Key Takeaways

- Vulnerability to weather volatility and legacy asset declines may suppress output and put ongoing pressure on earnings despite expansion into new regions and technologies.

- Rising debt levels and policy complexities threaten profitability and growth, as competition and geopolitical risks increase costs and delay project implementation.

- Volatile output, regulatory and auction risks, high leverage, and limited pricing flexibility threaten ERG's profitability, growth investments, and revenue stability.

Catalysts

About ERG- Through its subsidiaries, produces energy through renewable sources in Italy, France, Germany, the United Kingdom, Poland, Bulgaria, Sweden, Romania, and Spain.

- Although ERG is well positioned to benefit from the accelerated push for renewable energy and electrification in Europe, recent exceptionally weak wind conditions across its core geographies highlight inherent vulnerability to weather volatility, which can significantly suppress output and revenue, particularly if climate unpredictability persists longer than anticipated.

- While the company continues to diversify capacity by investing in wind, solar, and storage assets-expanding both in Europe and the U.S.-these efforts are only partially mitigating the production declines seen in existing assets, and there is a risk that legacy assets with expiring subsidies or PPAs will outpace new project contributions, putting continued pressure on earnings and net margins in the coming years.

- Despite long-term institutional momentum behind ESG investment, ERG's growing debt burden and rising financial charges associated with recent acquisitions and organic growth could erode future net profits, especially if global interest rates remain elevated and access to favorable capital becomes more difficult than anticipated.

- Although regulatory frameworks like CfDs and PPAs currently underpin revenue stability and predictability, increasing policy complexity and administrative delays-such as regional legal disputes in Italy over renewable site permitting-could limit ERG's ability to secure and build new projects, constraining growth and lengthening payback periods, which may negatively impact long-term EBITDA growth potential.

- While declining costs of renewables and grid modernization offer opportunities for margin expansion, intensifying competition for new project auctions, the risk of bidding wars eroding returns, and geopolitical factors-such as supply chain disruptions or trade barriers-could increase capital expenditures and threaten project economics, potentially pressuring both revenue growth and future profitability.

