Last Update 16 Dec 25

KPITTECH: Upcoming Board Decisions On Acquisitions Will Drive Bullish Outlook

Analysts have slightly raised their price target for KPIT Technologies to bring it more in line with their unchanged fair value estimate of ₹1,311.76 per share, reflecting marginally higher discount rate assumptions and steady expectations for revenue growth, profit margins, and future valuation multiples.

What's in the News

- Board meeting scheduled for November 10, 2025 to consider and approve the unaudited financial results for the quarter and half year ended September 30, 2025, along with the limited review report (company filing)

- Board meeting set for October 28, 2025 at 10:05 IST to evaluate the proposed acquisition of Caresoft, signaling potential inorganic expansion in automotive engineering services (company filing)

- On October 28, 2025 the board will also review planned strategic investments in N-Dream AG and Helm Ai, underscoring KPIT Technologies focus on gaming and autonomous software capabilities (company filing)

- The October 28, 2025 agenda includes consideration of granting 8,000 stock options to eligible employees under the KPIT Technologies Limited Restricted Stock Unit Plan 2022, highlighting continued use of equity-based incentives (company filing)

Valuation Changes

- Fair Value Estimate is unchanged at ₹1,311.76 per share, indicating no reassessment of intrinsic value.

- The Discount Rate has risen slightly from 15.16 percent to 15.20 percent, reflecting a marginally higher required return.

- Revenue Growth is effectively unchanged at about 13.25 percent, signaling stable long term top line assumptions.

- The Net Profit Margin is effectively unchanged at about 13.44 percent, indicating consistent expectations for profitability.

- The Future P/E has edged up slightly from 45.67x to 45.73x, suggesting a marginally higher valuation multiple applied to future earnings.

Key Takeaways

- Expansion in software-defined vehicles, embedded cybersecurity, and next-gen mobility drives demand for KPIT's engineering services, reinforcing margins and future earnings resilience.

- Proprietary technology and solutions-led models boost operational efficiency and diversification, leveraging global outsourcing trends and deepening relationships with leading automotive OEMs.

- Heavy reliance on European clients, slower conversion of wins, and delayed tech commercialization raise concerns over revenue growth, margin pressures, and execution risks in emerging markets.

Catalysts

About KPIT Technologies- Provides embedded software, artificial intelligence, and digital solutions for the automobile and mobility sector in the Americas, the United Kingdom, Europe, and internationally.

- Imminent recovery in client automotive spending post-tariff/regulatory uncertainty is expected to unlock stalled programs-especially in Europe, China, and India-where KPIT's pipeline is robust and large programs are ready to ramp, setting up for stronger revenue growth in the second half and across FY27.

- Rising industry focus on software-defined vehicles (SDVs), connected/e-cockpit solutions, and embedded cybersecurity is pushing OEMs to accelerate feature rollouts and compliance initiatives, directly increasing demand for KPIT's high-value software engineering and validation services-supporting higher realization rates and net margin resilience.

- Increased use and development of proprietary tools, accelerators, and AI-infused mobility solutions allow KPIT to address client cost and speed pressures more efficiently, shifting work toward fixed-price and solutions-led models, which can improve operating leverage and buttress EBITDA margins despite wage inflation.

- Strong traction and strategic foothold in fast-growing EV and next-gen mobility markets (India and China), including multi-year platforms with leading OEMs, are expected to diversify KPIT's revenue base beyond mature Western markets and drive higher long-term earnings visibility.

- Sustained global trend of outsourcing R&D and software integration by automotive OEMs, as platform complexity and software content in vehicles surges, continues to benefit KPIT's order book and future annuity streams, positioning revenue and margin upside as the industry transitions intensify.

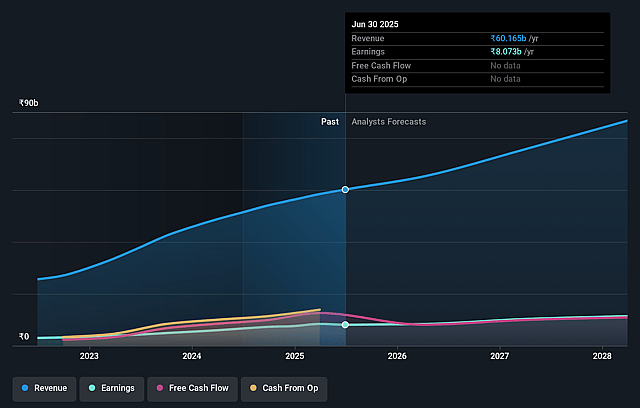

KPIT Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming KPIT Technologies's revenue will grow by 13.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.4% today to 13.8% in 3 years time.

- Analysts expect earnings to reach ₹12.2 billion (and earnings per share of ₹44.32) by about September 2028, up from ₹8.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 47.5x on those 2028 earnings, up from 41.0x today. This future PE is greater than the current PE for the IN Software industry at 35.9x.

- Analysts expect the number of shares outstanding to grow by 0.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.39%, as per the Simply Wall St company report.

KPIT Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing reprioritization and delay of OEM automotive programs, particularly in EV and new software architectures, signal slower client spending and reduced near-term conversion of deal wins into revenue, raising concerns over future topline growth.

- Rising cannibalization from KPIT's own solutions and accelerators (faster, AI-based project delivery), though improving margins and client stickiness, may substitute previous labor-intensive revenue streams and dilute overall revenue growth despite strong deal wins.

- Overdependence on the European market and a limited client set is evident; ongoing profit downgrades and margin pressures at major European OEMs could lead to client spend reductions, exposing KPIT to revenue volatility and slower earnings growth.

- Delay in the commercialization of high-potential technologies such as sodium-ion batteries and hydrogen fuel, with management admitting revenue impact is 2–3 years out and current involvement limited to pilots, risks missing shorter-term monetization opportunities and pushes out prospective earnings.

- Expansion in China and India is in early stages, and while management is optimistic, uncertainties around local competition, pricing, currency volatility, and the complexity of scaling platforms/products in these markets could impeded margin expansion and result in operational execution risk that impacts net profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1377.238 for KPIT Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1600.0, and the most bearish reporting a price target of just ₹1000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹88.8 billion, earnings will come to ₹12.2 billion, and it would be trading on a PE ratio of 47.5x, assuming you use a discount rate of 15.4%.

- Given the current share price of ₹1216.4, the analyst price target of ₹1377.24 is 11.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on KPIT Technologies?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.