Key Takeaways

- Exposure to tightening regulations, higher sustainability costs, and intense competition from automated peers threatens long-term margins and growth prospects.

- Heavy capital spending and client concentration increase financial risk if demand fluctuates or major contracts are renegotiated.

- Intensifying competition, heavy capital spending, and reliance on large multinational clients expose Hindustan Foods to significant risks around margin compression, revenue stability, and earnings predictability.

Catalysts

About Hindustan Foods- Engages in the business of contract manufacturing of fast moving consumer goods in India and internationally.

- Although rapid urbanization and growing demand for packaged, branded, and hygienic foods in India provide a long runway for volume growth, Hindustan Foods is exposed to risks from tightening environmental regulations and the emerging consumer shift towards more sustainable product categories. This may require significant capital to retrofit facilities or build new compliant lines, putting pressure on future operating margins and potentially diverting cash flow from growth projects.

- While the company benefits from rising outsourcing by FMCG players and a broader move towards contract manufacturing, competition is intensifying as more technologically advanced third-party manufacturers enter the space, leveraging automation and digital supply chain platforms to win share. If Hindustan Foods is slower to adopt these innovations, it could see its pricing power eroded, limiting the pace of future revenue and EBIT growth.

- Despite recent record profits and a robust capital expenditure pipeline scheduled to reach nearly ₹2,000 crore by FY27, Hindustan Foods' heavy investment cycle raises the risk of a leveraged balance sheet, especially if new capacity additions outpace end-market demand or are disrupted by global economic volatility. This could translate to higher interest outflows and increased risk to long-term earnings stability.

- Although expanding into categories like ice creams and shoes demonstrates the company's ability to diversify and capture new revenue streams, high client concentration with major FMCG brands leaves Hindustan Foods exposed to abrupt changes in outsourcing appetite or unfavorable renegotiations. Any shift in procurement strategy by these major brands could materially impact future top-line and earnings visibility.

- While strategic cost optimization and the ramp-up of new, dedicated manufacturing facilities should support incremental margin expansion, ongoing pressures from FMCG clients to reduce contract manufacturing rates, coupled with evolving food safety and labor regulations, may more than offset these gains, leading to potential net margin compression over the longer term.

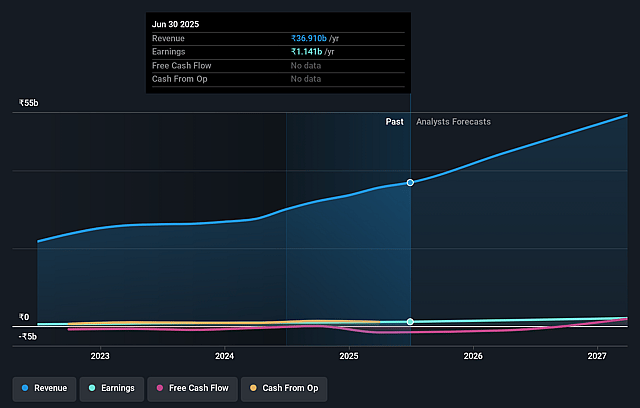

Hindustan Foods Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Hindustan Foods compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Hindustan Foods's revenue will grow by 23.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.1% today to 4.2% in 3 years time.

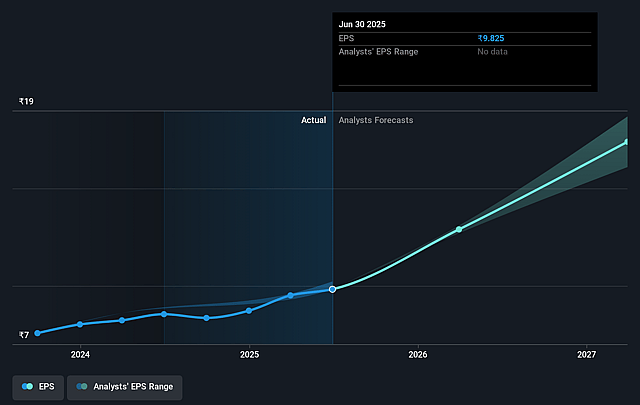

- The bearish analysts expect earnings to reach ₹2.9 billion (and earnings per share of ₹23.91) by about September 2028, up from ₹1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 42.2x on those 2028 earnings, down from 55.5x today. This future PE is greater than the current PE for the IN Food industry at 22.1x.

- Analysts expect the number of shares outstanding to grow by 2.9% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

Hindustan Foods Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from both established and emerging contract manufacturers, as highlighted during industry exhibitions and acknowledged by management, could lead to price wars and margin pressure for Hindustan Foods, negatively impacting both revenue growth and net margins over time.

- Heavy capital expenditure plans to reach up to ₹2,000 crore in gross block by FY '27 raise risks of a leveraged balance sheet; if anticipated volumes or margins do not materialize due to sector or macroeconomic headwinds, this could erode long-term earnings stability and return on equity.

- High dependency on large multinational FMCG clients leaves Hindustan Foods exposed to client concentration risk; any shift in outsourcing strategy, contract renegotiation, or volume reduction from these key customers would pose significant risks to revenue and earnings visibility.

- The reliance of the new Footwear business on multinational clients whose global sourcing decisions are affected by volatile tariff regimes and global trade disruptions increases the risk of unpredictable order flows and potential underutilization of new capacities, thus threatening revenue and margin predictability in that segment.

- Management acknowledges the need for ongoing cost-control and operational efficiency programs just to stay competitive, indicating persistent downward pressure on contract manufacturing margins; failure to continuously drive efficiency could result in margin compression and diminishing profitability in the face of inflationary or deflationary input cost swings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Hindustan Foods is ₹660.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Hindustan Foods's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹841.0, and the most bearish reporting a price target of just ₹660.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹69.6 billion, earnings will come to ₹2.9 billion, and it would be trading on a PE ratio of 42.2x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹530.5, the bearish analyst price target of ₹660.0 is 19.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.