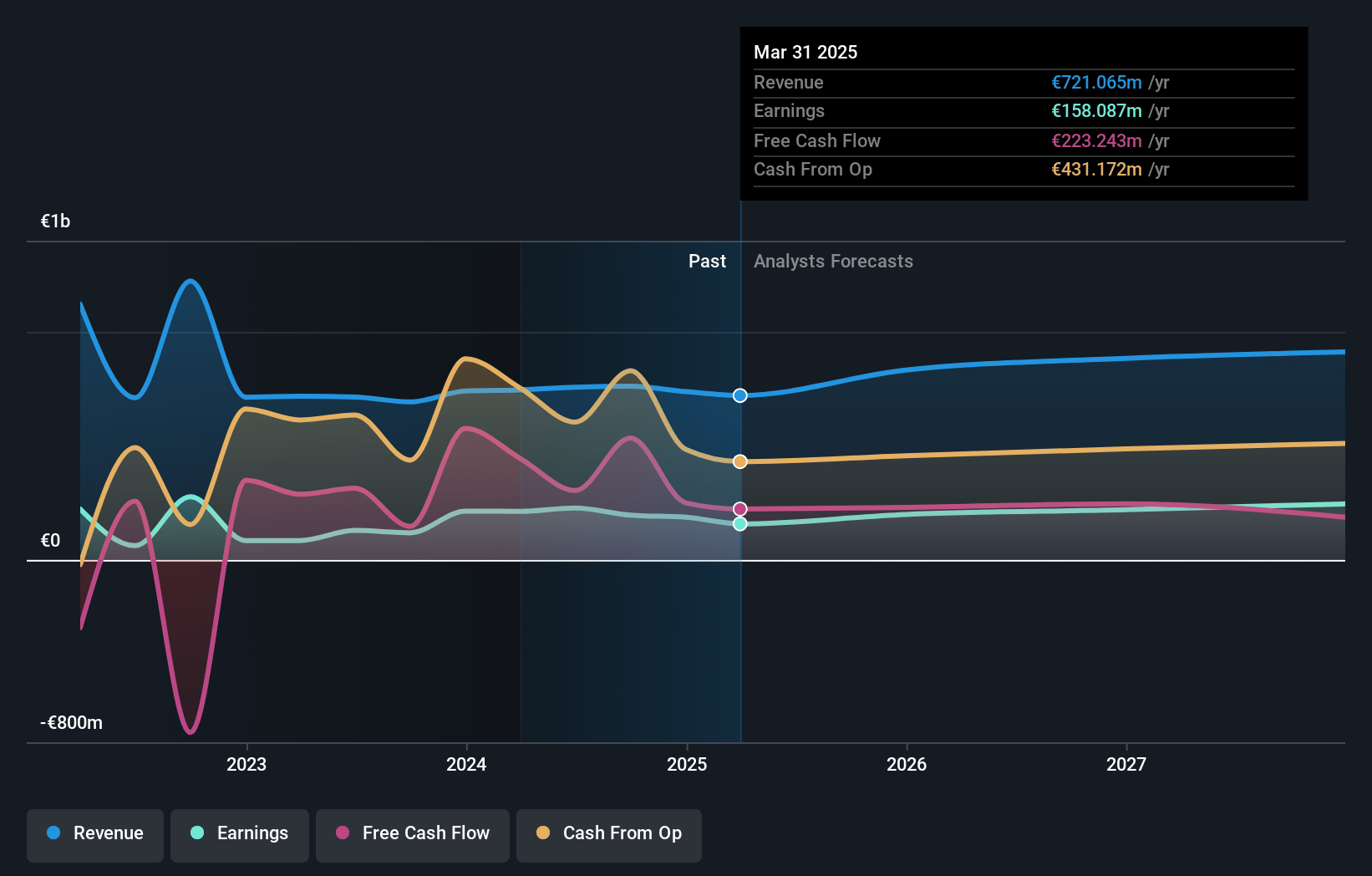

ERG Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on ERG compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming ERG's revenue will grow by 7.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 21.9% today to 28.7% in 3 years time.

