Last Update 11 Dec 25

Fair value Increased 0.32%NEOGEN: Market Perform Initiation Will Support Steady Future Return Potential

Analysts have nudged their price target for Neogen Chemicals slightly higher, reflecting a modest improvement in fair value to roughly ₹1,812 per share. This is supported by expectations of sustained high revenue growth and stable valuation multiples, despite only minor adjustments to discount rate and profit margin assumptions.

Analyst Commentary

Bullish analysts view the recent initiation and price target as validation of Neogen Chemicals' strong positioning in its niche specialty chemicals segments. The rating implies confidence in the company’s ability to sustain above-industry growth over the medium term.

They highlight that the implied upside to current trading levels is underpinned by expectations of consistent volume growth, operating leverage and a scalable product portfolio that can support premium pricing as end markets expand.

At the same time, neutral elements in the initiation stance signal that while the growth story is credible, the balance between execution risk and valuation is finely poised, leaving room for both upside surprise and downside if assumptions do not play out as expected.

Bullish Takeaways

- Bullish analysts point to the maintained growth narrative and note that the target price assumes continued market share gains in high value added chemistries, which can underpin revenue compounding and support current multiples.

- The initiation rating is seen as confirmation that earnings visibility is improving, with a clearer pipeline of contracts and capacity additions that can translate into steady margin expansion over time.

- Supporters argue that the company’s differentiated product mix and technical know how provide a competitive moat. This is seen as justifying a valuation premium to broader chemical sector peers if execution stays on track.

- They also see scope for positive revisions if management accelerates new product launches or successfully taps export markets at better realizations. In that scenario, some analysts believe a re rating of the stock could be warranted.

Bearish Takeaways

- Bearish analysts caution that the current valuation already discounts a large portion of the anticipated growth, leaving a narrower margin of safety if demand normalizes or project timelines slip.

- They flag execution risk around scaling up new capacities and complex chemistries, where delays or cost overruns could pressure margins and force downward revisions to fair value.

- There is concern that a more volatile input cost environment and potential pricing pressure from competitors could constrain profitability, challenging the assumptions embedded in the target price.

- Some also highlight currency and regulatory risks in key end markets, which, if adverse, could dampen export led growth and limit upside relative to the current valuation framework.

What's in the News

- A board meeting is scheduled on November 8, 2025 at 14:30 IST to review and approve unaudited standalone and consolidated financial results for the quarter and half year ended September 30, 2025, along with other matters (Key Developments).

Valuation Changes

- Fair Value has risen slightly from approximately ₹1,807 per share to about ₹1,812 per share, reflecting a modest upward revision in intrinsic value.

- Discount Rate has increased marginally from around 14.31 percent to about 14.36 percent, indicating a slightly higher required return or perceived risk.

- Revenue Growth assumptions are essentially unchanged, remaining at about 49.74 percent.

- Net Profit Margin has edged down slightly from roughly 7.32 percent to about 7.31 percent, implying a very small softening in long term profitability expectations.

- Future P/E has risen slightly from about 35.69x to approximately 35.88x, suggesting a minor increase in the multiple applied to projected earnings.

Key Takeaways

- Expansion into lithium-ion battery materials and global supply diversification is driving strong growth opportunities in electric vehicle and renewable energy storage sectors.

- Strategic partnerships and rising custom manufacturing demand are enhancing technological capabilities, supporting sustainable margins and resilient earnings.

- Delays in approvals, erratic lithium demand, concentrated product risk, and rising sustainability requirements threaten revenue growth, margin stability, and long-term financial health.

Catalysts

About Neogen Chemicals- Engages in the manufacture and sale of specialty chemicals in India.

- Neogen is accelerating its entry into lithium-ion battery materials, with large-scale capacity expansions for lithium salts and electrolytes coming online. This positions the company to capture outsized growth driven by the surging electric vehicle and renewable energy storage sectors, directly contributing to long-term revenue and earnings growth.

- Global customers are increasingly seeking non-China supply chains for battery chemicals due to stricter localization requirements and new subsidy frameworks in the U.S. and Europe. As one of the very few qualified non-Chinese suppliers, Neogen is attracting interest from global battery and EV makers-potentially enabling robust export-led revenue growth and higher-margin international contracts.

- Strong demand visibility is emerging from both EV battery and stationary energy storage markets, with Indian giga-factories (Ola, Exide, Reliance, Tata, etc.) commencing production between 2025–2027 and solar energy storage sharply picking up. This underpins a multi-year volume ramp-up, providing a structural tailwind to Neogen's advanced chemical segment revenues and asset utilization.

