Key Takeaways

- Aggressive digital, AI, and expansion strategies are driving operational efficiency, customer loyalty, and set up for significant gains in sales and profitability.

- Rapid café innovation, targeted marketing, and supply chain optimization position the company for substantial revenue growth and margin expansion in a rising market.

- Margin pressures and profitability risks persist due to soft demand, rising costs, increased competition, and slow success of new initiatives amid operational challenges in key segments.

Catalysts

About Restaurant Brands Asia- Together with its subsidiaries operates quick service restaurant chains in India and Indonesia.

- Analyst consensus expects moderate gains from digital transformation, but the company's rapid rollout of self-ordering kiosks, near-complete digital sales penetration, and aggressive plans to deploy AI across customer, staff, and supplier touchpoints could drive step-change improvements in operational efficiency, customer retention, and order frequency-unlikely to be fully priced into future earnings or net margins.

- While analysts broadly anticipate new product innovation and café expansion to produce incremental growth, the scale and speed of these initiatives-café coverage already above 90%, rapid new menu innovations like co-branded items, and a unique marketing flywheel-set the stage for a sustained acceleration in same-store sales growth and average ticket size, substantially boosting revenue and gross margin potential.

- The company's ongoing aggressive restaurant expansion into India's underpenetrated tier 2/3 cities aligns with rising urbanization and increasing disposable incomes, providing a much larger long-term addressable market and outsized systemwide revenue growth versus more mature QSR peers.

- Data-driven personalization through the digital platform, combined with a young and increasingly aspirational consumer base, positions the company to build a high-frequency, loyal customer cohort whose lifetime value can be further unlocked through targeted CRM, loyalty programs, and app-exclusive offers, powering structural gains in transaction volume and profitability.

- Supply chain optimization, backed by scale benefits from higher volumes and vertical integration, will increasingly translate to lower input costs, allowing margin expansion even as value-driven pricing draws mass-market consumers and supports market share gains in the rapidly formalizing Indian food services industry.

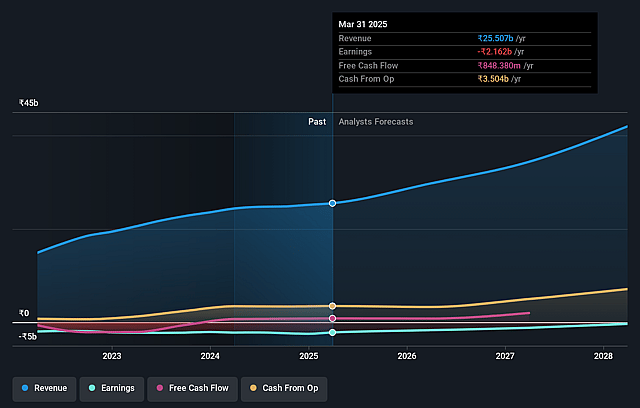

Restaurant Brands Asia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Restaurant Brands Asia compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Restaurant Brands Asia's revenue will grow by 18.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -8.0% today to 1.1% in 3 years time.

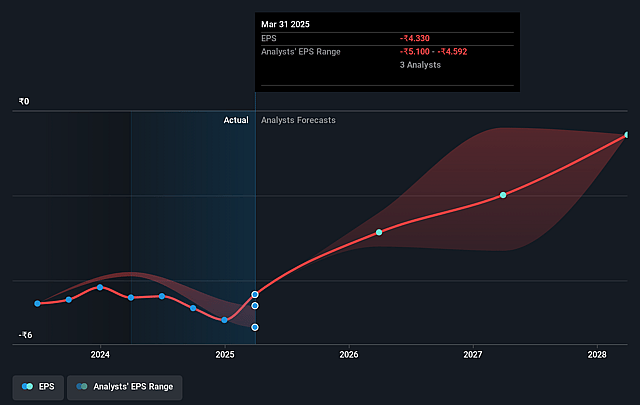

- The bullish analysts expect earnings to reach ₹477.6 million (and earnings per share of ₹0.82) by about September 2028, up from ₹-2.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 298.5x on those 2028 earnings, up from -22.3x today. This future PE is greater than the current PE for the IN Hospitality industry at 36.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.93%, as per the Simply Wall St company report.

Restaurant Brands Asia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent industry-wide demand softness, especially at the premium end, combined with consumer downtrading toward value menu items, may constrain growth in average per customer revenue, negatively impacting revenue and gross margin expansion over the long term.

- Rapid urbanization in India and South Asia, along with stated plans to accelerate store openings, may expose the company to rising real estate and rent costs, threatening store-level profitability and putting downward pressure on net margins and returns on capital.

- Despite heavy investment in digital and cafe rollouts, footfall and average daily sales per store are only gradually increasing, signaling potential limits to the scalability or relevance of current offerings in a market with fast-changing consumer preferences, which could limit the growth of same-store sales and overall earnings.

- Restaurant Brands Asia continues to face significant competition from both global QSRs (such as McDonald's and Domino's) and agile domestic brands, especially as food delivery platforms proliferate and commoditize offerings, making it difficult to maintain market share and may require higher marketing expenses, further squeezing net margins.

- Ongoing turnaround challenges and operational losses in the Indonesia segment, particularly with Popeyes, suggest continued risks to consolidated profitability, as high leverage and the need for sustained capital expenditure could constrain future earnings and slow overall top-line growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Restaurant Brands Asia is ₹125.07, which represents two standard deviations above the consensus price target of ₹94.73. This valuation is based on what can be assumed as the expectations of Restaurant Brands Asia's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹135.0, and the most bearish reporting a price target of just ₹76.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹43.4 billion, earnings will come to ₹477.6 million, and it would be trading on a PE ratio of 298.5x, assuming you use a discount rate of 16.9%.

- Given the current share price of ₹80.1, the bullish analyst price target of ₹125.07 is 36.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.