Key Takeaways

- Delays in plant ramp-up, regulatory challenges, and reliance on new technology introduce risks to revenue growth, earnings stability, and profit margins.

- Heavy dependence on exports amid volatile policies, customer concentration, and liquidity needs exposes the company to uncertainties in revenue timing and cash flow.

- Reliance on international markets, regulatory uncertainties, execution risks, and customer concentration expose the company to revenue delays, margin pressure, and earnings volatility.

Catalysts

About Neogen Chemicals- Engages in the manufacture and sale of specialty chemicals in India.

- Although Neogen Chemicals is set to benefit from the accelerating global transition towards electric mobility and battery storage, recent delays in plant capacity ramp-up, pending customer approvals for lithium salts, and slow-moving product qualification have postponed revenue recognition, raising the risk that anticipated top-line growth from lithium-based chemistries will be back-ended and vulnerable to further slippage.

- While the company has taken strategic steps such as forming a joint venture with Morita Chemicals of Japan and expanding in advanced lithium derivatives, its ongoing dependence on successful, large-scale technological transfer and seamless production integration introduces operational risks, potentially impeding realization of expected high-margin revenues and stable earnings in the next cycle.

- Despite rising regulatory support for green, non-China supply chains and India's advantage in China+1 sourcing, Neogen faces mounting global regulatory scrutiny; tightening environmental norms could escalate compliance costs and capital expenditures, eroding profitability before the full benefit of industry tailwinds is captured.

- Although the robust pipeline for battery and energy storage projects in India implies future domestic demand, much of Neogen's near-term ramp-up is reliant on export markets-primarily the US and Europe-where volatile tariff environments and complex localization mandates create uncertainty around revenue timing and margin stability.

- While Neogen's capacity expansion and vertical integration are positioned to leverage the global specialty chemical consumption trend, execution risks remain high in the face of customer concentration, project delays, and the need for additional liquidity to bridge insurance payouts, exposing the company to temporary over-leverage and potential pressure on net margins and cash flows.

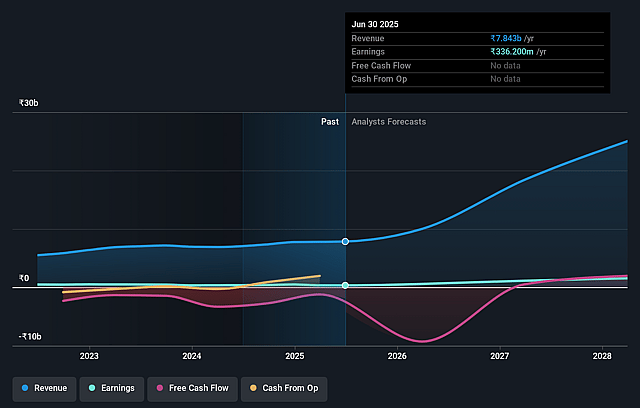

Neogen Chemicals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Neogen Chemicals compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Neogen Chemicals's revenue will grow by 49.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 4.3% today to 4.0% in 3 years time.

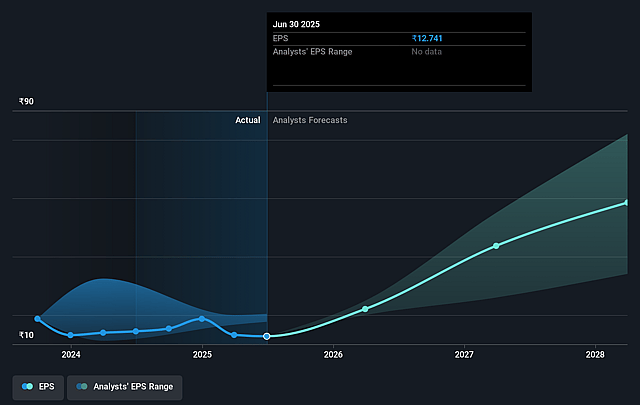

- The bearish analysts expect earnings to reach ₹1.0 billion (and earnings per share of ₹39.02) by about September 2028, up from ₹336.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 66.9x on those 2028 earnings, down from 124.9x today. This future PE is greater than the current PE for the IN Chemicals industry at 26.8x.

- Analysts expect the number of shares outstanding to decline by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.86%, as per the Simply Wall St company report.

Neogen Chemicals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent delays in securing customer product approvals, slow plant visits, and the dependence on international customers for ramping up lithium salt exports may postpone revenue realization and hinder near-term revenue and earnings growth.

- Key capacity expansion projects, including the Dahej plant reinstatement and the new greenfield sites, require substantial capital expenditure and financing; any execution missteps, delays, or demand shortfalls could lead to over-leverage and higher interest costs, which would reduce net margins and future free cash flows.

- High reliance on the evolving regulatory environment in the US and Europe for non-China supply chains introduces uncertainty, as changes in subsidy policies, tariffs, or slower-than-expected localization efforts may curb demand and negatively impact both export revenues and long-term earnings visibility.

- Significant customer concentration in export markets, particularly within the lithium battery segment, heightens vulnerability to the loss or deferral of major accounts, which could result in sharp declines in revenue and greater earnings volatility.

- Intensifying competition from global and Indian specialty chemical and battery material producers, as well as technological changes in battery chemistries, poses a risk of margin compression and product obsolescence, threatening long-term revenue growth and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Neogen Chemicals is ₹1670.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Neogen Chemicals's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2630.0, and the most bearish reporting a price target of just ₹1670.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹26.0 billion, earnings will come to ₹1.0 billion, and it would be trading on a PE ratio of 66.9x, assuming you use a discount rate of 13.9%.

- Given the current share price of ₹1479.0, the bearish analyst price target of ₹1670.0 is 11.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.