Last Update 08 Nov 25

Fair value Decreased 2.65%MANKIND: Expansion Into Russia And Rising Margins Will Drive Upside

Analysts have revised the fair value estimate for Mankind Pharma down from ₹2,799.65 to ₹2,725.59. This revision reflects slightly lower revenue growth expectations, partially offset by stronger profit margins and a marginally higher discount rate.

What's in the News

- Mankind Pharma's Board Meeting is scheduled for November 6, 2025. The meeting will consider and approve the unaudited standalone and consolidated financial results for the quarter and half year ended on September 30, 2025 (Board Meeting).

- The company has incorporated a wholly owned subsidiary, Mankind Pharma LLC, in Russia on August 18, 2025 as part of its business expansion strategy (Business Expansions).

Valuation Changes

- The Fair Value Estimate has decreased from ₹2,799.65 to ₹2,725.59.

- The Discount Rate has risen slightly from 12.73% to 12.76%.

- Revenue Growth expectations have decreased from 14.33% to 12.90%.

- The Net Profit Margin has increased from 17.65% to 18.48%.

- The Future P/E has fallen from 53.12x to 48.92x.

Key Takeaways

- Strong focus on high-margin chronic therapies, consumer health growth, and specialty drugs positions the company for sustained revenue expansion and improved earnings quality.

- Enhanced operational efficiency, R&D investment, and expanding modern trade presence support scalable profitability and mitigate future margin pressures.

- Heavy dependence on India, margin pressures, regulatory risks, slow overseas growth, and higher acquisition costs threaten earnings stability and long-term profitability.

Catalysts

About Mankind Pharma- Develops, manufactures, and markets pharmaceutical formulations and consumer healthcare products in India and internationally.

- The company's above-industry volume growth in chronic therapies (cardiac, diabetes) and sustained outperformance in anti-infectives and respiratory, paired with India's rising chronic disease burden and aging population, positions Mankind Pharma for strong, long-term revenue expansion and improved earnings quality as higher-margin, longer-duration therapies become a larger share of sales.

- Increasing penetration in modern trade and e-commerce channels (modern trade/e-comm share up 50% YoY) and robust growth from consumer health/OTC brands (15% YoY growth; key products up 12–36%), benefit from growing disposable income, expanded insurance coverage, and rising health awareness across India-likely supporting both top-line growth and higher-margin revenue streams in the future.

- Ongoing investment in R&D (expenditure up to 2.2% of sales) with new biosimilar and specialty drug pipeline (autoimmune, antimicrobial, biosimilar IVF, anti-obesity/diabetes therapies) aims to capture emerging demand and mitigate future margin compression-potentially boosting margins and supporting long-term earnings as these products scale.

- Successful integration and growth of BSV (targeting 18–20% YoY sales growth, margin guidance of 26–28%), including derisking with new biologics manufacturing, expands capabilities in specialty and biologics, aligning with increasing demand for branded generics, specialty medicines, and infertility solutions-providing a catalyst for both revenue acceleration and gross/EBITDA margin improvement.

- Field force restructuring and organizational productivity initiatives now completed, with early signs of operational leverage (cost control and salesforce efficiency), set the stage for a return to historical market-share gains and scalable margin improvement as industry growth drivers accelerate, likely enhancing net margins and profitability over the medium term.

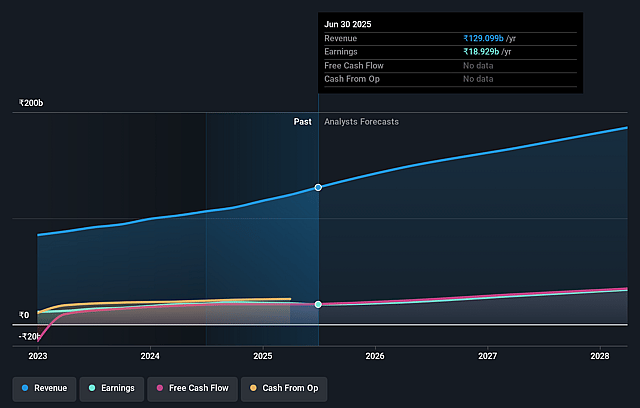

Mankind Pharma Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Mankind Pharma's revenue will grow by 14.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.7% today to 17.6% in 3 years time.

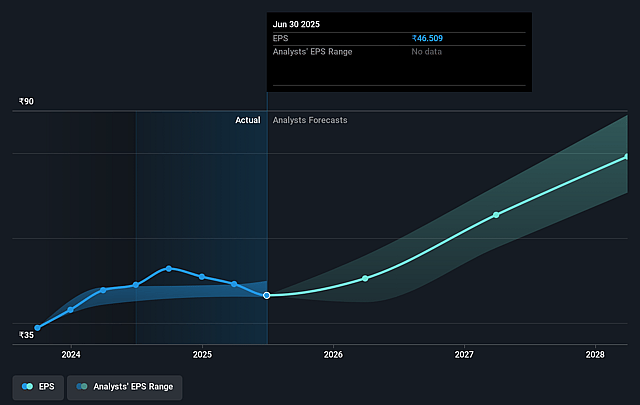

- Analysts expect earnings to reach ₹34.0 billion (and earnings per share of ₹75.74) by about September 2028, up from ₹18.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹29.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 53.1x on those 2028 earnings, down from 55.8x today. This future PE is greater than the current PE for the IN Pharmaceuticals industry at 29.9x.

- Analysts expect the number of shares outstanding to grow by 3.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

Mankind Pharma Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy dependence on the Indian domestic market remains a risk: Despite modest international growth and ongoing efforts to expand, the company's core growth and market share gains are largely driven by India, exposing Mankind Pharma to domestic regulatory, pricing, or economic risks that could increase earnings volatility and limit revenue diversification.

- Margin pressure from raw material costs, sales mix shifts, and competition: The decline in gross margins (down 130 bps YoY) and continued inventory-related accruals, combined with slightly lower margins in expanding channels like modern trade and e-commerce, indicate persistent cost pressures-these factors could compress EBITDA/net margins, especially if further cost inflation or price competition intensifies.

- Incremental risk from regulatory scrutiny and pricing controls: The company's high exposure to branded generics, and ongoing expansion in chronic and specialty segments, may face increased regulatory oversight and susceptibility to government-mandated drug price caps-potentially limiting future revenue growth and profitability for critical therapy segments.

- Slowdown in organic international growth and exposure to patent cliffs: The international business currently shows only single-digit organic growth, with overall improvement reliant on BSV consolidation and regulatory approvals that may be uncertain. Additionally, future global genericization and patent expiries may lead to commoditization, restricting the ability to sustain premium pricing and top-line growth.

- Rising finance and depreciation costs from recent acquisitions: Net profit fell 17.4% YoY despite strong revenue growth, driven by higher finance, depreciation, and amortization expenses from BSV consolidation and acquisition debt. Ongoing high interest and amortization outflows (projected until FY28) could continue to dampen net earnings growth and dilute return ratios in the medium term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹2799.647 for Mankind Pharma based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹3300.0, and the most bearish reporting a price target of just ₹2150.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹192.9 billion, earnings will come to ₹34.0 billion, and it would be trading on a PE ratio of 53.1x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹2559.1, the analyst price target of ₹2799.65 is 8.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.