Key Takeaways

- KPIT's integration of Chinese innovation and leadership in software and digital solutions positions it for major global contract wins and lasting, high-margin industry partnerships.

- Strategic collaborations, vertical expansion, and deep expertise in electrification and autonomous tech create multiple growth levers and enhance revenue visibility across key automotive markets.

- Reliance on major auto clients, industry shifts towards in-house software, and global uncertainties threaten KPIT's growth, margin stability, and long-term earnings visibility.

Catalysts

About KPIT Technologies- Provides embedded software, artificial intelligence, and digital solutions for the automobile and mobility sector in the Americas, the United Kingdom, Europe, and internationally.

- Analyst consensus sees opportunity in applying learnings from China to global OEMs, but the market may be underestimating the magnitude and speed at which KPIT's unique integration of Chinese innovation in cost, features, and speed-especially around autonomous driving and digital cockpit-will enable major global contract wins and steep acceleration in revenue and margin expansion over the next several years.

- While analysts agree KPIT is positioned to benefit from the vendor consolidation and fixed-price model shift among European OEMs, the true earnings catalyst lies in KPIT's ability to emerge as a preferred transformation partner, capturing disproportionately large deal sizes and securing multi-year, high-margin contracts as the European industry races to close the innovation gap with China and Tesla.

- KPIT's first-mover and expanding leadership in end-to-end validation, cybersecurity, and cost reduction offerings directly aligns with the rising regulatory and consumer focus on vehicle safety and sustainability-this positions KPIT for prolonged, sticky, higher-value collaborations that will both enhance topline growth and result in superior operating leverage.

- The ongoing electrification and autonomous vehicle shift is rapidly increasing the software content per vehicle and the complexity of software integration; KPIT's domain expertise, proprietary accelerators and AI-driven productivity tools are likely to substantially outpace peers in wallet share gain and margin expansion as this secular trend intensifies globally across both established and emerging OEMs.

- Contrary to perceptions of near-term uncertainty, KPIT's deepening strategic partnerships, breakthrough wins (e.g., Mercedes), and advanced-stage vertical expansion into commercial vehicles, off-highway, and semiconductors collectively create a multi-pronged growth vector that will drive both higher revenue visibility and potential upward revisions in earnings estimates as new deal flows materialize across North America, Europe, and Asia.

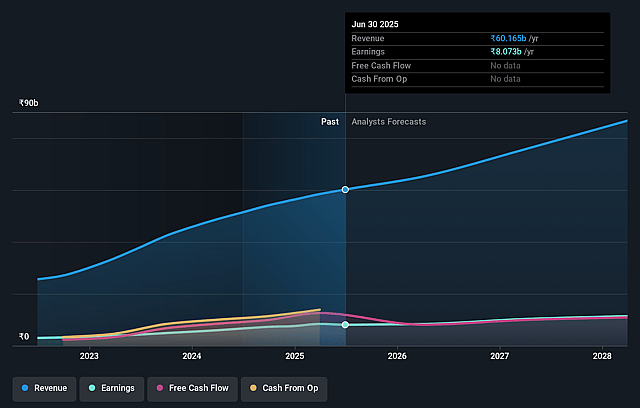

KPIT Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on KPIT Technologies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming KPIT Technologies's revenue will grow by 19.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 14.4% today to 14.3% in 3 years time.

- The bullish analysts expect earnings to reach ₹14.3 billion (and earnings per share of ₹52.35) by about June 2028, up from ₹8.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 49.7x on those 2028 earnings, up from 40.7x today. This future PE is greater than the current PE for the IN Software industry at 35.9x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.97%, as per the Simply Wall St company report.

KPIT Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating adoption of AI-driven automation and productivity tools threatens the long-term relevance of KPIT's outsourced automotive software engineering services, which could result in shrinking demand, intense pricing pressure, and margin compression, negatively impacting both revenue and EBITDA margins.

- KPIT is highly exposed to a handful of large automotive OEM clients, making it vulnerable to revenue volatility if demand cycles turn, clients increase insourcing of software, or key contracts are lost, all of which could reduce earnings visibility and stability.

- Increasing geopolitical uncertainty, including tariffs and protectionist policies, poses a significant risk to KPIT's ability to win and execute deals in global markets such as China, Europe, and the US, potentially constraining future revenue growth opportunities.

- The automotive industry's gradual shift toward in-house software development and the increasing focus on hardware, electrification, and non-software R&D by OEMs could reduce the addressable market for KPIT's traditional end-to-end software integration services, resulting in slower long-term growth.

- Persistent shortages and rising costs of specialized automotive engineering talent, coupled with ongoing pricing competition from global and local IT service providers, could force KPIT to increase compensation or lower prices, ultimately squeezing net margins and putting pressure on long-term earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for KPIT Technologies is ₹1720.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of KPIT Technologies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1720.0, and the most bearish reporting a price target of just ₹1000.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹99.7 billion, earnings will come to ₹14.3 billion, and it would be trading on a PE ratio of 49.7x, assuming you use a discount rate of 15.0%.

- Given the current share price of ₹1258.7, the bullish analyst price target of ₹1720.0 is 26.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.