Key Takeaways

- The shift to online shopping and changing consumer preferences threaten Senco Gold's reliance on traditional retail growth and could undermine long-term revenue stability.

- Intensifying competition and shifting demand toward alternatives like lab-grown diamonds risk eroding market share, compressing margins, and heightening volatility in earnings.

- Resilient demand, retail expansion, product innovation, proactive risk management, and industry formalization are positioning Senco Gold for sustained market share gains and stable profit growth.

Catalysts

About Senco Gold- Engages in the manufacture and trading of jewelry and articles made of gold, silver, platinum, and other precious and semi-precious stones in India.

- The rapid shift towards digital adoption and a growing preference for e-commerce in jewelry purchases threatens to erode Senco Gold's traditional retail store foot traffic, limiting potential revenue growth and undermining their reliance on new store openings as a key growth driver.

- Wider consumer trends showing a growing bias towards experiences over material goods raise the risk that discretionary spending on traditional gold jewelry will stagnate, directly impacting same-store sales growth and leading to a more volatile, possibly declining, revenue base over the long term.

- Intensifying competition from large national chains and agile online jewelry brands increases the risk that Senco Gold's geographic concentration in East and North India and slower omni-channel adoption will lead to market share loss, resulting in shrinking net margins as the company is forced to compete more aggressively on price and promotions.

- Persistently high gold prices, compounded by global macroeconomic and geopolitical volatility, could push more consumers towards trading old gold rather than making new purchases, constraining top-line revenue growth and disrupting the company's inventory management, thereby heightening volatility in earnings.

- The rising popularity of lab-grown diamonds and heightened environmental/ethical concerns threaten to undermine Senco Gold's core offering of traditional mined gold and natural diamonds, leading to potential long-term margin compression and earnings stagnation as consumer preferences shift away from their conventional products.

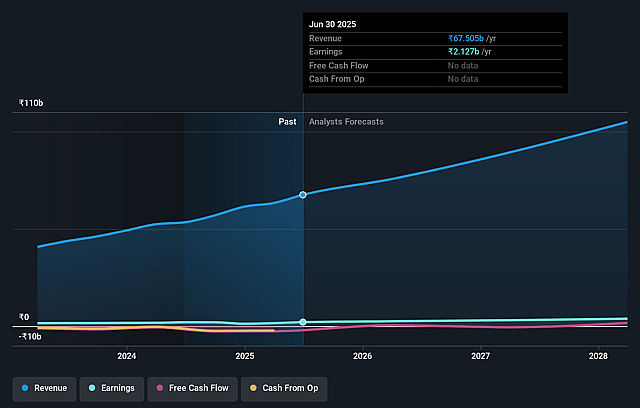

Senco Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Senco Gold compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Senco Gold's revenue will grow by 17.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.2% today to 3.4% in 3 years time.

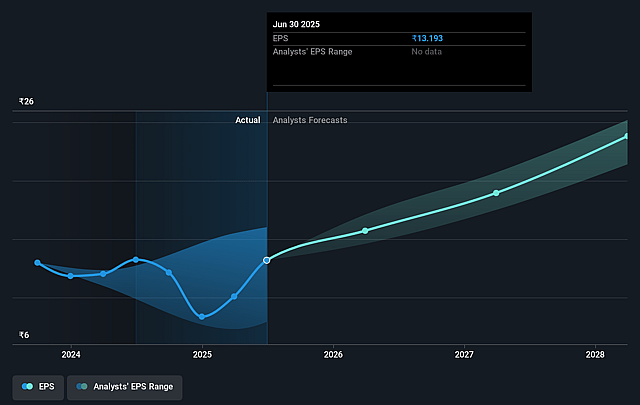

- The bearish analysts expect earnings to reach ₹3.8 billion (and earnings per share of ₹23.0) by about August 2028, up from ₹2.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 30.6x on those 2028 earnings, up from 28.4x today. This future PE is greater than the current PE for the IN Specialty Retail industry at 28.2x.

- Analysts expect the number of shares outstanding to grow by 5.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.21%, as per the Simply Wall St company report.

Senco Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite rising gold prices, Senco Gold has demonstrated strong resilience in consumer demand, with revenue up over 28 percent and profit after tax doubling over the prior year, suggesting that secular demand for gold and jewelry remains robust and could continue supporting both top-line revenue and earnings.

- The company is successfully expanding its retail network, including franchisee-led growth into new geographies beyond its traditional stronghold in Eastern India, which is increasing both brand visibility and market share and could drive sustained double-digit revenue growth for years to come.

- Product innovation and differentiation, including over 11,000 new designs in a single quarter and a focus on lightweight, affordable, and studded (diamond) jewelry, are meeting evolving consumer preferences and supporting higher margins, which could maintain or improve net profit margins.

- Senco's strategic risk management around currency and commodity price volatility, such as dynamic hedging and proactive adjustment to making charges, is supporting stable gross margins and mitigating risks to earnings despite gold price fluctuations.

- The ongoing shift from unorganized to organized jewelry retail in India-accelerated by regulatory moves such as mandatory hallmarking-favors established, branded players like Senco Gold, potentially enabling increased market share, pricing power, and a more stable revenue and profit base over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Senco Gold is ₹385.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Senco Gold's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹583.0, and the most bearish reporting a price target of just ₹385.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹109.4 billion, earnings will come to ₹3.8 billion, and it would be trading on a PE ratio of 30.6x, assuming you use a discount rate of 16.2%.

- Given the current share price of ₹369.35, the bearish analyst price target of ₹385.0 is 4.1% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.