Key Takeaways

- Market conditions are temporarily obscuring ERG's true earnings potential, with normalization expected to reveal significant upside in revenues and margins.

- Strategic contract structures, geographic diversification, and operational efficiencies position ERG for robust, sustained growth ahead of market expectations.

- Climate-driven wind volatility, intense competition, regulatory risks, and elevated debt levels threaten ERG's revenue stability, earnings visibility, and profitability in core European markets.

Catalysts

About ERG- Through its subsidiaries, produces energy through renewable sources in Italy, France, Germany, the United Kingdom, Poland, Bulgaria, Sweden, Romania, and Spain.

- While analyst consensus views repowering and capacity upgrades as a key driver of returns, the extraordinary wind drought in early 2025 has created a temporary earnings dip that is masking the unprecedented earnings power ERG can unlock once wind conditions normalize, meaning a post-drought rebound could push revenues and net margins sharply higher than previously modeled.

- Analysts broadly agree that ERG's focus on long-term PPAs and CfDs will stabilize cash flows, but they may be significantly underestimating the impact of inflation-linked tariffs and indexation within those contracts, which can structurally lift future earnings above current market expectations, especially as electricity demand accelerates.

- ERG is positioned to capitalize on the accelerating electrification of industrial and transportation sectors in Europe, and its geographically diversified portfolio across Italy, France, Germany, UK, Spain, Eastern Europe, and the U.S. provides a unique platform for double-digit compound revenue growth as electricity demand structurally outpaces GDP growth in these markets.

- The current market is shifting towards a buyer's market for renewable assets, allowing ERG-armed with strong balance sheet firepower and a patient capital approach-to execute highly accretive M&A at attractive valuations, setting up rapid EBITDA expansion and potential upward revisions to EPS forecasts once market sentiment turns.

- ERG's ongoing operational optimization, increasing use of digitalization, and a declining trend in wind, solar, and storage technology costs are not only structurally raising company-level EBITDA margins but are creating a virtuous cycle of free cash flow generation that supports sustained upward momentum in dividends and return on equity.

