Key Takeaways

- Early-mover advantage, capacity expansion, and strategic partnerships uniquely position Neogen for outsized growth and margin gains in the non-Chinese lithium chemicals and domestic battery sector.

- Product innovation, client diversification, and premium positioning enable sustainable revenue growth, margin expansion, and preference as a partner amid global supply chain shifts.

- Heavy investments in new projects, regulatory and market shifts, and high customer concentration create multiple risks to cash flow, margins, and long-term growth prospects.

Catalysts

About Neogen Chemicals- Engages in the manufacture and sale of specialty chemicals in India.

- While analysts broadly agree that international expansion and local capacity additions can deliver export-led growth, the ongoing global push for non-China battery supply chains and Neogen's rapid capacity scaling position the company to become a top-tier supplier in the non-Chinese lithium chemicals market-offering potential for an exponential step-up in export revenues and margin premiums far above current expectations as global OEMs accelerate diversification before 2027.

- Analyst consensus recognizes the impact of the BuLi and Neogen Ionics merger for cost synergies, but this view understates the strategic value of integrated lithium production and Japanese partnership; these position Neogen to command a price and technology premium, support higher market share, and deliver outsized earnings and ROCE as customers prioritize secure, high-quality supplies.

- Neogen's dominant early-mover advantage in India's battery chemicals sector, combined with its scalable brownfield and greenfield expansions, positions it uniquely to capture disproportionate share as domestic giga-factory and energy storage investments surge, leading to structurally higher revenue growth and sustainable long-term margin uplift.

- The company's ability to address customized demand from high-value verticals such as semiconductors, energy storage, and advanced pharma intermediates-combined with strong client interest for non-Chinese sourcing-suggests not only volume growth but significant gross margin expansion due to better pricing power and product mix.

- As supply chain localization and "China+1" accelerate, Neogen's technical collaborations, regulatory readiness, and R&D-driven product innovation make it an attractive, preferred partner in key global markets, underpinning multi-year visibility on both topline growth and upside surprise to operating margins.

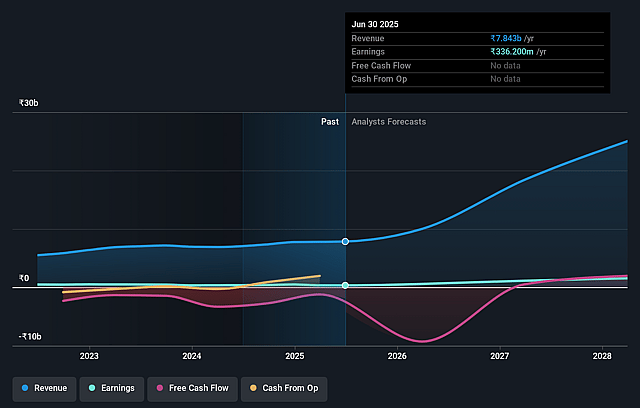

Neogen Chemicals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Neogen Chemicals compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Neogen Chemicals's revenue will grow by 59.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.3% today to 7.7% in 3 years time.

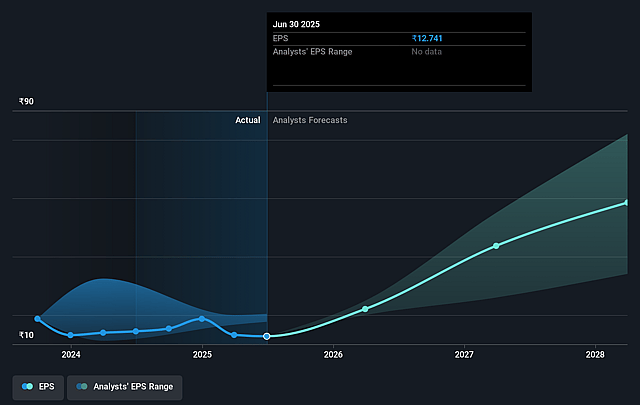

- The bullish analysts expect earnings to reach ₹2.5 billion (and earnings per share of ₹94.3) by about September 2028, up from ₹336.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 43.8x on those 2028 earnings, down from 134.0x today. This future PE is greater than the current PE for the IN Chemicals industry at 26.9x.

- Analysts expect the number of shares outstanding to decline by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.89%, as per the Simply Wall St company report.

Neogen Chemicals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Elevated capital expenditure on new greenfield projects and specialty battery chemical capacity, combined with large JV investments, introduces significant risk to the company's free cash flow and return on invested capital if market uptake lags expectations and demand in battery chemicals does not materialize as forecasted, thereby impacting long-term earnings and balance sheet strength.

- The global transition toward green chemistry and increasing pressure to phase out hazardous or legacy chemicals could erode demand for Neogen's core organic and inorganic products, risking product obsolescence and causing revenue stagnation or decline, especially if the company is slow to pivot its portfolio.

- Intensifying global regulatory scrutiny and more stringent environmental compliance requirements can elevate operational and compliance costs, which may squeeze margins and limit Neogen's ability to scale exports, especially in sensitive end markets such as the United States and Europe, weighing on net margins.

- Neogen's high concentration in lithium-based and bromine-based chemicals and dependence on a relatively small number of large customers or new battery industry entrants exposes its revenues to volatility if key procurement relationships shift, global battery supply chains evolve differently, or technological substitutes reduce demand.

- The specialty chemicals space faces escalating competition, both from domestic players such as Gujarat Fluoro and from potential global consolidation; delays in moving up the advanced value chain or a failure to maintain technological differentiation could erode pricing power and market share, compressing margins and long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Neogen Chemicals is ₹2630.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Neogen Chemicals's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2630.0, and the most bearish reporting a price target of just ₹1670.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹32.1 billion, earnings will come to ₹2.5 billion, and it would be trading on a PE ratio of 43.8x, assuming you use a discount rate of 13.9%.

- Given the current share price of ₹1587.4, the bullish analyst price target of ₹2630.0 is 39.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.