Key Takeaways

- Climate-related disruptions and regulatory obstacles threaten NHPC's operational stability, project timelines, and profitability through increased downtimes and capital inefficiencies.

- Advancements in alternative renewables and unfavorable tariff dynamics reduce hydropower's market share, pricing power, and compromise future revenue streams and earnings quality.

- Strategic project execution, regulatory support, robust receivables management, and diversified renewables expansion position NHPC for sustained revenue growth and long-term earnings stability.

Catalysts

About NHPC- Engages in the generation, sale, and trading of electricity through hydro, wind, and solar power stations in India.

- Heightened climate change-induced volatility, such as flash floods and landslides-as recently seen in the complete shutdown of the Teesta power station and ongoing restoration delays-suggests that NHPC's hydro generation will face persistent operational disruptions in the coming years. This raises the risk of more frequent, unpredictable downtimes and sustained earnings volatility, which is likely to weigh on long-term revenue growth and margin stability.

- Increasing regulatory hurdles, coupled with intensifying environmental and social scrutiny of large hydro projects, are expected to further delay project clearances, land acquisition, and commissioning timelines. These structural headwinds will likely lock up significant capital without corresponding returns, impeding the pace of revenue realization and leading to rising cost overruns that compress overall profitability.

- The accelerating pace of technological advances and cost reductions in alternative renewables-particularly solar, wind, and battery storage-threatens to erode hydropower's market share within India's expanding energy system. This could diminish NHPC's pricing power, reduce utilization rates for its upcoming projects, and ultimately compress revenues and future earnings.

- Chronic project execution delays and persistent cost escalation, as indicated by massive capex commitments and multiple projects still stuck in the approval or partial-completion stage, increase the likelihood of missed revenue targets and further gross margin compression. Moreover, these delays elevate project risk and can inflate financing costs, thereby adversely affecting net income growth.

- With a large portion of NHPC's future cash flows tied to long-dated power purchase agreements at regulated tariffs, growing exposure to tariff renegotiations and financial stress at state discoms creates a long-term risk of lower realizations and potential receivables build-up. This undermines the reliability of revenue streams and puts sustained pressure on cash generation and net margins.

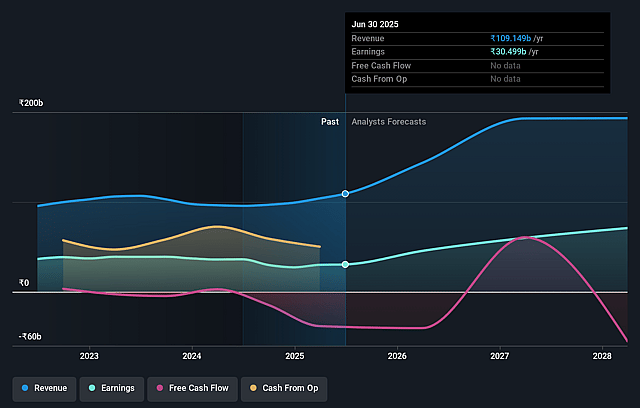

NHPC Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on NHPC compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming NHPC's revenue will grow by 22.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 27.9% today to 33.7% in 3 years time.

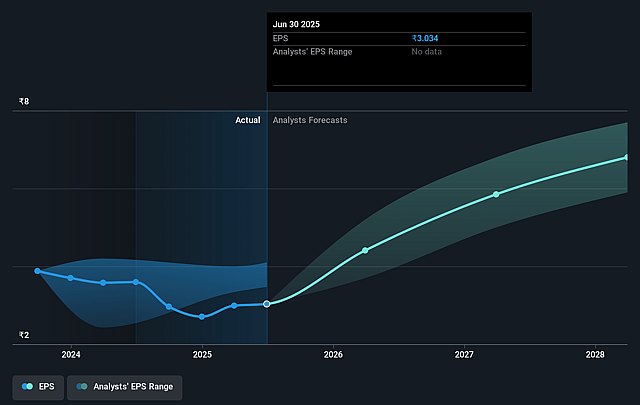

- The bearish analysts expect earnings to reach ₹67.6 billion (and earnings per share of ₹6.54) by about September 2028, up from ₹30.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, down from 26.2x today. This future PE is lower than the current PE for the IN Renewable Energy industry at 25.9x.

- Analysts expect the number of shares outstanding to decline by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.3%, as per the Simply Wall St company report.

NHPC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant commissioning of new hydro and solar projects-including the 800 MW Parbati-II, large-scale commissioning at Subansiri (2,000 MW), and strong progress across Dibang, Lanco Teesta, Pakal Dul, Rangit IV, and major solar plants-provide clear visibility for robust capacity addition and revenue growth in the coming years.

- NHPC's expanding regulated equity base from ongoing and upcoming project completions directly supports higher returns on equity, enhancing profitability and potentially stabilizing or increasing earnings over the long term.

- Government policy remains strongly supportive, with fast-tracked approvals, new project clearances, and targeted incentives for hydropower and renewables, increasing the likelihood of continuous project pipeline buildup and stable or rising revenues for NHPC.

- Consistent improvement in receivables with detailed billing reconciliation and only a small portion of outstanding debt over 45 days as of year-end mitigates risks to cash flows and indicates resilient working capital management that supports healthy net margins.

- NHPC's strategic diversification into solar and pump storage projects, as well as regional hydropower expansion (including cross-border initiatives in Nepal), positions the company to benefit from secular growth trends in renewables and grid-balancing requirements, which could drive long-term revenue expansion and margin stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for NHPC is ₹70.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of NHPC's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹117.0, and the most bearish reporting a price target of just ₹70.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹200.5 billion, earnings will come to ₹67.6 billion, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 15.3%.

- Given the current share price of ₹79.56, the bearish analyst price target of ₹70.0 is 13.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.