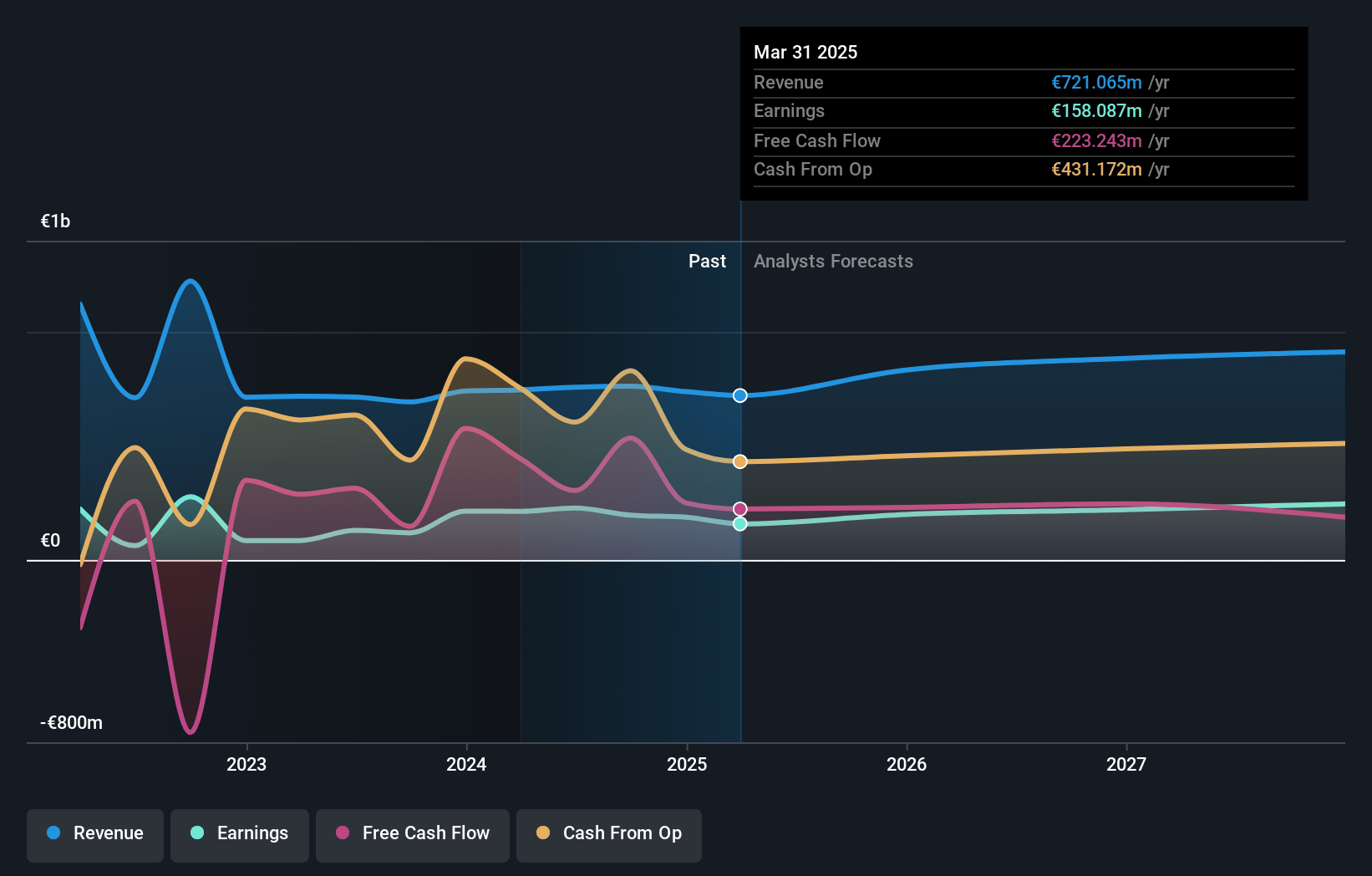

ERG Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on ERG compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming ERG's revenue will grow by 12.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 21.9% today to 26.8% in 3 years time.

