Key Takeaways

- Strategic shift to premium, hit-driven content and global partnerships is set to accelerate revenue growth and boost margins well beyond current expectations.

- Leveraging technology and industry dynamics will drive higher monetization per stream and solidify long-term profit growth through stronger market positioning.

- Overdependence on a few digital partners, outdated music catalog, limited new content investment, and reliance on lump-sum deals expose Tips Music to volatility and growth risks.

Catalysts

About Tips Music- Engages in the acquisition and exploitation of music rights in India and internationally.

- While analyst consensus anticipates robust revenue growth from Tips Music's ongoing investment of 25% to 28% of revenue into new content, this may significantly understate the impact of their sharply increased focus on high-quality, high-virality content, as management has signaled a deliberate strategy shift toward fewer but more premium, hit-driven releases and blockbuster film soundtracks, which historically yield both faster payback and higher monetization; this could drive a sustained, outsized increase in both top-line revenue and net margins.

- The extension and scaling up of international partnerships (notably the Sony Music Publishing and YouTube international deal), which the consensus views as a moderate growth lever, actually sets the stage for a step-change in global monetization owing to improved royalty rates, fourfold deal size increases, and access to more lucrative global streaming and collection societies-positioning international revenue to expand from a small base to a major component of group earnings and accelerate overall profit growth.

- The rapid evolution of India's paid streaming ecosystem, buoyed by rising smartphone penetration and expected platform moves to drive paywall adoption, creates massive operating leverage for Tips Music-paid subscriber penetration could see an S-curve inflection that would rapidly push digital revenues and operating profits much higher than current projections.

- Tips is leveraging advanced analytics, proprietary distribution technology, and machine-learning systems to optimize song metadata, placement, and cross-platform engagement, which is likely to enhance discoverability and virality of both catalog and new content, thereby increasing monetization per stream and providing new margin upside over the medium term.

- Industry consolidation and heightened regulatory enforcement around copyright are increasing barriers to entry and bargaining power for incumbent rights-holders like Tips, enabling continued increases in royalty rates and revenue per stream; this structural shift will support both sustained revenue growth and higher long-term operating margins across multiple digital channels.

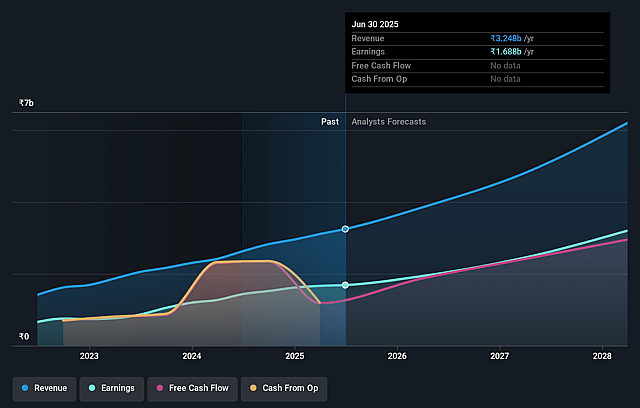

Tips Music Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Tips Music compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Tips Music's revenue will grow by 33.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 53.6% today to 51.2% in 3 years time.

- The bullish analysts expect earnings to reach ₹3.8 billion (and earnings per share of ₹29.85) by about July 2028, up from ₹1.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 42.2x on those 2028 earnings, down from 47.8x today. This future PE is greater than the current PE for the IN Entertainment industry at 34.4x.

- Analysts expect the number of shares outstanding to decline by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.97%, as per the Simply Wall St company report.

Tips Music Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tips Music's revenue is highly concentrated with a few digital distribution partners, as management confirmed YouTube is the largest revenue source and the Warner deal accounts for around 25 percent of overall revenue; this creates significant risk of unfavorable renegotiations or changes in platform algorithms, potentially compressing future earnings and profit margins.

- The company continues to depend heavily on its legacy Bollywood and older music catalog for driving engagement, with multiple examples of 90s and 2000s hits going viral, while annual new song acquisition remains low in volume; this increases the risk of stagnating revenue growth as streaming audiences shift to fresher, independent, or user-generated content, impacting long-term revenues.

- Management has guided to invest only 25 to 28 percent of revenue into new content, citing competitive costs and quality concerns, which limits pipeline expansion and innovation; as content costs per song rise and the marketplace becomes more crowded, insufficient new content investment may weaken Tips Music's brand relevance and put future revenues at risk.

- The business model is highly exposed to broader secular threats: content piracy, low digital subscription conversion rates in India, and global consolidation among big tech streaming platforms, all of which can erode royalty rates and diminish pricing power, negatively impacting both gross margins and net profits.

- A significant portion of reported cash flows and profitability is explained by timing and size of large lump-sum advances from deals with global music entities like Warner, rather than consistent, recurring, or diversified income sources; this could introduce volatility and unpredictability into cash flows and earnings, potentially undermining long-term investor confidence.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Tips Music is ₹818.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Tips Music's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹818.0, and the most bearish reporting a price target of just ₹612.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹7.4 billion, earnings will come to ₹3.8 billion, and it would be trading on a PE ratio of 42.2x, assuming you use a discount rate of 16.0%.

- Given the current share price of ₹623.2, the bullish analyst price target of ₹818.0 is 23.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.