Catalysts

About LTIMindtree

LTIMindtree is a global technology consulting and digital engineering company that delivers AI led transformation, cloud, and platform services to enterprises across industries.

What are the underlying business or industry changes driving this perspective?

- Rapid client adoption of AI driven productivity, particularly in large, long tenure accounts, risks structurally shrinking traditional effort based revenue pools faster than LTIMindtree can backfill with new AI programs. This could pressure medium term revenue growth.

- Widespread recalibration of contract pricing and scope at renewals, as clients embed AI and vendor consolidation demands, could reset commercials at lower run rate levels and cap the company’s ability to sustain recent EBIT margin expansion.

- The push to become an AI centric, agentic enterprise partner requires heavy, continuing investment in platforms like BlueVerse, studios, centers of excellence and large scale reskilling. These investments may outpace monetization and dilute net margins if win rates or ramp ups underdeliver.

- High utilization levels combined with staggered wage hikes, elevated fresher intake, and selective subcontractor use to ramp mega deals increase execution risk on complex transformations. This creates potential for cost overruns or delivery issues that could hurt earnings.

- As AI infused delivery lets clients do more with fewer people across BFSI, technology, media and other key verticals, LTIMindtree’s current headcount heavy model may face a prolonged mix shift toward lower ticket, higher automation work. This could constrain long term revenue scale and return on equity.

Assumptions

This narrative explores a more pessimistic perspective on LTIMindtree compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

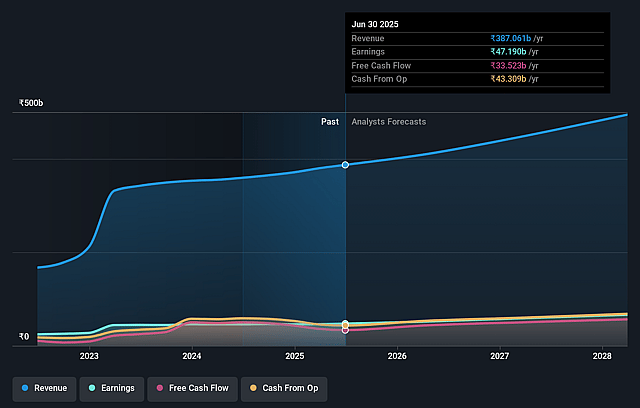

- The bearish analysts are assuming LTIMindtree's revenue will grow by 8.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 12.3% today to 13.2% in 3 years time.

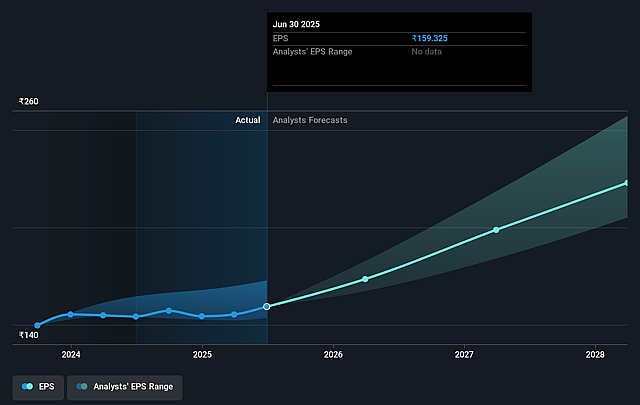

- The bearish analysts expect earnings to reach ₹67.2 billion (and earnings per share of ₹226.49) by about December 2028, up from ₹48.7 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₹85.9 billion.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 30.6x on those 2028 earnings, down from 37.9x today. This future PE is greater than the current PE for the IN IT industry at 25.1x.

- The bearish analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.97%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The company is already demonstrating steady top line growth, with Q2 FY '26 revenue of USD 1.18 billion growing 4.8% year on year in dollar terms and crossing INR 10,000 crore in INR terms. If this is sustained or accelerated by strong order inflow, it could support higher future revenue and earnings than a bearish view assumes, thereby underpinning the share price.

- Structural demand for AI centric transformation appears strong and broad based, with four consecutive quarters of around USD 1.6 billion in order inflow, large wins across all five verticals, and more than 1,500 digital agents already in use. This suggests a durable long term growth engine that may drive resilient revenue and expanding EBIT margins.

- Management is executing a multi lever margin improvement program, with EBIT already at 15.9% after a 160 basis point sequential expansion and further gains targeted from AI driven productivity, pyramid correction and overhead optimization. These initiatives could lift net margins and earnings beyond conservative expectations.

- Large scale AI reskilling and capability building, evidenced by over 80,000 employees completing GenAI training, new BlueVerse studios, patents and ecosystem partnerships, positions the company to capture secular AI adoption tailwinds. This may enhance win rates, support premium pricing and strengthen long term earnings power.

- A robust balance sheet and cash generation profile, including cash and investments of about USD 1.58 billion, free cash flow to profit after tax of 72.4% and return on equity of 21.8%, plus a rising dividend, provide financial resilience. This can fund growth investments and shareholder returns, limiting downside risk to valuation and the share price.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for LTIMindtree is ₹4438.4, which represents up to two standard deviations below the consensus price target of ₹5867.44. This valuation is based on what can be assumed as the expectations of LTIMindtree's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹7500.0, and the most bearish reporting a price target of just ₹4250.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be ₹508.2 billion, earnings will come to ₹67.2 billion, and it would be trading on a PE ratio of 30.6x, assuming you use a discount rate of 16.0%.

- Given the current share price of ₹6220.5, the analyst price target of ₹4438.4 is 40.2% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on LTIMindtree?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.