Key Takeaways

- Aggressive expansion into smaller Indian cities and digital adoption are enhancing reach, efficiency, and margins, fueling growth and customer engagement.

- Menu innovation, operational efficiencies, and international turnaround measures support sustained sales momentum and improved long-term profitability.

- Heavy promotional focus, aggressive expansion, and rising competition are pressuring margins, while weak premium sales signal challenges in boosting revenue and profitability.

Catalysts

About Restaurant Brands Asia- Together with its subsidiaries operates quick service restaurant chains in India and Indonesia.

- Expansion into underserved Tier II and III Indian cities and consistent addition of 60-80 new stores per year is growing Restaurant Brands Asia's addressable market, allowing it to capture rising urban demand and increase revenues and operating leverage.

- Rapid adoption of digital ordering (SOKs in 93% of stores, 90%+ sales from digital channels, and growing BK app penetration) is improving operational efficiency and customer engagement, which supports higher revenue growth and helps drive down cost-to-serve and lift net margins.

- Successful implementation of a value-driven barbell menu strategy and ongoing cafe rollout (now in 480+ locations) is driving consistent dine-in traffic, repeat business, and average ticket size improvements, supporting stable same-store sales growth and topline expansion.

- Ongoing upgrades in procurement, utilities, and rent negotiations-enabled by scale and technology investments-are leading to structurally lower cost lines (e.g., utilities, rents, IT costs), supporting improvement in EBITDA margins and long-term profitability.

- Margin-accretive turnaround initiatives in Indonesia (ADS growth, closure of underperforming stores, and reduction in corporate overheads) are positioning the international business for breakeven and future earnings contribution, complementing core India growth.

Restaurant Brands Asia Future Earnings and Revenue Growth

Assumptions

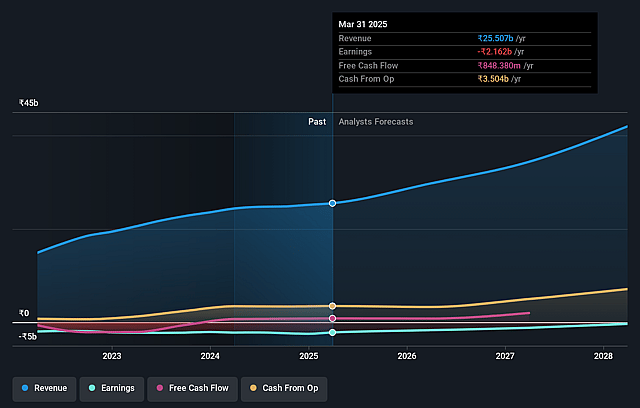

How have these above catalysts been quantified?- Analysts are assuming Restaurant Brands Asia's revenue will grow by 16.7% annually over the next 3 years.

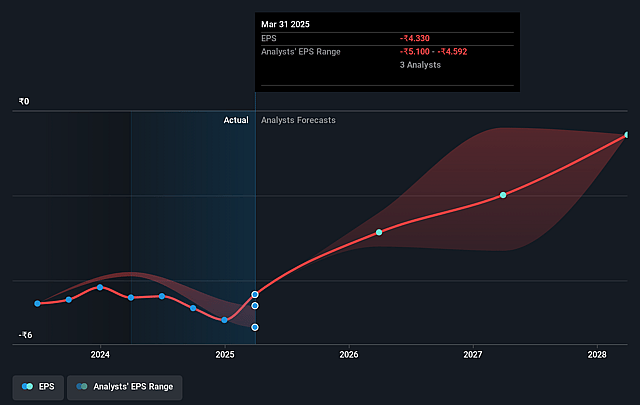

- Analysts are not forecasting that Restaurant Brands Asia will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Restaurant Brands Asia's profit margin will increase from -8.0% to the average IN Hospitality industry of 14.4% in 3 years.

- If Restaurant Brands Asia's profit margin were to converge on the industry average, you could expect earnings to reach ₹6.0 billion (and earnings per share of ₹8.35) by about September 2028, up from ₹-2.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.1x on those 2028 earnings, up from -22.7x today. This future PE is lower than the current PE for the IN Hospitality industry at 37.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.93%, as per the Simply Wall St company report.

Restaurant Brands Asia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent softness and limited growth in premium menu categories, reflected by modest same-store sales growth (SSSG) of only 2.6%, may signal a lack of pricing power and consumer willingness to spend, potentially constraining revenue growth and gross margin expansion if this trend persists long-term.

- Heavy reliance on value-driven traffic growth and price-sensitive promotions (such as 2 for ₹79/99) may erode average ticket sizes, limit ability to pass on inflationary costs, and drive lower overall earnings quality over time if consumer downtrading becomes entrenched.

- The ongoing ramp-up of store count amid slow demand recovery and lower ADS (Average Daily Sales) in new stores, particularly in Indonesia and the newly launched cafes, risks margin dilution and operating inefficiency, which could negatively affect net margins if store productivity fails to keep pace with expansion.

- Rising operational complexities and costs, such as increased staffing/training to support digital initiatives and aggressive menu innovation, could escalate SG&A and labor costs and may outweigh savings from utilities and rent renegotiations in the near to medium term-pressuring net margins and earnings.

- Intensifying competition from global and local QSR players in both India and Indonesia, coupled with higher promotional intensity and the growing impact of food delivery platforms like Swiggy and Zomato, could further reduce footfall and force margin-eroding price actions, impacting both revenue growth and long-run profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹94.727 for Restaurant Brands Asia based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹135.0, and the most bearish reporting a price target of just ₹76.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹41.3 billion, earnings will come to ₹6.0 billion, and it would be trading on a PE ratio of 18.1x, assuming you use a discount rate of 16.9%.

- Given the current share price of ₹81.44, the analyst price target of ₹94.73 is 14.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.