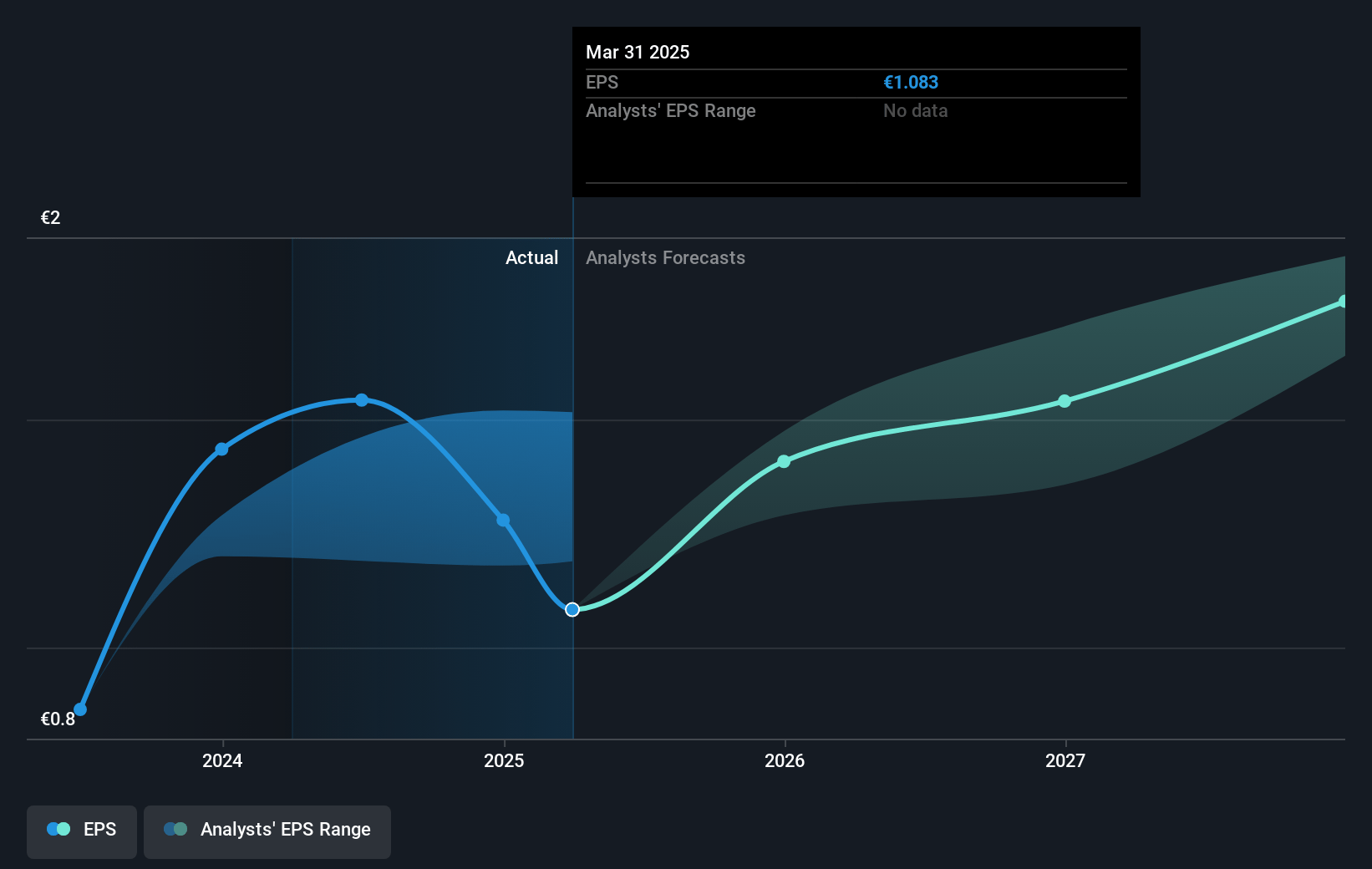

- The bullish analysts expect earnings to reach €274.3 million (and earnings per share of €1.99) by about July 2028, up from €158.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 20.2x on those 2028 earnings, up from 16.9x today. This future PE is lower than the current PE for the GB Renewable Energy industry at 20.5x.

- Analysts expect the number of shares outstanding to decline by 0.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.17%, as per the Simply Wall St company report.

ERG Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Extraordinary wind droughts and high volatility in wind availability across ERG's European portfolio, combined with climate unpredictability, could lead to recurring periods of below-average production, resulting in significant revenue and EBITDA swings as seen by the double-digit declines in 2025.

- Increasing competition from both new clean energy technologies and incumbent utilities, along with oversubscribed auctions such as the FER X Decree in Italy, may put sustained pressure on pricing power, compressing ERG's net margins and reducing future earnings visibility due to more competitive auction bidding.

- Heavy reliance on regulated mechanisms like PPAs and CfDs caps ERG's ability to benefit from high market prices during times of scarcity, which limits upside on revenue during price spikes while exposing downside risk if production volumes decline further.

- High geographical and regulatory concentration in European markets, especially Italy, leaves ERG vulnerable to local permitting delays, legal disputes (for example, with Sardinian regional laws), and sudden regulatory or incentive shifts that impede project pipeline development and create volatility in revenue streams.

- Elevated interest expenses and a rising net debt position-owing to increased capex for acquisitions and repowering projects-heighten risk from higher long-term interest rates, which can further erode net margins and lower return on invested capital if refinancing or new project finance becomes costlier.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for ERG is €28.21, which represents two standard deviations above the consensus price target of €21.77. This valuation is based on what can be assumed as the expectations of ERG's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €29.4, and the most bearish reporting a price target of just €19.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €1.0 billion, earnings will come to €274.3 million, and it would be trading on a PE ratio of 20.2x, assuming you use a discount rate of 11.2%.

- Given the current share price of €18.42, the bullish analyst price target of €28.21 is 34.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.