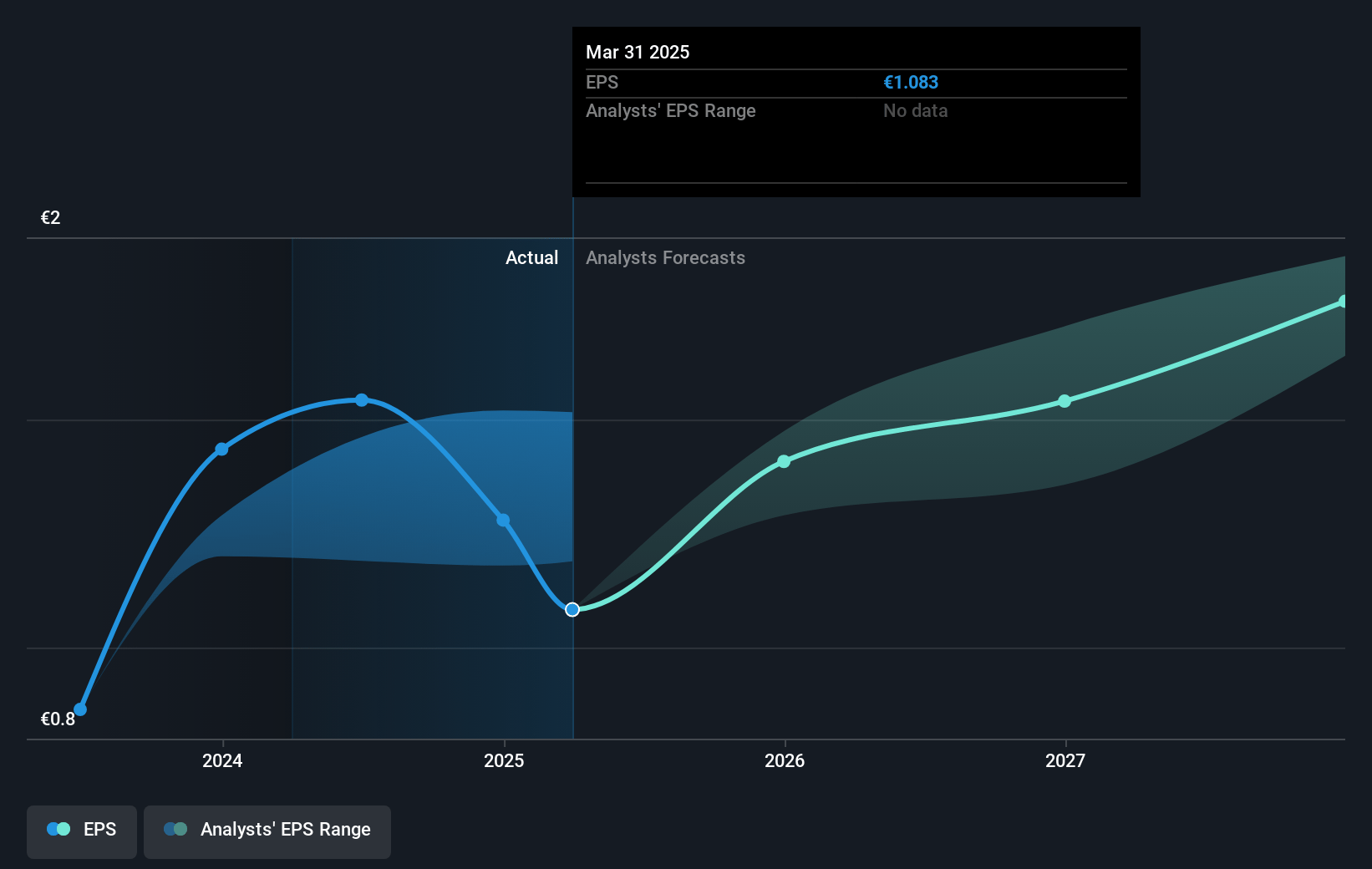

- The bearish analysts expect earnings to reach €255.3 million (and earnings per share of €1.77) by about July 2028, up from €158.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.0x on those 2028 earnings, down from 17.0x today. This future PE is lower than the current PE for the GB Renewable Energy industry at 20.3x.

- Analysts expect the number of shares outstanding to decline by 0.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.1%, as per the Simply Wall St company report.

ERG Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The persistent and volatile low wind conditions experienced across all main European markets have significantly reduced ERG's energy output, leading to a year-on-year decline in both EBITDA and adjusted net profit, and raising concerns about ongoing revenue volatility and future earnings if adverse weather patterns continue.

- The increasing competition in upcoming auctions, especially for the Italian FER X Decree and other regulated frameworks, may push prices down or lead to ERG missing out on awards, which could negatively affect the returns on new projects and exert pressure on net margins and top-line growth.

- Regulatory uncertainty and delays related to regional permitting hurdles in Italy, such as disputes over aree idonee and shifting local government decisions, are causing project implementation delays and elevated legal costs, which may slow capacity growth and limit revenue expansion.

- High financial leverage after recent acquisitions and elevated capital expenditure is being compounded by rising financial charges, meaning a higher proportion of cash flows will go toward servicing debt, reducing available funds for growth investments and risking profitability.

- The limited ability to capture upside during periods of high energy prices-due to a large portion of ERG's output being locked into long-term PPAs or CfDs-constrains ERG's capacity to offset deficits from low production periods, thus impacting both revenue stability and potential net profit recovery.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for ERG is €19.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of ERG's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €29.4, and the most bearish reporting a price target of just €19.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €889.9 million, earnings will come to €255.3 million, and it would be trading on a PE ratio of 15.0x, assuming you use a discount rate of 11.1%.

- Given the current share price of €18.52, the bearish analyst price target of €19.5 is 5.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.