Key Takeaways

- Failure to accelerate digital transformation and adapt to fintech competition may drive higher customer attrition, margin pressure, and revenue erosion over time.

- Execution risks in complex mergers and rising regulatory burdens threaten cost control, efficiency gains, and long-term profitability compared to more agile peers.

- Strong fee-based revenue growth, improved efficiency, superior capital strength, better asset quality, and strategic consolidation efforts position the bank for sustainable profitability and competitive advantage.

Catalysts

About Banca Monte dei Paschi di Siena- Engages in the provision of retail and commercial banking services in Italy.

- Despite strong recent profit growth and record capital ratios, prolonged digital disruption and competition from agile fintechs continue to threaten traditional revenue streams at Monte dei Paschi di Siena; without a significant acceleration in technology adoption, customer attrition and margin compression are likely, which may erode both topline revenue and net margins over the long-term.

- The bank's future net interest income is highly exposed to macro trends, as even management acknowledges declines in interest rates are only partially mitigated by funding cost management; an extended environment of subdued or falling European rates would suppress net interest margins and dampen earnings growth beyond current guidance.

- Although the proposed business combination with Mediobanca promises synergies, its complexity, unclear terms, and Mediobanca's lack of integration track record at this scale raise acute execution risks; potential integration pitfalls could inflate costs and lead to value destruction rather than the forecast earnings accretion, undermining medium-term profitability and capital strength.

- Stringent and rising regulatory, compliance, and ESG demands are likely to disproportionately burden legacy banks like MPS, whose large, unionized workforce and structural cost base make further meaningful efficiency gains elusive, thereby pressuring operating expenses and reducing future earnings flexibility.

- Accelerating consolidation across the European banking sector risks relegating Monte dei Paschi to a takeout target or marginal player if it fails to integrate successfully or adapt to heightened competition, which could ultimately result in competitive losses, market share erosion, and muted long-term revenue and capital generation for shareholders.

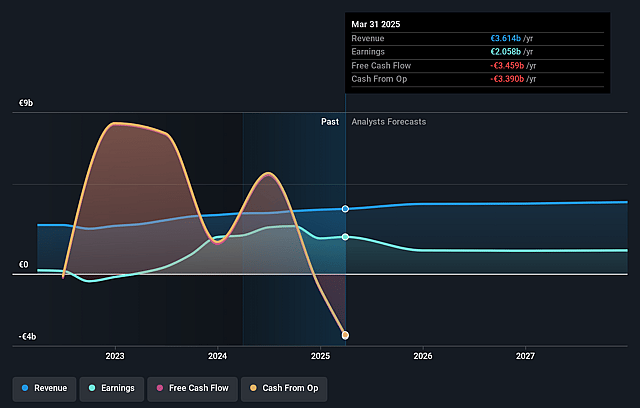

Banca Monte dei Paschi di Siena Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Banca Monte dei Paschi di Siena compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Banca Monte dei Paschi di Siena's revenue will grow by 2.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 56.9% today to 27.6% in 3 years time.

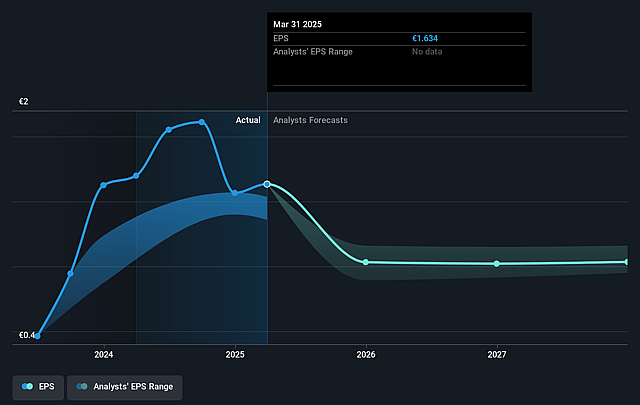

- The bearish analysts expect earnings to reach €1.1 billion (and earnings per share of €0.87) by about July 2028, down from €2.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.0x on those 2028 earnings, up from 4.4x today. This future PE is greater than the current PE for the IT Banks industry at 7.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.61%, as per the Simply Wall St company report.

Banca Monte dei Paschi di Siena Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued robust growth in wealth management and advisory fees, supported by a 15 percent year-on-year increase and sustained inflows, indicates the bank is capturing long-term secular demand for fee-based revenue streams, which could bolster top-line revenues and margin resilience.

- A record-high common equity Tier 1 capital ratio above 19 percent, among the highest in Europe, provides substantial capacity for further shareholder distributions and strategic investments, increasing the potential for enhanced earnings and dividend growth.

- Demonstrated success in cost discipline and restructuring, evident in a declining cost-to-income ratio (now at 47 percent) and ongoing reductions in non-HR costs, points to lasting operating efficiency improvements, which drive higher net profit and margin expansion.

- Significant improvement in asset quality, with a declining NPE ratio now at 4.5 percent gross and 2.2 percent net, alongside a falling cost of risk and increasing coverage, reduces the risk of future credit losses and supports sustainable growth in earnings and return on equity.

- The bank's proactive strategic positioning for further consolidation, including the planned Mediobanca combination that targets €700 million in annual pre-tax synergies and projected double-digit earnings per share accretion, may provide durable competitive advantages and value creation for shareholders through revenue and net income growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Banca Monte dei Paschi di Siena is €6.35, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Banca Monte dei Paschi di Siena's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €9.7, and the most bearish reporting a price target of just €6.35.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €3.9 billion, earnings will come to €1.1 billion, and it would be trading on a PE ratio of 10.0x, assuming you use a discount rate of 10.6%.

- Given the current share price of €7.24, the bearish analyst price target of €6.35 is 14.0% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.