Key Takeaways

- Accelerated digital transformation and potential merger synergies could drive outsized gains in revenue, efficiency, and customer growth, strengthening the bank's strategic market position.

- Robust capital levels and favorable economic tailwinds create opportunities for enhanced shareholder returns, sustained expansion, and further value-creating acquisitions.

- Structural risks from legacy loan issues, fintech disruption, rising costs, and heightened competition threaten profitability, efficiency, and long-term revenue prospects.

Catalysts

About Banca Monte dei Paschi di Siena- Engages in the provision of retail and commercial banking services in Italy.

- While analyst consensus expects the Mediobanca combination to produce substantial synergies, there is potential for these synergies to far exceed the €700 million estimate due to immediate cost rationalization, cross-selling benefits, and the emergence of a powerful third pillar in Italian banking, which could result in a step-change for revenue, cost-to-income, and long-term earnings power.

- Analysts broadly agree on strong fee growth from wealth management, but ongoing generational wealth transfer and the acceleration in retail mortgage originations signal that fee-based income could sustain double-digit growth for multiple years, significantly boosting net margins and driving durable top-line expansion.

- BMPS's digital transformation, underpinned by new data-driven commercial tools and technology investments, is already producing above-market gains in both lending and deposit growth, positioning the bank for structural improvements in customer acquisition, cost efficiency, and scalable revenue streams.

- The bank's record-high capital ratios, combined with sustained organic capital generation, not only de-risk the investment case but unlock the possibility of outsized shareholder distributions and optionality for further value-accretive acquisitions, amplifying future EPS growth.

- The improving Eurozone macroeconomic backdrop and renewed economic integration are driving a resurgence in Italian credit demand and business activity, creating a foundation for above-trend loan growth and supporting BMPS's ambitions to outperform on both revenue and earnings over the next cycle.

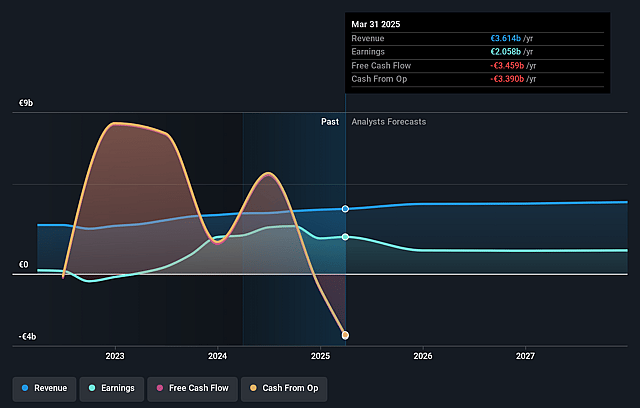

Banca Monte dei Paschi di Siena Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Banca Monte dei Paschi di Siena compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Banca Monte dei Paschi di Siena's revenue will grow by 5.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 56.9% today to 31.1% in 3 years time.

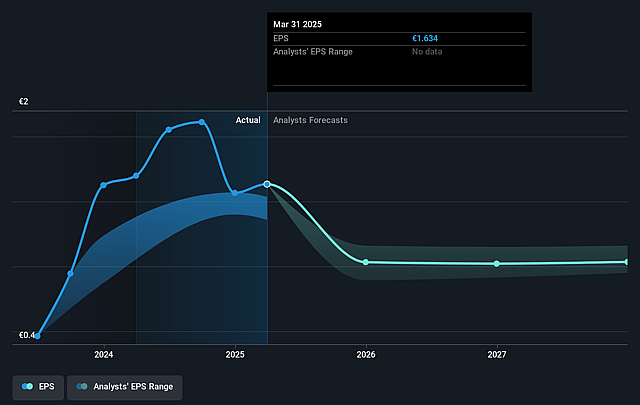

- The bullish analysts expect earnings to reach €1.3 billion (and earnings per share of €1.06) by about July 2028, down from €2.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.4x on those 2028 earnings, up from 4.4x today. This future PE is greater than the current PE for the IT Banks industry at 7.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.61%, as per the Simply Wall St company report.

Banca Monte dei Paschi di Siena Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating shift toward digital banking and fintech disruptors is likely to lead to the gradual disintermediation of traditional banks, such as Banca Monte dei Paschi di Siena, putting long-term downward pressure on fee income and potentially eroding the retail customer base, which could negatively impact overall revenue growth.

- The persistent legacy of non-performing loans and historically low asset quality, even with short-term improvements, continues to present a structural risk; this legacy can constrain the bank's ability to improve net margins and maintain earnings stability, especially if economic conditions deteriorate or loan performance worsens.

- Prolonged periods of low or negative interest rates in Europe are compressing net interest margins, as indicated by recent net interest income being only partially offset by cost of funding management, suggesting the bank's core profitability remains exposed to further downward pressure on earnings.

- High and rising regulatory and ESG compliance demands are increasing operational and compliance costs; even as the company reports cost discipline, labor cost inflation from contract renewals and investment needs for technology modernization can cause structurally elevated cost-to-income ratios, reducing net margins over time.

- The ongoing consolidation of the European banking sector and the rise of pan-European giants threaten to marginalize smaller, less efficient players like Banca Monte dei Paschi di Siena, which could result in increased competition, squeezed market share, and reduced future revenues if the company cannot maintain or extend its scale and competitive positioning.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Banca Monte dei Paschi di Siena is €9.7, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Banca Monte dei Paschi di Siena's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €9.7, and the most bearish reporting a price target of just €6.35.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €4.3 billion, earnings will come to €1.3 billion, and it would be trading on a PE ratio of 12.4x, assuming you use a discount rate of 10.6%.

- Given the current share price of €7.24, the bullish analyst price target of €9.7 is 25.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.