Key Takeaways

- Strategic expansions, operational efficiency, and automation initiatives are driving sustainable improvements in margins, market leadership, and earnings quality.

- Strong positioning in premiumization and modern retail makes Hindustan Foods the preferred partner for top brands, supporting higher growth and long-term stability.

- Shifting consumer trends, rising regulatory costs, and dependence on key clients expose Hindustan Foods to revenue risks, margin pressure, and potential underutilization of expanded capacity.

Catalysts

About Hindustan Foods- Engages in the business of contract manufacturing of fast moving consumer goods in India and internationally.

- While analyst consensus expects robust revenue growth and margin gains from new category expansions (ice cream, OTC, footwear), record production ramp-ups, rapid facility commercialization, and visible execution outperformance strongly suggest that Hindustan Foods can achieve market leadership and higher-than-forecast growth-potentially doubling revenues in Ice Cream and exceeding current FY '27 estimates across multiple categories.

- Analysts broadly agree that step changes in operational efficiency and earnings will stem from leadership strengthening and strategic expansions; however, continued discipline in cost controls, faster inventory turns, and proactive automation initiatives point to a larger and sustained improvement in net margins and return on equity than currently modeled by the Street.

- Hindustan Foods is uniquely positioned to capture a disproportionate share of the wave of premiumization and SKU proliferation among FMCG companies, as consumers in India demand more health-focused, convenient, and branded products-fueling both higher-margin contracts and new, longer-duration manufacturing agreements, which should structurally raise revenue and earnings quality.

- With an asset base approaching ₹2,000 crore and multi-year, take-or-pay contracts averaging 8–9 years, Hindustan Foods enjoys unprecedented visibility and stability, while its ability to scale, leverage long-term customer relationships, and pursue further strategic M&A could accelerate top-line growth and drive EPS accretion ahead of forecasts.

- The rapid expansion of modern retail, e-commerce, and direct-to-consumer channels in India is creating an urgent need for large, technology-enabled, flexible manufacturing partners; Hindustan Foods is increasingly becoming the default partner for marquee brands and private labels, enabling above-industry growth rates and further upside to both revenues and operating leverage.

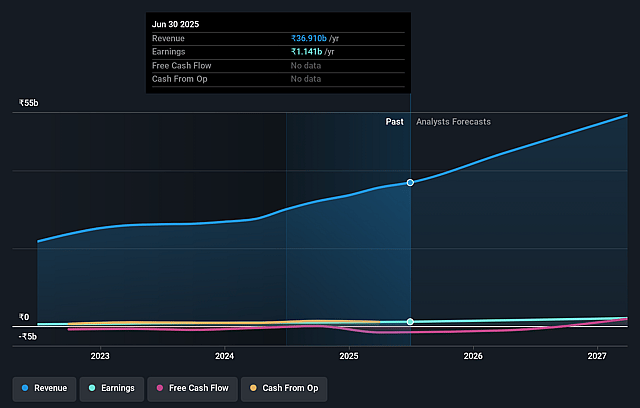

Hindustan Foods Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Hindustan Foods compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Hindustan Foods's revenue will grow by 26.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.1% today to 4.5% in 3 years time.

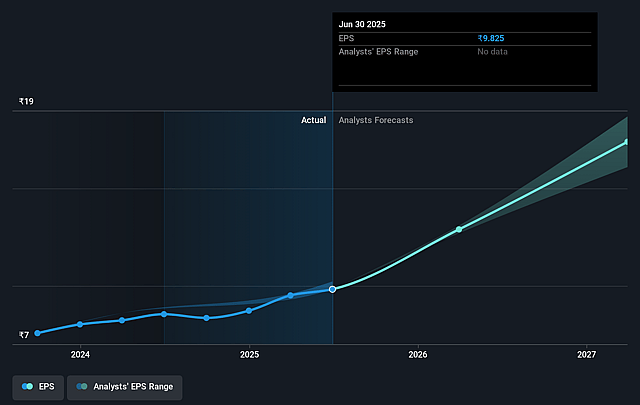

- The bullish analysts expect earnings to reach ₹3.3 billion (and earnings per share of ₹27.93) by about September 2028, up from ₹1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 47.2x on those 2028 earnings, down from 56.0x today. This future PE is greater than the current PE for the IN Food industry at 22.6x.

- Analysts expect the number of shares outstanding to grow by 2.9% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

Hindustan Foods Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- As consumer preferences shift toward fresh, organic, and minimally processed foods, demand for traditional packaged FMCG products could stagnate or decline, raising long-term risks of slower revenue growth and underutilized manufacturing capacity for Hindustan Foods.

- The company's aggressive capital expenditure plans, including multiple new facility expansions in Ice Cream and Footwear, may result in asset underutilization if order visibility does not materialize, putting downward pressure on net margins and return on equity.

- Customer concentration in large FMCG players such as Hindustan Unilever and Marico creates a structural vulnerability: loss or downsizing of even a single contract may lead to steep declines in revenue and operational leverage, affecting both earnings and overall stability.

- The rise of D2C brands and rapid digitalization in the FMCG sector may reduce major brands' reliance on external contract manufacturers, thereby compressing Hindustan Foods' future revenues and profit margins if these brands internalize more of their production.

- Heightened regulatory scrutiny around environmental standards and the potential tightening of compliance for packaging materials and waste management could escalate operational costs and dampen net profitability, especially in a low-margin contract manufacturing model.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Hindustan Foods is ₹841.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Hindustan Foods's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹841.0, and the most bearish reporting a price target of just ₹660.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹73.9 billion, earnings will come to ₹3.3 billion, and it would be trading on a PE ratio of 47.2x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹535.1, the bullish analyst price target of ₹841.0 is 36.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.