- Strategic technology partnerships (such as the JV with Morita of Japan) are deepening Neogen's technological moat, enabling backward integration, improved efficiencies, and access to proven production know-how. This should support sustainable margin expansion and enhanced return on capital over the medium

- to long-term.

- Secular China Plus One dynamics and stricter environmental compliance requirements globally are prompting pharma, agrochemical, and advanced industrial customers to diversify supply-driving rising recurring business for Neogen's custom synthesis and contract manufacturing business, which stabilizes earnings and increases gross margin resilience.

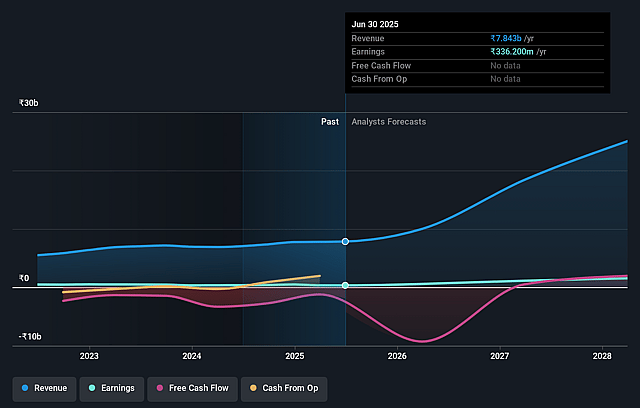

Neogen Chemicals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Neogen Chemicals's revenue will grow by 50.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.3% today to 7.0% in 3 years time.

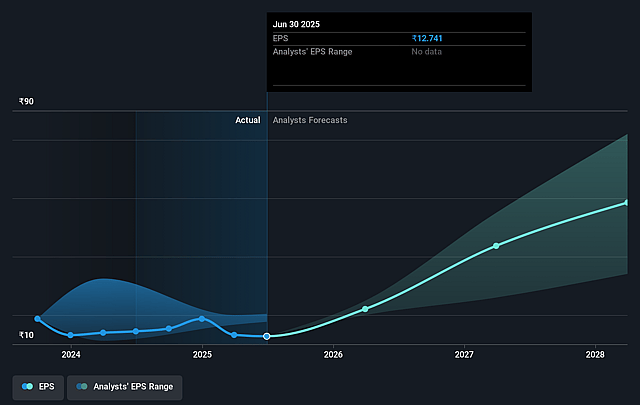

- Analysts expect earnings to reach ₹1.9 billion (and earnings per share of ₹70.86) by about September 2028, up from ₹336.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹2.2 billion in earnings, and the most bearish expecting ₹901 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 45.6x on those 2028 earnings, down from 124.9x today. This future PE is greater than the current PE for the IN Chemicals industry at 26.8x.

- Analysts expect the number of shares outstanding to decline by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.86%, as per the Simply Wall St company report.

Neogen Chemicals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Delays in customer product approvals and plant audits, particularly from major international clients, have slowed the ramp-up of export revenues in battery chemicals (notably lithium salts and electrolytes), risking underutilization of expanded capacity and potentially impacting both revenue growth and EBITDA in the near-to-medium term.

- Ongoing softness in lithium chemical demand and price volatility-exacerbated by global tariff and subsidy uncertainties, especially in the US-may result in erratic sales and margin pressures, with significant risk to revenue and net margins if Neogen cannot consistently pass through input cost increases.

- The company's substantial capital expenditure programs (₹1,500+ crore) are being financed in part by insurance proceeds and new debt issuances, creating execution risk if project timelines slip or there are further delays in insurance receipts, which could increase interest costs and strain free cash flow and net earnings.

- Heavy reliance on a limited product set-mainly bromine and lithium-based compounds-exposes Neogen to concentration risk; any cyclical downturn or increased competition in these segments (including from larger global or low-cost Chinese players) can directly hurt revenue and compress margins.

- Intensifying global movement towards greener and more sustainable (biobased or next-gen) chemicals, together with rising regulatory scrutiny and environmental compliance costs in India, could erode demand for traditional specialty chemicals, drive up operating expenses, and threaten Neogen's long-term profitability and investor appeal.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹2062.833 for Neogen Chemicals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2630.0, and the most bearish reporting a price target of just ₹1670.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹26.6 billion, earnings will come to ₹1.9 billion, and it would be trading on a PE ratio of 45.6x, assuming you use a discount rate of 13.9%.

- Given the current share price of ₹1479.0, the analyst price target of ₹2062.83 is 28.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Neogen Chemicals?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.