Key Takeaways

- Franchise-led expansion, record store openings, and premium product mix position Senco Gold for accelerated revenue growth and margin improvement beyond industry expectations.

- Efficient inventory systems, innovative customer strategies, and digital engagement enhance profitability, youth appeal, and sustainable, above-industry revenue growth.

- Structural shifts in consumer preferences, regional concentration, and slow digital adoption expose Senco Gold to persistent market, regulatory, and demographic headwinds threatening growth and profitability.

Catalysts

About Senco Gold- Engages in the manufacture and trading of jewelry and articles made of gold, silver, platinum, and other precious and semi-precious stones in India.

- Analysts broadly agree that Senco Gold's expansion into Tier 2 and Tier 3 cities will fuel growth, but this may be understated as the company's franchise-led expansion and rapid same-store sales growth indicate a potential for much faster revenue and market share gains, especially given robust 19%+ same-store growth and record store openings.

- The consensus recognizes the benefits of product premiumization, yet given Senco's exceptional momentum in lightweight, modern, and studded jewelry collections-where stud ratio jumped from 9.5% to over 11% and diamond value sales spiked by more than 50%-the resulting shift in mix could drive a step-change in blended gross and EBITDA margins well above current guidance.

- Senco's dynamic and data-driven inventory management, including real-time stock movement analytics and precise hedging strategies, positions it to operate with enhanced working capital efficiency and rapidly optimize margin even in volatile gold price environments, supporting improved returns on equity and strong net earnings compounding.

- The surging adoption of old gold exchange-now 40% of transactions versus 25% three years ago-creates a powerful self-reinforcing flywheel that reduces cash purchase barriers and keeps customer acquisition cost low, driving higher frequency repeat business and sustainable revenue growth ahead of industry averages.

- Rapidly increasing youth engagement through 9-carat/14-carat offerings, digital platforms, and upcoming Melorra collaboration opens access to a vast, underpenetrated demographic that is highly responsive to online-to-offline journeys, establishing a long runway for high-margin omnichannel sales growth and structural uplift in long-term earnings power.

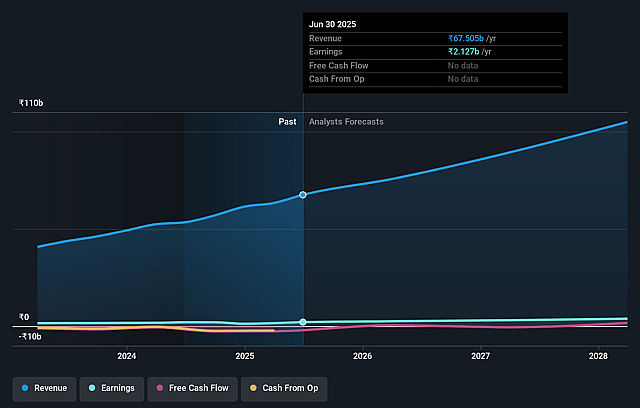

Senco Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Senco Gold compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Senco Gold's revenue will grow by 19.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.2% today to 3.9% in 3 years time.

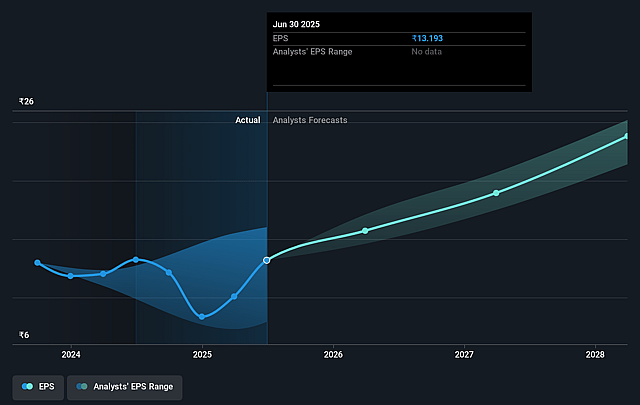

- The bullish analysts expect earnings to reach ₹4.5 billion (and earnings per share of ₹27.26) by about September 2028, up from ₹2.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 39.1x on those 2028 earnings, up from 29.4x today. This future PE is greater than the current PE for the IN Specialty Retail industry at 29.4x.

- Analysts expect the number of shares outstanding to grow by 5.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.15%, as per the Simply Wall St company report.

Senco Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The shift towards digital alternatives for wealth, like cryptocurrencies, digital gold, and financial assets, may gradually reduce consumer interest in physical jewellery, putting downward pressure on Senco Gold's core product demand and future revenue growth.

- Senco Gold remains heavily focused on Eastern India, especially West Bengal, which exposes the company to regional economic downturns, regulatory changes, and political instability. This creates persistent concentration risks that could lead to heightened earnings volatility in the longer term.

- As national jewellery chains and digital-first brands accelerate expansion and adoption of omnichannel strategies, Senco Gold's relatively slow digital penetration and moderate store opening plans may limit its ability to capture market share, eroding pricing power and compressing net margins.

- Secular demographic trends, such as the growing preference among younger consumers for experiences over traditional jewellery, risk limiting long-term demand growth for gold and diamond products, which could constrain Senco Gold's addressable market and dampen top line revenue over time.

- Increasing gold price volatility, heightened regulatory scrutiny, and growing compliance costs linked to environmental and ethical sourcing concerns all pose risks to gross margins and operational complexity, threatening the predictability of future earnings and potentially impacting profitability if not proactively managed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Senco Gold is ₹583.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Senco Gold's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹583.0, and the most bearish reporting a price target of just ₹385.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹114.9 billion, earnings will come to ₹4.5 billion, and it would be trading on a PE ratio of 39.1x, assuming you use a discount rate of 16.1%.

- Given the current share price of ₹382.1, the bullish analyst price target of ₹583.0 is 34.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.