Last Update 30 Nov 25

Fair value Decreased 4.13%SENCO: Expanded Partnerships And Fresh Designs Will Drive Future Upside

Analysts have adjusted their price target for Senco Gold downward from ₹476.14 to ₹456.50. This change reflects updated forecasts for revenue growth, profit margins, and risk assumptions.

What's in the News

- Senco Gold's Board of Directors will meet on November 12, 2025 to consider and approve the unaudited financial results for the quarter and half year ended September 30, 2025. (Key Developments)

- The company has extended its strategic and marketing tie-up with August Jewellery Private Limited, known for the Melorra brand, until December 31, 2025. The extension continues on the same terms as the previous arrangement. (Key Developments)

- Senco Gold & Diamonds has entered a collaboration with Sky Gold & Diamonds to design and supply 9kt gold jewellery collections. This initiative aims to meet India's demand for affordable and stylish jewellery with contemporary designs. (Key Developments)

Valuation Changes

- Consensus Analyst Price Target has been reduced from ₹476.14 to ₹456.50.

- Discount Rate has risen slightly from 16.41% to 16.71%.

- Revenue Growth assumptions have decreased marginally from 18.54% to 18.31%.

- Net Profit Margin has improved slightly, moving from 3.56% to 3.58%.

- Future P/E projection has decreased from 35.62x to 33.24x.

Key Takeaways

- Focus on expanding into smaller cities, premiumizing product offerings, and omni-channel strategy positions the company for growth and margin improvement amid shifting consumer preferences.

- Increased investments in branding, franchising, and compliance with regulations bolster market share, customer trust, and long-term earnings stability.

- Heavy regional focus, rising competition, volatile gold prices, and franchise constraints threaten Senco Gold's national expansion, margin stability, and sustained earnings growth.

Catalysts

About Senco Gold- Engages in the manufacture and trading of jewelry and articles made of gold, silver, platinum, and other precious and semi-precious stones in India.

- The company is actively expanding its retail footprint, especially in underpenetrated Tier 2 and Tier 3 cities, which-supported by ongoing urbanization and a rising middle class-should drive sustained revenue growth and enhance operating leverage in coming years.

- There is a clear focus on premiumization and expanding designer/lightweight and studded jewelry collections, positioning Senco Gold to benefit from changing consumer preferences and improving its brand; this supports margin expansion and has already resulted in higher average ticket sizes and improved gross margins.

- Increasing investment in franchisee models and brand building outside the core Eastern India region positions Senco Gold to increase its market share as consumers shift from unorganized to organized jewelry retail, directly supporting both revenue growth and earnings stability.

- The push towards omni-channel strategies-including advancements in digital platforms and planned collaborations (e.g., Melorra)-is poised to capture a broader, younger consumer base, further boosting same-store sales growth and supporting both top-line and margin expansion.

- Regulatory developments such as hallmarking and tougher compliance play to Senco Gold's strengths as an established, trusted brand; this reduces competition from the grey market, enhances customer trust, and increases long-term earnings visibility.

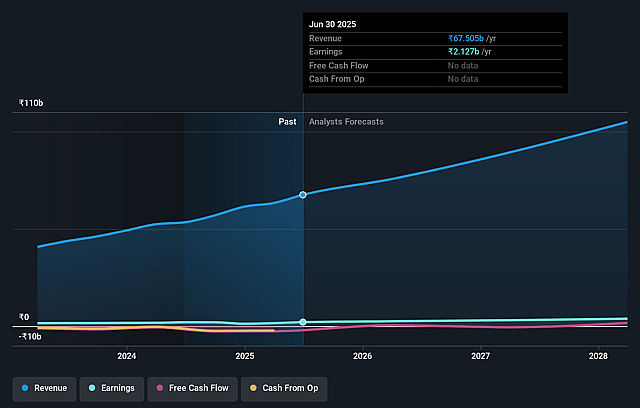

Senco Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Senco Gold's revenue will grow by 17.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.2% today to 3.7% in 3 years time.

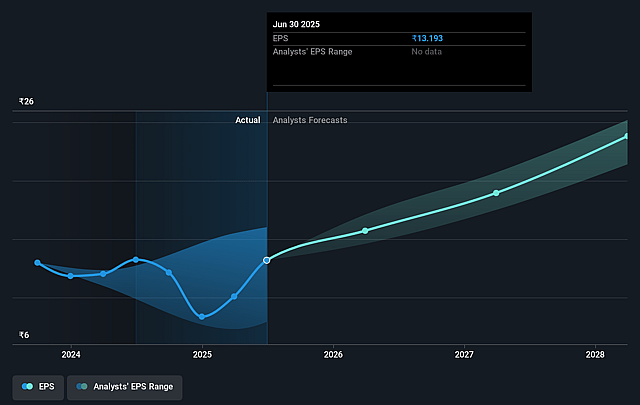

- Analysts expect earnings to reach ₹4.0 billion (and earnings per share of ₹22.6) by about September 2028, up from ₹2.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹3.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.0x on those 2028 earnings, up from 29.2x today. This future PE is greater than the current PE for the IN Specialty Retail industry at 28.7x.

- Analysts expect the number of shares outstanding to grow by 5.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.15%, as per the Simply Wall St company report.

Senco Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened competition from larger pan-India jewelry brands like Titan and Kalyan, who are rapidly increasing their store footprint and targeting similar demographics, could erode Senco Gold's regional market share and compress gross margins, impacting revenue growth and profitability over the long term.

- Persistent concentration in Eastern and Northern India and limited presence in high-growth Southern markets exposes Senco Gold to regional economic slowdowns and constrains its ability to achieve nationwide scale, making revenue and earnings vulnerable to localized headwinds.

- Continuously rising gold prices may reduce average ticket sizes and shift consumer preference towards lighter, lower-carat jewelry-despite management's optimism, this secular trend could dampen both top-line growth and operating leverage if increases in consumer incomes do not keep pace.

- The company's strategy of dynamic hedging and active management of gold price risk, while intended to protect liquidity, introduces a risk of income and margin volatility if not managed conservatively, which could unsettle investor confidence and adversely affect earnings predictability.

- Expansion via franchisee stores is limited by the availability of suitable partners with sufficient capital and the brand's relative strength outside its core geographies; this may slow Senco Gold's ability to penetrate newer markets and could impact its long-term revenue growth trajectory and return on capital employed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹495.167 for Senco Gold based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹583.0, and the most bearish reporting a price target of just ₹385.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹108.2 billion, earnings will come to ₹4.0 billion, and it would be trading on a PE ratio of 37.0x, assuming you use a discount rate of 16.2%.

- Given the current share price of ₹378.7, the analyst price target of ₹495.17 is 23.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.