥2631 to ¥2609.

What's in the News

- Yakult Honsha lowered its earnings guidance for both the first six months and full fiscal year, citing decreased domestic dairy sales due to weakened consumer demand from price increases and expectations of a stronger yen, resulting in lower projected sales and profits than previously announced.

- The company completed its previously announced share buyback program, repurchasing a total of 10,105,600 shares (3.36%) for ¥29,999.72 million.

- The board approved the disposal of treasury shares for use as restricted stock compensation.

Valuation Changes

Summary of Valuation Changes for Yakult HonshaLtd

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from ¥2631 to ¥2609.

- The Consensus Revenue Growth forecasts for Yakult HonshaLtd has fallen from 1.6% per annum to 1.5% per annum.

- The Net Profit Margin for Yakult HonshaLtd remained effectively unchanged, moving only marginally from 9.08% to 8.93%.

Key Takeaways

- Expansion in emerging Asian markets and rising global health awareness are driving strong growth in demand for Yakult's probiotic products.

- Operational efficiencies, successful overseas pricing, and active shareholder returns strategies position the company for improved margins and sustained long-term growth.

- Weak domestic sales, cost pressures, and currency volatility threaten Yakult's growth outlook, margins, and investor confidence despite increased international market reliance.

Catalysts

About Yakult HonshaLtd- Manufactures and sells food and beverage products in Japan, the Americas, Asia, Oceania, and Europe.

- The company is seeing double-digit sales volume growth in emerging markets such as Vietnam and steady increases in China and other Asian/Oceanian countries, indicating continued geographic expansion into markets with strong demographic tailwinds, which is likely to drive multi-year revenue and earnings growth.

- Rising international health awareness and the shift toward preventive healthcare are fueling demand for probiotic-rich functional foods, evidenced by overseas volume growth even as the company faces headwinds in its home market, laying the foundation for sustained global revenue increase.

- Despite current margin pressure from rising input and labor costs, the company's operational focus on expense control, cost optimization, and potential automation initiatives positions it for improved operational efficiency and wider net margins in the coming years.

- Mainstream acceptance of functional and probiotic foods, combined with Yakult's ability to increase prices overseas without sales volume decline, points to industry-wide category expansion and pricing power that should support ongoing growth in revenues and margins.

- Share buybacks and steady dividends highlight management's commitment to shareholder returns, potentially boosting EPS and supporting a re-rating of the stock as underlying operational performance in growth markets continues to improve.

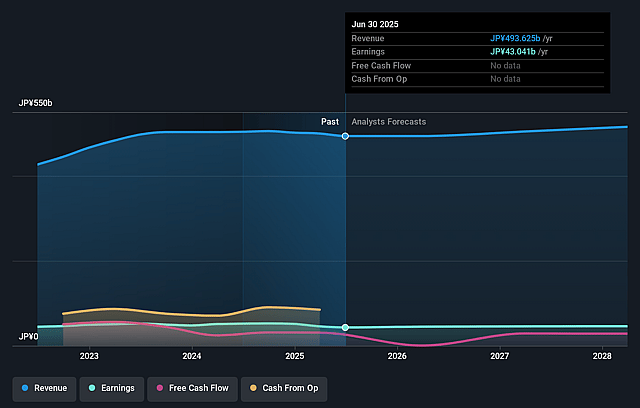

Yakult HonshaLtd Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Yakult HonshaLtd's revenue will grow by 1.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.7% today to 9.1% in 3 years time.

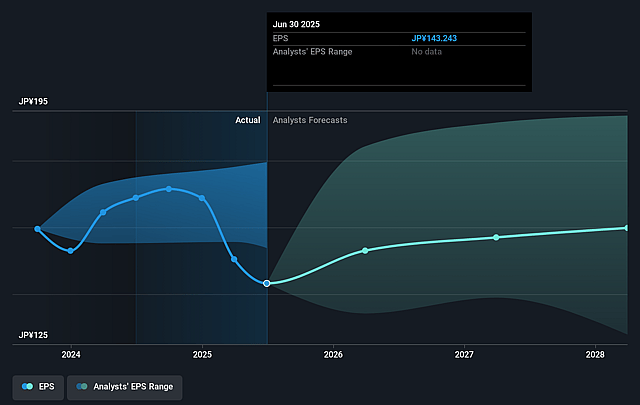

- Analysts expect earnings to reach ¥47.0 billion (and earnings per share of ¥165.04) by about September 2028, up from ¥43.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥56.4 billion in earnings, and the most bearish expecting ¥36.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.0x on those 2028 earnings, up from 16.8x today. This future PE is greater than the current PE for the JP Food industry at 16.9x.

- Analysts expect the number of shares outstanding to decline by 3.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.72%, as per the Simply Wall St company report.

Yakult HonshaLtd Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Declining domestic sales volumes-particularly a 7% drop in Japan's dairy product segment and underperformance of the new Yakult 1000 series-signal potential long-term contraction in the core domestic market, risking future revenue declines and diminished economies of scale.

- Persistent currency fluctuations, specifically yen appreciation against foreign currencies, have significantly reduced Yakult's reported overseas sales and profits in key markets, and continued volatility is likely to keep pressuring consolidated net margins and earnings.

- Rising raw material, labor, and promotional costs (both in Japan and overseas) are outpacing revenue growth and contributing to margin compression, posing a structural risk to operating profit if inflationary trends persist.

- The company's increased dependence on international markets for growth increases exposure to exogenous risks, including regulatory changes and competitive dynamics in emerging markets, which could threaten revenue diversification and long-term earnings stability.

- Downward revision of the full-year forecast, driven by lower domestic sales assumptions and negative foreign exchange impacts, highlights a potential trend of stagnant or weakening growth outlook, undermining investor confidence and pressuring the share price through lower expected profits.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥2631.111 for Yakult HonshaLtd based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥3600.0, and the most bearish reporting a price target of just ¥1900.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥517.7 billion, earnings will come to ¥47.0 billion, and it would be trading on a PE ratio of 17.0x, assuming you use a discount rate of 4.7%.

- Given the current share price of ¥2470.0, the analyst price target of ¥2631.11 is 6.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.