Catalysts

About LTIMindtree

LTIMindtree is a global technology consulting and digital solutions company helping enterprises modernize, automate and scale their businesses through cloud, data and AI led transformation.

What are the underlying business or industry changes driving this perspective?

- Accelerating adoption of AI centric and agentic solutions, underpinned by the BlueVerse platform, is deepening LTIMindtree's role in client technology stacks and supporting faster revenue growth and higher earnings quality over time.

- A structural shift toward large scale digital and cloud transformation, evidenced by multiyear vendor consolidation deals across all five verticals, is expanding average deal size and visibility, which supports double digit type revenue growth aspirations.

- Rising demand for data led, industry specific AI use cases in BFSI, healthcare and public services, combined with recognized leadership positions in AI application development, is widening competitive differentiation and supporting premium pricing and EBIT margin expansion.

- Systematic productivity gains from AI infused delivery, Fit for Future margin programs and pyramid optimization, including strong fresher intake, are reducing unit delivery costs and can drive steady improvement in net margins and return on equity.

- Broad based growth across geographies and verticals, together with declining attrition and large scale reskilling of more than 80,000 employees in GenAI, is strengthening execution capacity and operating leverage and supporting sustained EPS growth.

Assumptions

This narrative explores a more optimistic perspective on LTIMindtree compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

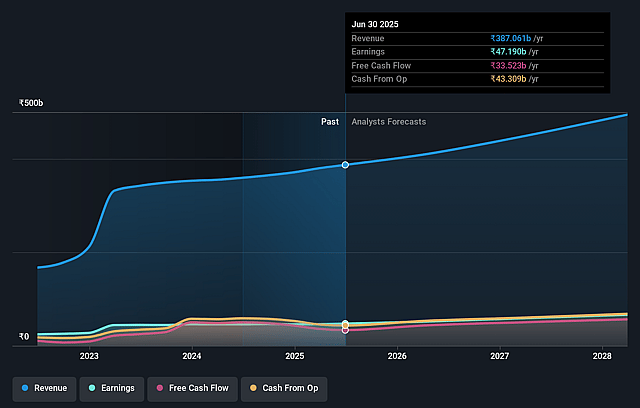

- The bullish analysts are assuming LTIMindtree's revenue will grow by 14.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 12.3% today to 14.6% in 3 years time.

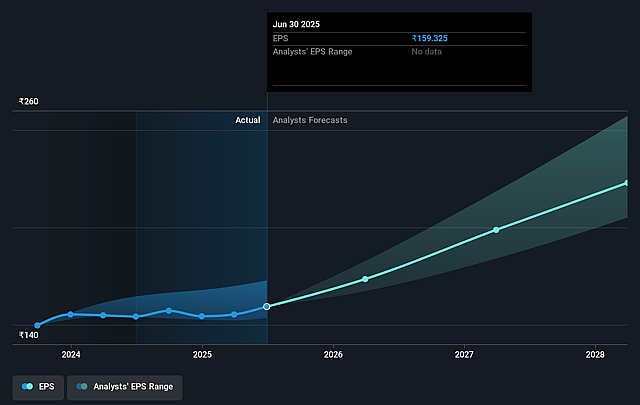

- The bullish analysts expect earnings to reach ₹86.3 billion (and earnings per share of ₹292.02) by about December 2028, up from ₹48.7 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹67.5 billion.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 39.5x on those 2028 earnings, up from 37.5x today. This future PE is greater than the current PE for the IN IT industry at 25.6x.

- The bullish analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.06%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- A structural reset in pricing, with AI driven productivity systematically passed back to large clients in BFSI, high tech and other verticals, could cap growth in the largest accounts, limit the ability of headline revenue to compound at the assumed mid teens rate, and pressure EBIT expansion over the long term.

- If the industry wide shift to AI centric delivery leads to clients consolidating vendors or rebasing renewals at lower price points more quickly than LTIMindtree can backfill with higher value AI and transformation work, the company could see slower order book conversion and weaker earnings growth than expected.

- Sustained high utilization levels, combined with aggressive large deal ramp ups and reliance on subcontractors, could constrain execution flexibility, cause delivery slippages or higher fulfillment costs, and weigh on net margins while diluting the anticipated improvement in return on equity.

- If the heavy upfront investments in GenAI reskilling, BlueVerse platforms, delivery modernization and facilities do not translate into durable pricing power or wallet share gains in key accounts, the company may face an extended period in which operating expenses grow faster than revenues and compress earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for LTIMindtree is ₹7353.07, which represents up to two standard deviations above the consensus price target of ₹5885.98. This valuation is based on what can be assumed as the expectations of LTIMindtree's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹7500.0, and the most bearish reporting a price target of just ₹4250.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be ₹589.9 billion, earnings will come to ₹86.3 billion, and it would be trading on a PE ratio of 39.5x, assuming you use a discount rate of 16.1%.

- Given the current share price of ₹6163.0, the analyst price target of ₹7353.07 is 16.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on LTIMindtree?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.