Key Takeaways

- Strong specialty biologics portfolio, innovative pipeline, and rapid execution position the company for accelerated margin and earnings growth ahead of consensus expectations.

- Expanding distribution, premium consumer brands, and robust R&D create a structural edge to capitalize on rising healthcare demand and chronic disease prevalence.

- Heavy reliance on India, rising costs, regulatory risks, limited innovation, and intense competition could challenge Mankind Pharma's ability to sustain margins and long-term growth.

Catalysts

About Mankind Pharma- Develops, manufactures, and markets pharmaceutical formulations and consumer healthcare products in India and internationally.

- While analysts broadly agree that BSV integration will be a growth driver, they are underestimating the scale and velocity possible given Mankind's rapid post-acquisition execution, which is now translating into strong double-digit secondary growth and the potential for BSV's first-mover specialty biologics portfolio to dramatically lift both revenue and net margins in coming years.

- The consensus expects incremental margin improvements from corrective measures in OTC and Rx, but the visible acceleration in productivity and early signs of operating leverage suggest Mankind could rapidly regain and surpass its historical industry-leading growth pace, delivering sharper-than-expected earnings and margin expansion.

- Mankind is uniquely positioned to capture India's growing healthcare spend and rising middle class demand, leveraging its established rural and urban distribution-with consumer and OTC brands already showing over 50 percent year-on-year growth in e-commerce and modern trade channels-implying significant headroom for premiumization and accelerated revenue growth ahead.

- The company's deep and expanding chronic therapy pipeline, with a robust focus on innovative diabetes and obesity treatments (such as its novel GPR119 small molecule), gives it a structural edge to benefit from the sustained rise in chronic lifestyle disease prevalence, setting the stage for higher-margin mix and outsized top-line compounding.

- Mankind's investments in proprietary biologics manufacturing, integrated R&D, and persistent in-licensing, coupled with India's shift toward quality and compliance, strongly position it for market share gains both domestically and in new export markets, driving long-run improvements in operating margins and resilient double-digit earnings growth.

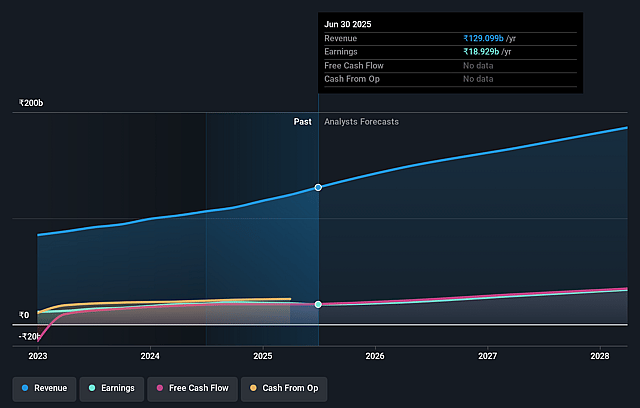

Mankind Pharma Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Mankind Pharma compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Mankind Pharma's revenue will grow by 16.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 14.7% today to 19.3% in 3 years time.

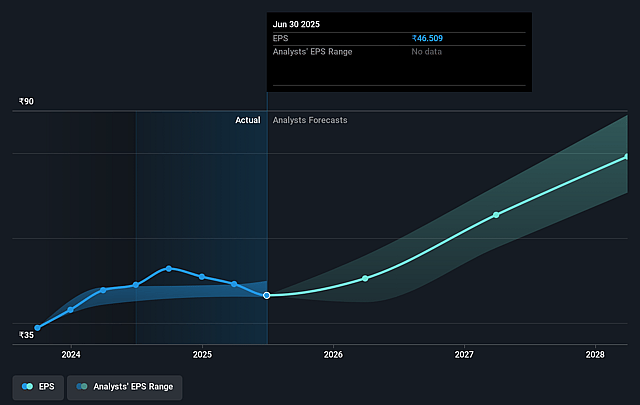

- The bullish analysts expect earnings to reach ₹39.6 billion (and earnings per share of ₹95.91) by about September 2028, up from ₹18.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 53.8x on those 2028 earnings, down from 56.9x today. This future PE is greater than the current PE for the IN Pharmaceuticals industry at 30.6x.

- Analysts expect the number of shares outstanding to grow by 3.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

Mankind Pharma Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising cost pressures due to global inflation, inventory write-offs for slow-moving products, and changing sales mix have already led to a drop in gross margins, and ongoing secular inflationary trends could further erode margins and reduce future net profit and EBITDA.

- Mankind Pharma's heavy focus on the Indian domestic market, coupled with only single-digit organic international growth, exposes it to local regulatory risks, price caps, and policy changes that could restrict revenue growth and compress long-term net margins.

- Regulatory headwinds such as tightening approval standards and increased compliance requirements in both India and key export markets could lead to higher costs, slower new product launches, and greater risk of product withdrawals, thereby impacting revenue scalability and earnings.

- The company's limited presence in innovation-driven and specialty drug segments makes it vulnerable to commoditization, price-based competition, and growing global demand for preventive wellness solutions, which could restrict premium pricing and sustained revenue growth in traditional pharmaceuticals.

- Intensifying competitive pressures from both multinational pharma companies and the rapid expansion of lower-cost generic manufacturers, combined with industry-wide pushes for price transparency and institutional tendering, could trigger price wars and sustained pressure on both revenue and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Mankind Pharma is ₹3300.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Mankind Pharma's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹3300.0, and the most bearish reporting a price target of just ₹2150.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹204.8 billion, earnings will come to ₹39.6 billion, and it would be trading on a PE ratio of 53.8x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹2608.5, the bullish analyst price target of ₹3300.0 is 21.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.