Key Takeaways

- Expedited commissioning of major hydro projects and accelerating renewables growth are set to sharply boost returns and margin profiles beyond market expectations.

- Unique positioning in India's energy transition and international expansion enables lucrative offtake deals, capital access, and long-term earnings quality improvements.

- Climate and execution risks, geographic concentration, weak collections, and intensifying competition from cheaper renewables threaten NHPC's earnings stability and long-term revenue growth.

Catalysts

About NHPC- Engages in the generation, sale, and trading of electricity through hydro, wind, and solar power stations in India.

- Analyst consensus expects Subansiri Lower and Parbati-II to materially boost revenue at commissioning, but market is underestimating both the speed of ramp-up-with Parbati-II already fully operational and Subansiri set for majority commissioning within FY26-and the upside to regulated equity, which should sharply lift return on equity and long-term earnings far ahead of current forecasts.

- While consensus sees renewables as incremental, the scale and pace of NHPC's diversification are poised to accelerate meaningfully; with solar and pumped hydro projects covering multiple states, rapid buildout could double clean energy contribution to EBITDA by end-FY27 and structurally improve margins due to rising blended tariffs and superior asset returns.

- Few are factoring in the transformative impact of India's energy transition push, which is creating unprecedented demand for round-the-clock, carbon-free baseload; as one of the few players with a large and growing hydro and storage pipeline, NHPC is exceptionally positioned to capture premium offtake agreements and favorable tariffs, ensuring outsized revenue visibility and tariff growth.

- The pending development of massive cross-border hydro projects in Nepal and active pursuit of export-linked power agreements gives NHPC early-mover advantage in what could become a high-margin regional export business, likely driving a step-change in profitability and earnings quality from FY28 onwards.

- Structural improvements in transmission infrastructure and grid interconnection, combined with ongoing regulatory support (including green bond financing and carbon credits), are about to unlock a new era of capital access and portfolio monetization options for NHPC, significantly lowering its cost of capital and enhancing net margins over the coming decade.

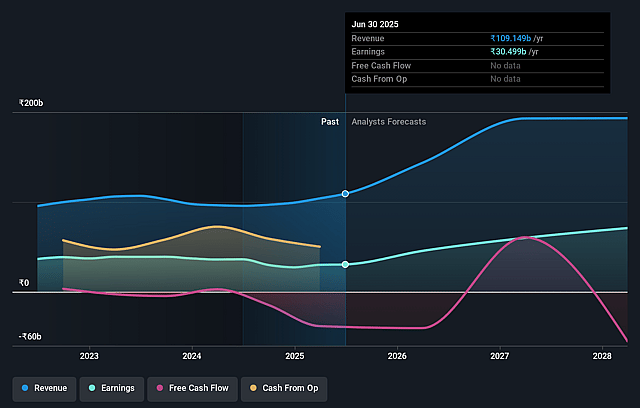

NHPC Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on NHPC compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming NHPC's revenue will grow by 25.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 27.9% today to 39.6% in 3 years time.

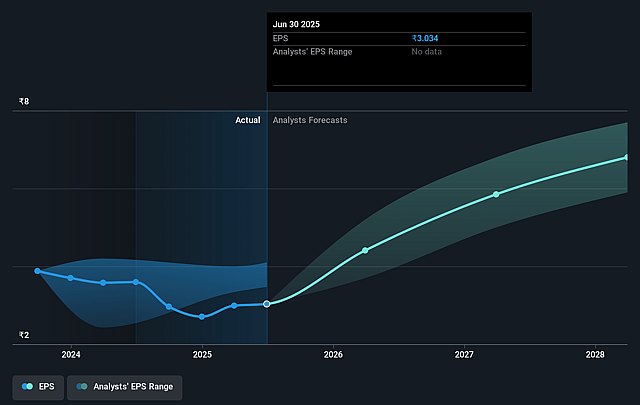

- The bullish analysts expect earnings to reach ₹86.1 billion (and earnings per share of ₹8.54) by about September 2028, up from ₹30.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 20.6x on those 2028 earnings, down from 26.2x today. This future PE is lower than the current PE for the IN Renewable Energy industry at 25.9x.

- Analysts expect the number of shares outstanding to decline by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.3%, as per the Simply Wall St company report.

NHPC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The lower generation in FY '25, a decline of around 9% due to climate-related events such as heavy flash floods and landslides in the Teesta Basin, demonstrates increasing exposure to climate change-induced disruptions, which could make NHPC's revenues and net margins more volatile in the future.

- Several large projects, including Subansiri, Dibang, Teesta-6, and others, continue to face execution risks involving land acquisition, environmental clearances, and delays in contract awards, which raises the likelihood of cost overruns and deferred revenue recognition, thereby compressing profit margins.

- Despite efforts to diversify into solar and pump storage, NHPC's core business remains highly concentrated in the Northeast and Himalayan regions, leaving it susceptible to regional geopolitical, seismic, and hydrological risks, all of which could threaten plant availability and long-term earnings stability.

- The increasing share of unbilled debtors (rising from ₹2,263 crores to ₹3,677 crores over the year), along with reliance on regulatory and arbitration-related revenue recognition, hints at potential collection and regulatory risks that may adversely impact actual realized cash flow and reported profits.

- Growing competition from cost-effective renewables such as solar (with some projects now bidding at tariffs below ₹3 per unit) threatens the long-term attractiveness and tariff competitiveness of NHPC's newer hydro projects, especially given their higher levelized costs, which could lead to downward pressure on realized tariffs and overall revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for NHPC is ₹117.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of NHPC's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹117.0, and the most bearish reporting a price target of just ₹70.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹217.1 billion, earnings will come to ₹86.1 billion, and it would be trading on a PE ratio of 20.6x, assuming you use a discount rate of 15.3%.

- Given the current share price of ₹79.56, the bullish analyst price target of ₹117.0 is 32.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.