Key Takeaways

- Reliance on low-margin domestic generics and regulatory shifts risks eroding margins and threatens long-term profit sustainability.

- Limited global presence and lag in digital healthcare adoption expose the company to heightened market and competitive vulnerabilities.

- Strong growth in diversified therapies, strategic acquisitions, operational efficiency, and favorable industry trends support improved margins and sustained long-term profitability.

Catalysts

About Mankind Pharma- Develops, manufactures, and markets pharmaceutical formulations and consumer healthcare products in India and internationally.

- Intensifying global regulatory scrutiny and stricter compliance regimes are likely to make drug approvals increasingly costly and time consuming, putting a structural drag on Mankind Pharma's ability to introduce new products or expand overseas, ultimately restricting revenue growth and curtailing international earnings potential.

- With domestic revenue growth still heavily reliant on low-margin, price-sensitive branded generics and acute therapies, mounting pressure from Indian government price controls and calls for lower drug costs will further erode pricing power, compress gross and net margins, and threaten the sustainability of long-term profit expansion.

- The company's limited global presence and ongoing heavy dependence on the Indian domestic market exposes it to outsized risk from local policy shifts in drug pricing and healthcare spending, making revenue growth and earnings increasingly vulnerable to sudden regulatory interventions and unfavorable market shifts.

- Shifting consumer habits towards digital healthcare, including the rapid rise of e-pharmacies and telemedicine, threatens to displace traditional sales channels where Mankind has built its dominance, which could undermine future sales growth and increase the risk of market share losses to more agile, digitally-native competitors.

- Despite recent efforts to expand into chronic therapies and build out an R&D pipeline, slower-than-expected delivery of complex generics or specialty pharmaceuticals could result in persistently high R&D expenses without sufficient top-line payoff, putting incremental pressure on operating margins and weakening the company's long-term return on capital.

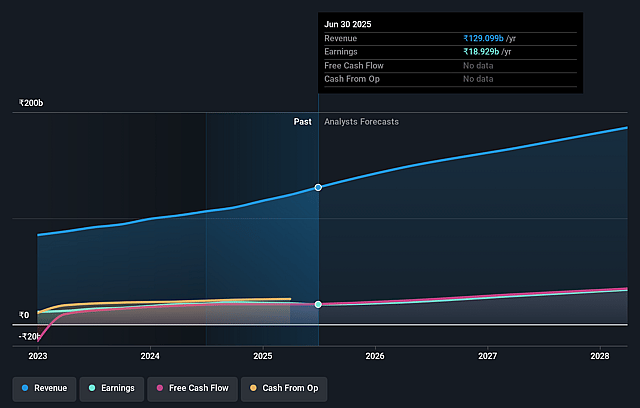

Mankind Pharma Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Mankind Pharma compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Mankind Pharma's revenue will grow by 13.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 14.7% today to 16.8% in 3 years time.

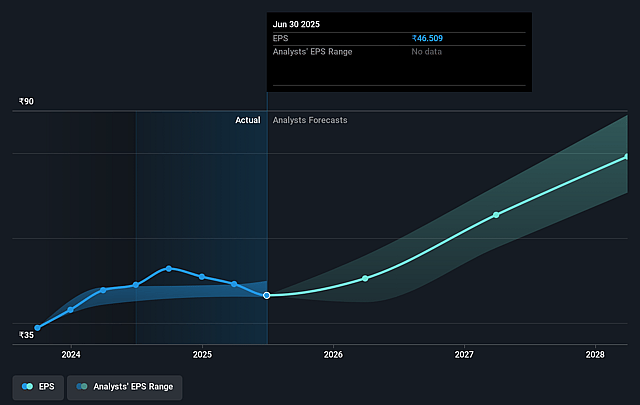

- The bearish analysts expect earnings to reach ₹31.5 billion (and earnings per share of ₹76.19) by about September 2028, up from ₹18.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 44.1x on those 2028 earnings, down from 56.9x today. This future PE is greater than the current PE for the IN Pharmaceuticals industry at 30.6x.

- Analysts expect the number of shares outstanding to grow by 3.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

Mankind Pharma Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Mankind Pharma is demonstrating rapid revenue and earnings growth, registering a 25% year-on-year increase in consolidated revenues, maintaining upward EBITDA margin guidance, and consistently outperforming industry growth rates, especially in chronic and acute therapies, which bodes well for long-term earnings.

- Expansion into new, high-growth business segments such as chronic therapies, lifestyle-related product categories, biosimilars, and international markets, combined with robust R&D pipeline development, positions the company to enhance its revenue mix, raise realizations and strengthen net margin prospects over time.

- The integration and scaling up of newly acquired businesses, such as BSV and Panacea, alongside the establishment of new biologics capacity designed to unlock new revenue from domestic and regulated international markets, are likely to enable step-jump increases in cash flow and consolidated profits in coming years.

- Macro tailwinds from rising healthcare demand, higher chronic disease incidence, increasing access to healthcare (insurance and government initiatives), and secular growth in India's pharmaceuticals market create a favorable structural environment that can drive long-term volume growth, benefiting top-line and cash flow.

- Mankind Pharma's strong focus on operational efficiency, backward integration, and debt repayment-evidenced by improving net debt-to-EBITDA metrics and significant cash flow from operations-improves the company's ability to manage costs, boost net margins, and increase overall earnings, contradicting the expectation of a persistent long-term share price decline.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Mankind Pharma is ₹2150.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Mankind Pharma's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹3300.0, and the most bearish reporting a price target of just ₹2150.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹187.6 billion, earnings will come to ₹31.5 billion, and it would be trading on a PE ratio of 44.1x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹2608.5, the bearish analyst price target of ₹2150.0 is 21.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Mankind Pharma?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.