Key Takeaways

- Rising health consciousness and regulatory scrutiny are likely to weigh on revenue growth and compress margins despite ongoing menu and digital innovation efforts.

- Urban challenges, competitive pressures, and brand concentration threaten expansion plans and expose revenues to volatility and operational uncertainty.

- Expansion into new cities, digital engagement, menu innovation, cost control, and operational recovery in Indonesia collectively position the company for broader growth and margin improvement.

Catalysts

About Restaurant Brands Asia- Together with its subsidiaries operates quick service restaurant chains in India and Indonesia.

- Rising health consciousness among consumers is likely to lead to stagnation or long-term decline in sales volume of quick service restaurant offerings, directly impacting Restaurant Brands Asia's ability to sustain revenue growth even as it continues to pursue aggressive store expansion.

- Urban congestion, worsening pollution, and climate change-driven disruptions are expected to make physical retail and restaurant expansion significantly more costly and operationally uncertain, thereby threatening the company's long-term expansion targets and pressuring both margins and future earnings.

- Persistent losses in key geographies, particularly from slow or negative same-store sales growth despite new product launches and menu innovation efforts, could erode operational leverage and delay the company's path to sustainable net profitability, resulting in a drag on both EBITDA margins and overall earnings.

- Overdependence on the Burger King brand in a highly saturated and increasingly competitive QSR market amplifies vulnerability to brand-specific setbacks or shifts in consumer tastes, introducing the risk of volatile revenues and undermining the resilience of long-term cash flows.

- Growing regulatory scrutiny around ESG issues such as waste management, food sourcing, and packaging is likely to intensify, driving up compliance and operational costs and compressing Restaurant Brands Asia's net margins, even as menu and digital innovation require continual investment for customer retention.

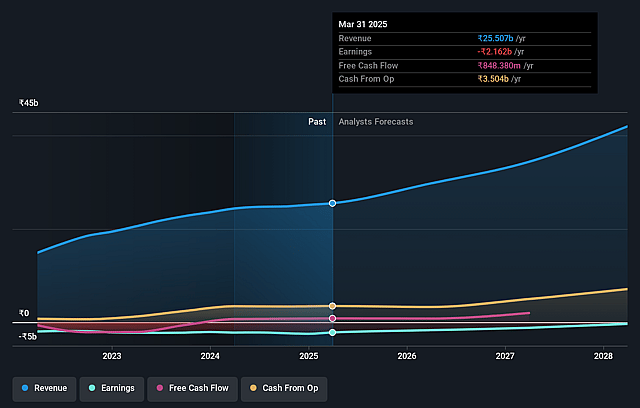

Restaurant Brands Asia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Restaurant Brands Asia compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Restaurant Brands Asia's revenue will grow by 14.6% annually over the next 3 years.

- The bearish analysts are not forecasting that Restaurant Brands Asia will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Restaurant Brands Asia's profit margin will increase from -8.0% to the average IN Hospitality industry of 15.1% in 3 years.

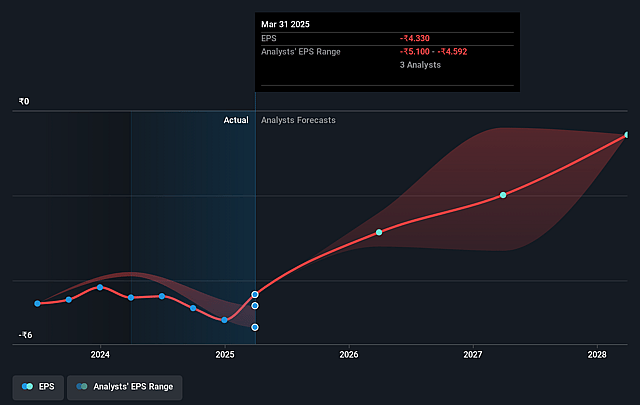

- If Restaurant Brands Asia's profit margin were to converge on the industry average, you could expect earnings to reach ₹5.9 billion (and earnings per share of ₹8.29) by about August 2028, up from ₹-2.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.6x on those 2028 earnings, up from -22.3x today. This future PE is lower than the current PE for the IN Hospitality industry at 34.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.86%, as per the Simply Wall St company report.

Restaurant Brands Asia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued expansion into Tier 2 and Tier 3 cities, with a consistent net addition of 60 to 80 new restaurants annually, positions Restaurant Brands Asia to capture long-term revenue growth and benefit from operational leverage as urbanization and consumer spending rise.

- Persistent positive same-store sales growth, strong dine-in traffic trends, and increasing digital engagement through app-based loyalty and promotions indicate deepening customer stickiness, supporting potential long-term improvements in both revenue and net margins.

- Strategic innovations such as menu diversification, value-oriented and premium offerings, and the rapid roll-out of in-store cafes and new digital ordering channels have shown early success and are likely to broaden demographic appeal, boosting the company's addressable market and top-line growth.

- Ongoing initiatives to reduce costs-including rent renegotiation on new stores, improvements in utility expenditure, and reduction in corporate overhead-are already translating to higher restaurant EBITDA margins and are expected to drive further enhancement of profitability and earnings over time.

- The improvement and stabilization of the Indonesian operations, especially with Burger King returning to positive store-level EBITDA and rationalization nearly complete, could unlock further earnings growth and margin recovery at a consolidated level for the company.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Restaurant Brands Asia is ₹76.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Restaurant Brands Asia's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹135.0, and the most bearish reporting a price target of just ₹76.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹39.2 billion, earnings will come to ₹5.9 billion, and it would be trading on a PE ratio of 14.6x, assuming you use a discount rate of 16.9%.

- Given the current share price of ₹79.81, the bearish analyst price target of ₹76.0 is 5.0% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.