Key Takeaways

- LIC Housing Finance is set to benefit from cheaper funding, sector consolidation, and strong parentage, improving margins and supporting robust, above-industry growth.

- Strategic focus on affordable housing and digital expansion positions the company for sustained revenue diversification and long-term leadership as housing demand rises.

- Competitive rate pressures, slow affordable housing growth, legacy loan risks, digital lag, and regulatory shifts threaten margins, earnings stability, and long-term profitability.

Catalysts

About LIC Housing Finance- A housing finance company, provides loans for the purchase, construction, repair, and renovation of houses/buildings in India.

- While analysts broadly agree that policy rate cuts and RBI-driven liquidity infusions should lower cost of funding and support home loan growth, they may underappreciate the leverage LIC Housing Finance gains as over Rs 30,000 crores of NCDs refinance through FY25, allowing for a more dramatic and sustained reduction in interest expense and expansion of net interest margins, especially as management expresses confidence in securing much lower borrowing rates tied to strong AAA credit and parentage.

- Analyst consensus recognizes ongoing recovery and backlog clearance in key centers like Bangalore and Hyderabad, but may be overly conservative; with a 24% Q4 disbursement jump and management targeting at least 10-12% business and double-digit AUM growth, a normalization of operations could catalyze multiple quarters of above-trend loan growth and robust revenue acceleration as regional disruptions fade.

- The ongoing build-out in affordable housing, supported by deliberate training of frontline teams and leveraging the wide branch and digital infrastructure, sets up the company for a step-change in addressable market, with high-yield affordable products at 11-12% rates likely to drive structurally higher blended margins and revenue diversification as these products rapidly scale over the next two to three years.

- Accelerating urbanization and a rising middle class in India can lead to outsized, multi-year structural demand for both prime and affordable housing finance; as a market leader with a trusted brand, deep pan-India franchise, and growing digital adoption, LIC Housing Finance is uniquely positioned to capture above-industry disbursement growth, directly translating to outperformance on loan book expansion and top-line growth.

- The formalization and consolidation underway in the housing finance sector create a winner-take-most dynamic in which well-capitalized, regulated, and technologically advanced players like LIC Housing Finance not only gain share from weaker NBFCs but also see sector-wide improvements in asset quality and lower credit costs, driving sustained uplift in earnings and return on equity.

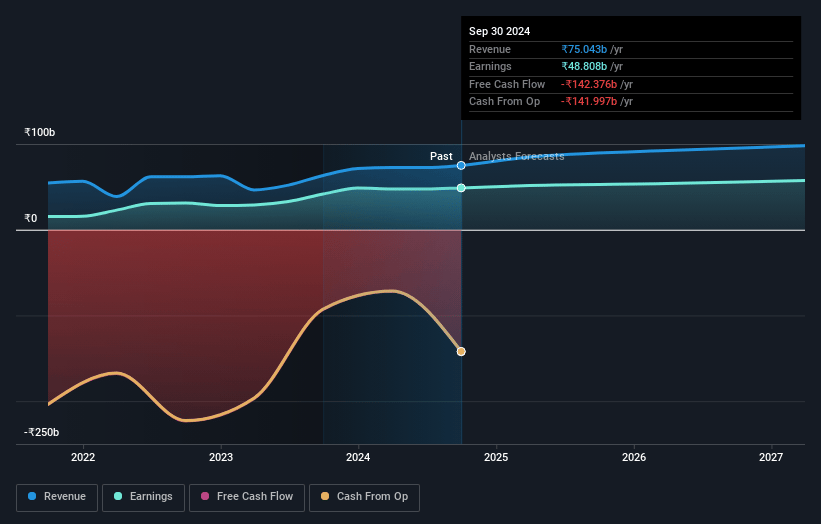

LIC Housing Finance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on LIC Housing Finance compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming LIC Housing Finance's revenue will grow by 11.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 65.6% today to 62.1% in 3 years time.

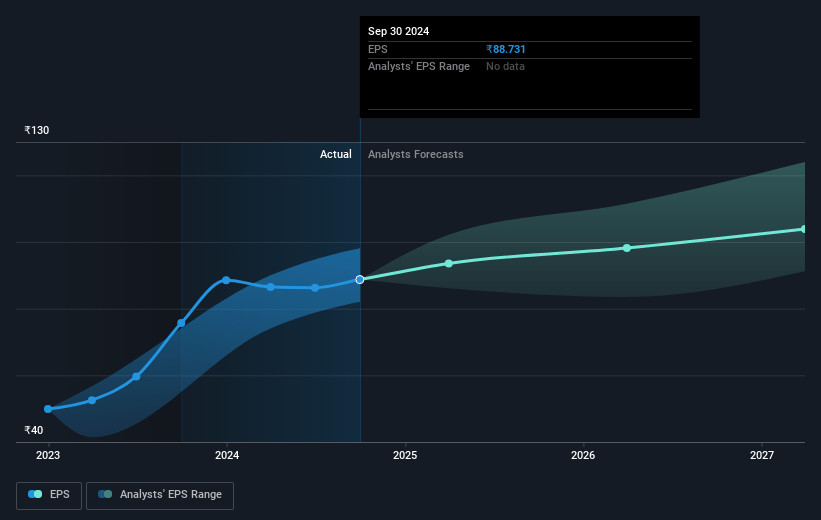

- The bullish analysts expect earnings to reach ₹70.8 billion (and earnings per share of ₹128.26) by about July 2028, up from ₹54.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.0x on those 2028 earnings, up from 6.1x today. This future PE is lower than the current PE for the IN Diversified Financial industry at 27.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.15%, as per the Simply Wall St company report.

LIC Housing Finance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intense competition from banks with lower cost of funds, especially as they swiftly reduce home loan rates due to CASA advantages, could erode LIC Housing Finance's market share and force it to lower its own lending rates, impacting revenue growth and compressing net interest margins.

- The company's slow expansion and cautious approach to affordable housing-amid an industry shift and aggressive government-backed initiatives-may prevent it from capturing sufficient growth in this high-yield, fast-growing segment, resulting in stagnant or declining revenue.

- High and persistent exposure to legacy project finance and wholesale loans, with unresolved large-ticket NPAs locked in lengthy litigation, risks higher non-performing assets and increased credit costs, threatening long-term earnings stability and weighing on provisions.

- Continued reliance on traditional funding sources and the parent LIC for branding and liabilities, paired with a lack of rapid digital transformation, exposes the business to fintech disruption and sector consolidation, which may restrict its ability to diversify funding efficiently and maintain net margins.

- Regulatory tightening and sector consolidation trends favoring larger banks and nimble fintechs could lead to higher capital buffer requirements and further price pressure on spreads, putting sustained pressure on LIC Housing Finance's return on equity and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for LIC Housing Finance is ₹866.0, which represents two standard deviations above the consensus price target of ₹670.75. This valuation is based on what can be assumed as the expectations of LIC Housing Finance's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹940.0, and the most bearish reporting a price target of just ₹480.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹114.0 billion, earnings will come to ₹70.8 billion, and it would be trading on a PE ratio of 10.0x, assuming you use a discount rate of 14.1%.

- Given the current share price of ₹604.65, the bullish analyst price target of ₹866.0 is 30.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.