Key Takeaways

- Rising piracy, shifting consumer preferences, and dominant competitors threaten Tips Music's revenue stability, long-term growth, and audience monetization potential.

- Escalating content costs and reliance on few streaming platforms increase margin pressure and expose the company to client concentration risks.

- Expanding digital reach, enduring catalog earnings, and international partnerships position Tips Music for sustained high-margin growth and diversified global revenue streams.

Catalysts

About Tips Music- Engages in the acquisition and exploitation of music rights in India and internationally.

- Prolonged and intensifying digital piracy, combined with persistent ease of content sharing across platforms in India, continues to undermine consumer willingness to pay for music, directly eroding Tips Music's addressable paid audience and long-term digital monetization potential; this poses a major risk to sustaining revenue growth and recurring earnings.

- Consumer preferences are shifting more rapidly toward independent and global artist-driven content, threatening long-term relevance and demand for Tips Music's predominantly Bollywood and legacy catalog; this dynamic could significantly decelerate new user growth and place its top-line expansion under sustained pressure.

- Escalating content acquisition costs, evidenced by the rising per-song spend and management's acknowledgment of fierce bidding for quality music rights, are likely to persist as industry competition intensifies. This drives down the company's ability to maintain current margin levels and increases the risk of underperforming investments, thereby compressing operating profits and net margins over time.

- Heavy reliance on a handful of streaming platforms like YouTube, Spotify, and Meta poses substantial client concentration risk, and any future renegotiation of royalty rates, changes in platform algorithms, or tightening of partner terms could materially impact digital revenue streams and lead to pronounced margin contraction.

- Large music industry players such as Universal, Sony, and T-Series, along with direct artist distribution channels, are capturing an expanding share of the growing digital music market and can outbid Tips Music for high-potential content, resulting in ongoing loss of market share and a structurally lower long-term growth trajectory, ultimately threatening both revenue stability and earning visibility.

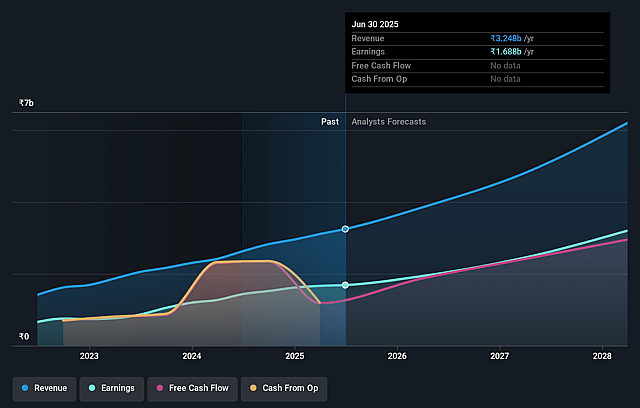

Tips Music Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Tips Music compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Tips Music's revenue will grow by 24.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 53.6% today to 49.1% in 3 years time.

- The bearish analysts expect earnings to reach ₹2.9 billion (and earnings per share of ₹25.92) by about July 2028, up from ₹1.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 41.0x on those 2028 earnings, down from 50.0x today. This future PE is greater than the current PE for the IN Entertainment industry at 33.0x.

- Analysts expect the number of shares outstanding to decline by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.0%, as per the Simply Wall St company report.

Tips Music Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rapid digital penetration, rising paid subscriptions on platforms like Spotify and YouTube, and India's expanding music consumer base are driving significant top-line growth, suggesting strong future revenue potential.

- The company's robust and monetizable legacy catalog, demonstrated by viral hits from past decades that continue to drive high engagement and streaming volumes, provides recurring royalty and streaming income supporting consistent earnings.

- International licensing deals and renewed partnerships, such as the expanded Sony Music Publishing agreement and TikTok/YouTube global integrations, position Tips Music to capture higher-yielding revenues abroad and diversify its revenue streams.

- Management is maintaining disciplined reinvestment into high-quality content and reporting a high content success ratio, supporting the sustainability of attractive operating and PAT margins in the face of rising per-song acquisition costs.

- Strong guidance and confidence from management, reflecting multi-year sustained 29-31% revenue and PAT growth rates, as well as expectations to maintain similar growth rates due to ongoing platform partnerships and industry tailwinds, underline resilience in long-term earnings and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Tips Music is ₹612.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Tips Music's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹818.0, and the most bearish reporting a price target of just ₹612.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹6.0 billion, earnings will come to ₹2.9 billion, and it would be trading on a PE ratio of 41.0x, assuming you use a discount rate of 16.0%.

- Given the current share price of ₹652.1, the bearish analyst price target of ₹612.0 is 6.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.