Key Takeaways

- Overdependence on wind-focused offerings and limited product diversification could cap growth and increase vulnerability to shifting technology trends and market competition.

- Geopolitical supply chain risks, execution delays, and potential for weaker order flows amid high interest rates may constrain margins and earnings reliability.

- Rising competition, a shift toward lower-margin solar, heavy capital needs, and liquidity pressures threaten Inox Wind's profitability, growth, and earnings quality.

Catalysts

About Inox Wind- Engages in the manufacture and sale of wind turbine generators and components for independent power producers, utilities, public sector undertakings, businesses, and private investors in India.

- Although Indian and global policy support for renewables, as well as the CERC's recent regulation enabling hybridization of wind and solar capacity, should create a stronger long-term order pipeline and higher project execution volumes, the risk remains that solar solutions could continue to outpace wind in cost and adoption, which may cap revenue growth for purely wind-focused offerings.

- While Inox Wind is currently benefiting from favorable domestic manufacturing policies such as the ALMM requirements and deepening ESG investment trends, the company could be negatively impacted over time by supply chain disturbances arising from global geopolitical issues, which would pressure margins and inflate input costs.

- Despite significant operational improvements, new manufacturing capacity, and an expanding order book that would typically point to growing earnings, any prolonged environment of elevated interest rates may limit new project investments and slow order inflows, dampening both topline and net margin expansion over the long-term.

- While the demerger and balance sheet strengthening initiatives, supported by successful capital raises, are expected to enhance net margins, any ongoing execution delays or challenges in completing large turnkey projects could erode customer confidence and affect order book visibility, directly impacting future earnings reliability.

- Although the group's integrated renewables strategy allows for expansion into hybrid and solar O&M markets, an ongoing reliance on current wind turbine models with limited product diversification could expose Inox Wind to risks of technological obsolescence, making it harder to defend revenues and margins against international and domestic competitors offering differentiated solutions.

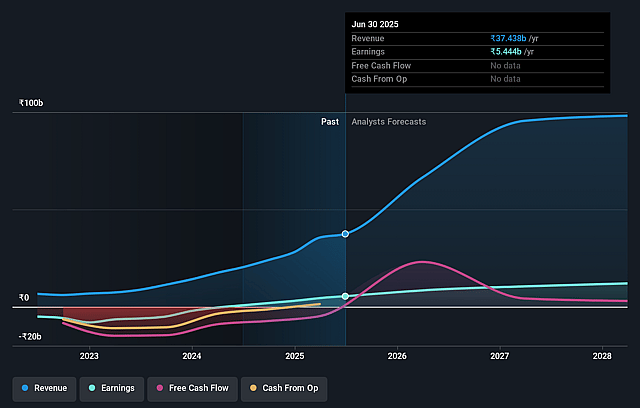

Inox Wind Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Inox Wind compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Inox Wind's revenue will grow by 37.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 14.5% today to 13.8% in 3 years time.

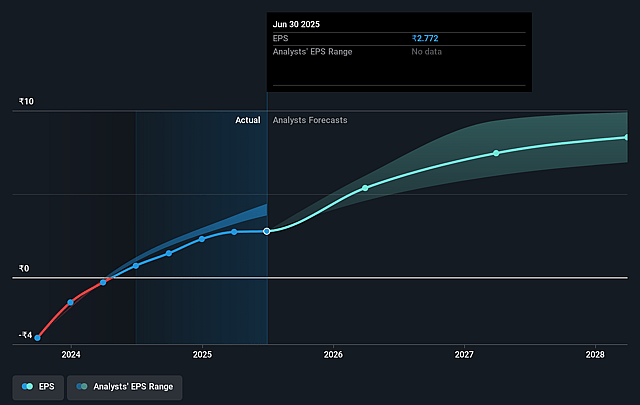

- The bearish analysts expect earnings to reach ₹13.5 billion (and earnings per share of ₹8.05) by about September 2028, up from ₹5.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 38.5x on those 2028 earnings, down from 46.3x today. This future PE is greater than the current PE for the IN Electrical industry at 37.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.91%, as per the Simply Wall St company report.

Inox Wind Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition in the wind and hybrid renewable sector, including the entry of new EPC players, could put pressure on Inox Wind's market share and realization per megawatt, potentially impacting future revenues and margins.

- The ongoing shift in industry economics, where solar energy offers lower per-megawatt O&M revenues and margins (₹2 lakh per megawatt, around 20% margin compared to wind's ₹8–10 lakh per megawatt and 45–50% margin), means an increasing solar mix could dilute blended profitability and earnings growth.

- The company's continued need for capacity expansion-such as new nacelle and blade plants-requires significant ongoing capital expenditure, raising the risk that returns on invested capital may be pressured if market growth under-delivers, ultimately weighing on net margins and free cash flow.

- Management repeatedly emphasizes profitability over volume, sometimes downplaying declines in relative execution growth or market share, which could lead to future earnings stagnation if revenue growth does not match profit guidance expectations, especially when industry peers are recording faster capacity additions.

- High working capital requirements, with guidance for net working capital days around 120, along with delayed cash flows from O&M contracts (which only start after a two-year warranty period), can create pressure on liquidity and constrain the company's ability to invest in growth, directly affecting both earnings quality and return metrics.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Inox Wind is ₹158.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Inox Wind's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹281.0, and the most bearish reporting a price target of just ₹158.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹98.1 billion, earnings will come to ₹13.5 billion, and it would be trading on a PE ratio of 38.5x, assuming you use a discount rate of 15.9%.

- Given the current share price of ₹145.82, the bearish analyst price target of ₹158.0 is 7.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.