Key Takeaways

- Slower digital adoption and legacy systems are raising costs and reducing competitiveness as fintechs and banks rapidly capture market share in digitally enabled regions.

- Heightened regulation, rising compliance costs, and stagnant affordable housing demand are limiting growth opportunities and squeezing profitability.

- Robust demand, ongoing asset quality improvement, margin-enhancing strategies, disciplined cost management, and digital investments are positioning the company for sustainable growth and increased market share.

Catalysts

About LIC Housing Finance- A housing finance company, provides loans for the purchase, construction, repair, and renovation of houses/buildings in India.

- The accelerating shift toward digital-first and fintech-based lending platforms is expected to erode LIC Housing Finance's traditional customer base, leading to a loss of market share, compressing revenue growth, and making it harder to maintain scale advantages over the medium to long term.

- Persistent and intensifying competition from banks with lower cost of funds, as well as agile fintechs, is likely to drive continued pressure on home loan yields, resulting in compressed net interest margins and lower earnings growth, especially as LIC Housing Finance remains primarily focused on low-yield, highly competitive salaried home loans.

- Urban migration into digitally penetrated regions is expected to benefit nimble, tech-driven competitors, while LIC Housing Finance's slower digital transformation and legacy systems increase operational costs and slow customer acquisition, further squeezing net margins and limiting operational leverage.

- Regulatory tightening including stricter environmental mandates, higher compliance costs, and more demanding provisioning requirements for non-banking and housing finance companies could significantly increase cost structures, requiring larger capital buffers and reducing return on equity over time.

- Stagnant real wage growth and periodic increases in property prices are likely to shrink affordable housing demand, directly limiting the addressable market and curbing disbursement volumes, which would drag on top-line revenue growth even as competition remains fierce.

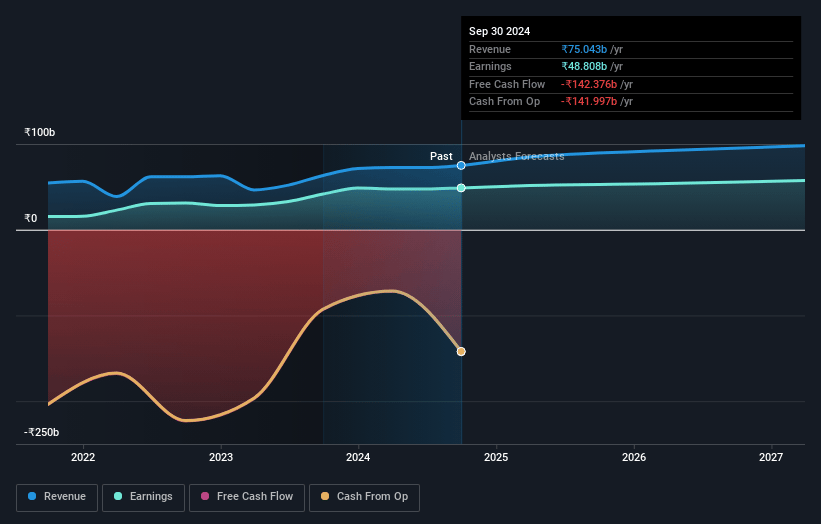

LIC Housing Finance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on LIC Housing Finance compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming LIC Housing Finance's revenue will grow by 2.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 65.6% today to 66.7% in 3 years time.

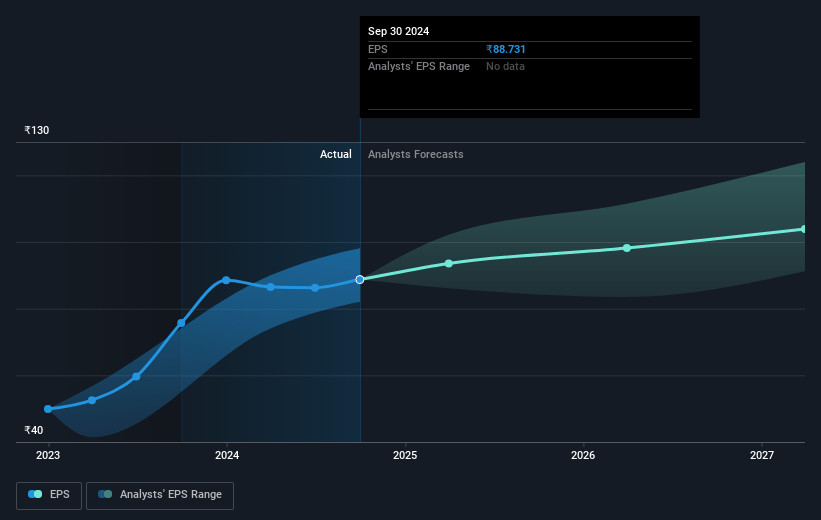

- The bearish analysts expect earnings to reach ₹59.2 billion (and earnings per share of ₹99.29) by about July 2028, up from ₹54.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.6x on those 2028 earnings, up from 6.3x today. This future PE is lower than the current PE for the IN Diversified Financial industry at 28.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.21%, as per the Simply Wall St company report.

LIC Housing Finance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong nationwide demand for affordable and mid-income housing, backed by both rapid urbanization and supportive government policies like 'Housing for All', is likely to support double-digit loan growth and AUM expansion for LIC Housing Finance, leading to sustained revenue increases.

- The company is successfully improving asset quality year-over-year, reducing Stage 3 assets from 4.41 percent two years ago to 2.46 percent, and management expects to bring this below 2.2 percent, suggesting continued moderation in provisioning and improved net profitability.

- LIC Housing Finance is strategically expanding its higher-margin offerings, notably in affordable housing and loan-against-property segments, with affordable housing yields in the 11 to 12 percent range and plans to double affordable housing disbursements this year, which is likely to support net interest margins even if core housing loan margins are pressured.

- The company is maintaining strong operational discipline during a challenging rate environment, leveraging its AAA rating and negotiating lower funding costs, with ₹30,000 crores of NCDs set to reprice at lower rates, which should alleviate cost of funds and support margins in the medium term.

- LIC Housing Finance expects to benefit from long-term industry consolidation and formalization, with its size, asset quality improvements, and digital investments positioning it to capture additional market share and sustain stable earnings growth even amid heightened competition from banks and fintechs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for LIC Housing Finance is ₹480.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of LIC Housing Finance's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹940.0, and the most bearish reporting a price target of just ₹480.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹88.7 billion, earnings will come to ₹59.2 billion, and it would be trading on a PE ratio of 6.6x, assuming you use a discount rate of 14.2%.

- Given the current share price of ₹619.65, the bearish analyst price target of ₹480.0 is 29.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.