Last Update 01 May 25

Fair value Increased 1.26%New Facilities And Diversified Segments Will Amplify Industry Presence

Key Takeaways

- Expansion into high-growth categories and increased automation are set to improve margins and drive earnings growth.

- Long-term contracts and acquisitions boost revenue stability and capitalize on industry outsourcing trends.

- Exposure to global trade risks, high capex, rising competition, and client concentration could strain margins, revenue stability, and long-term profitability.

Catalysts

About Hindustan Foods- Engages in the business of contract manufacturing of fast moving consumer goods in India and internationally.

- Continued capacity expansion-including new facilities in Nashik and North India-as well as aims to become India's largest contract manufacturer of ice cream positions the company to capture a larger share of rising demand for packaged and processed foods, supporting sustained revenue growth.

- Diversification into high-growth, higher-margin segments such as ice cream and footwear, along with ongoing operational efficiency initiatives (automation, Kaizen), is likely to drive improved EBITDA margins and earnings growth.

- Deepening partnerships with multinational FMCG clients through long-term, take-or-pay contracts enhances forward revenue visibility and reduces volatility, supporting stable or rising net margins.

- Increased capital expenditure and targeted acquisitions in core and high-margin verticals leverages industry trends towards outsourcing, which should boost operational scale and topline revenues.

- Urbanization and shifts in consumer preferences toward convenient, ready-to-consume products support ongoing portfolio expansion, enabling higher utilization rates at new and existing plants, with a direct positive impact on profitability and ROE.

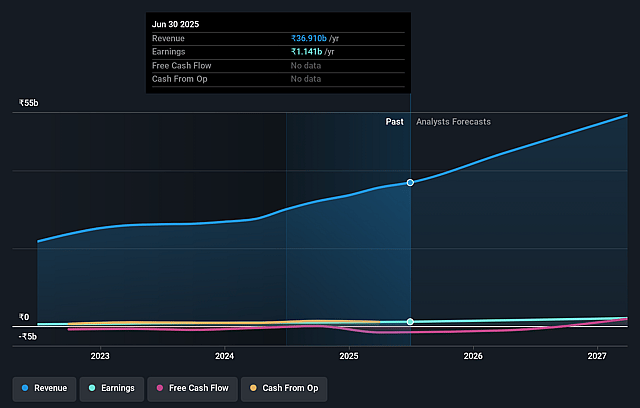

Hindustan Foods Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hindustan Foods's revenue will grow by 23.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.1% today to 4.3% in 3 years time.

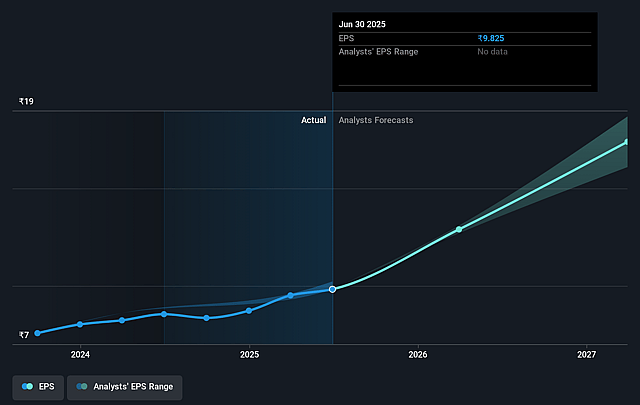

- Analysts expect earnings to reach ₹3.0 billion (and earnings per share of ₹24.6) by about September 2028, up from ₹1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 47.0x on those 2028 earnings, down from 55.5x today. This future PE is greater than the current PE for the IN Food industry at 22.1x.

- Analysts expect the number of shares outstanding to grow by 2.9% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

Hindustan Foods Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Uncertainty in global trade and tariffs, especially for multinational customers in the footwear segment, could have a negative knock-on effect on order flow and demand visibility, impacting revenue and future earnings.

- Large planned capital expenditures (targeting ₹2,000 crore gross block by FY '27) may increase debt levels or impair future returns if demand assumptions don't materialize, potentially pressuring net margins and ROE.

- Intensifying competition in contract manufacturing, with many new and established players entering categories like ice cream and footwear, could limit pricing power and lead to margin compression.

- Client concentration risk and dependence on multi-year/long-tenure dedicated manufacturing contracts expose the company to sudden changes in customer strategy, product disruption, or contract renegotiations, which may affect revenue stability and long-term earnings predictability.

- Volatility in raw material sourcing (notably in imports for footwear) and global supply chain disruptions-compounded by factors like climate change, ESG pressures, and changing regulatory norms-could raise costs or operational hurdles, reducing net margins and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹750.5 for Hindustan Foods based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹841.0, and the most bearish reporting a price target of just ₹660.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹69.6 billion, earnings will come to ₹3.0 billion, and it would be trading on a PE ratio of 47.0x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹530.5, the analyst price target of ₹750.5 is 29.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.