Key Takeaways

- Margin expansion and profitability are outpacing expectations, with strong guidance upgrades and improving net margin profile reflecting operational strength not fully recognized by the market.

- Regulatory shifts, increased O&M outsourcing, and favorable policy frameworks are driving rapid scale, dominant market positioning, and a strong, sustainable growth outlook.

- Ongoing working capital issues, industry policy risks, rising competition, and contract unpredictability threaten Inox Wind's profitability and margins despite expansion efforts.

Catalysts

About Inox Wind- Engages in the manufacture and sale of wind turbine generators and components for independent power producers, utilities, public sector undertakings, businesses, and private investors in India.

- While analysts broadly agree that nacelle, crane and transformer commissioning will drive margin gains, the magnitude could be much greater than consensus expects as management is repeatedly upgrading margin guidance and actual profitability has been exceeding targets by 25% or more; this suggests a rapidly strengthening net margin profile that the market is yet to fully price in.

- Analyst consensus acknowledges ambitious execution plans, but recent commentary indicates management is targeting wind and O&M scaling at an even faster pace: Inox Green expects its O&M portfolio to triple from 5 gigawatts currently to 17 gigawatts by FY27, materially exceeding market expectations for top-line and annuity revenue acceleration.

- The CERC amendment now enables hybridization of existing wind transmission for solar, unlocking access to 10 gigawatts of ready infrastructure and making Inox among the only private players with such plug and play scale; this structural regulatory change allows for rapid project roll-out, reduces capex, and could deliver a step function increase in revenue and order inflows.

- Underappreciated industry consolidation is accelerating, with management emphasizing that outsourcing of O&M (including from large conglomerates exiting captive models) is driving multi-gigawatt scale new customer wins-positioning Inox Green for dominant market share gains and sustained EBITDA margin improvement.

- India's long-term policy mandate for 500 gigawatts of non-fossil generation by 2030, coupled with recently introduced ALMM and domestic content requirements (which reduce import competition), structurally ensures high underlying demand and pricing power for domestic leaders like Inox Wind-supporting a multiyear cycle of order book expansion, premium pricing, and superior earnings visibility.

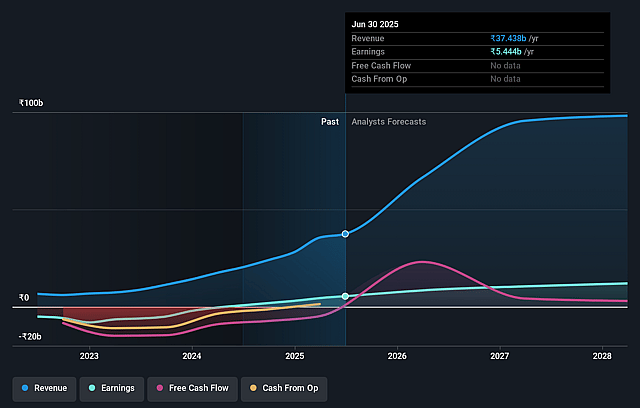

Inox Wind Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Inox Wind compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Inox Wind's revenue will grow by 51.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 14.5% today to 11.0% in 3 years time.

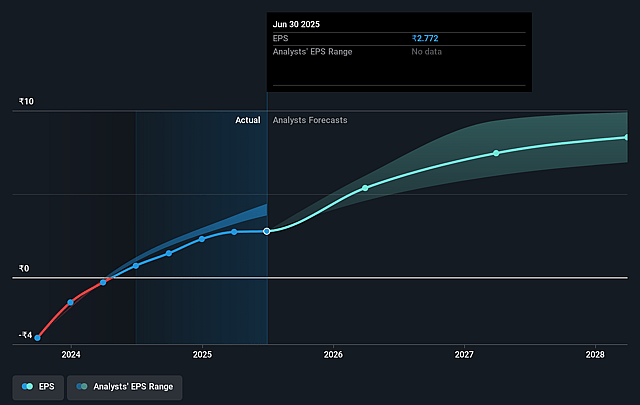

- The bullish analysts expect earnings to reach ₹14.2 billion (and earnings per share of ₹11.26) by about September 2028, up from ₹5.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 65.0x on those 2028 earnings, up from 47.4x today. This future PE is greater than the current PE for the IN Electrical industry at 38.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.89%, as per the Simply Wall St company report.

Inox Wind Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Inox Wind continues to face persistent working capital challenges and high levels of debt, with management targeting 120 net working capital days, which can put ongoing pressure on net earnings and potentially constrain future profitability if order execution is delayed or receivables rise.

- The company's shift toward a higher mix of equipment supply versus turnkey contracts could introduce greater unpredictability in revenue recognition, especially as some contracts involve delayed commissioning and multi-quarter lags, which may amplify earnings volatility.

- Despite near-term policy support, the wind industry in India remains vulnerable to eventual reductions or removal of government incentives and subsidies, which would likely reduce demand for Inox Wind's projects and compress both revenue and net margins.

- Inox Wind's market is becoming increasingly competitive, not only from established wind players but also from rapid cost declines and scaling in alternative renewables such as solar PV and battery storage, which risks making wind less attractive and could exert downward pressure on average selling prices and margins.

- Execution and quality issues have been highlighted in the past, and as the company rapidly expands capacity and order book, any recurring delays or quality concerns could necessitate higher warranty provisions and lead to reduced net margins despite higher reported revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Inox Wind is ₹281.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Inox Wind's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹281.0, and the most bearish reporting a price target of just ₹158.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹129.9 billion, earnings will come to ₹14.2 billion, and it would be trading on a PE ratio of 65.0x, assuming you use a discount rate of 15.9%.

- Given the current share price of ₹149.22, the bullish analyst price target of ₹281.0 is 46.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.