Last Update19 Aug 25Fair value Decreased 12%

The consensus price target for Inox Wind has been lowered to ₹206.00, primarily reflecting concerns about declining net profit margins, despite strengthened revenue growth forecasts.

What's in the News

- Inox Wind announced a 51 MW order from First Energy Private Limited for 3 MW turbines in Tamil Nadu, including EPC and multi-year O&M services.

- The board is considering and proceeding with a rights issue, including determining record date, issue price, rights entitlement ratio, and related matters.

- Inox Wind filed a follow-on equity offering totaling INR 12.5 billion through a rights offering under Regulation S.

- Appointment of Shri Sanjeev Aganval as CEO, replacing Kailash Lal Tarachandani.

- Upcoming board meetings to approve unaudited Q1 FY26 results, appoint secretarial auditors, and consider ESOP grants.

Valuation Changes

Summary of Valuation Changes for Inox Wind

- The Consensus Analyst Price Target has significantly fallen from ₹235.57 to ₹206.00.

- The Net Profit Margin for Inox Wind has significantly fallen from 13.29% to 11.30%.

- The Consensus Revenue Growth forecasts for Inox Wind has significantly risen from 46.4% per annum to 51.5% per annum.

Key Takeaways

- Supportive regulations and rising renewable adoption boost order pipeline, revenue growth, and market share for Inox Wind while ensuring long-term sector tailwinds.

- Operational expansion, integrated services, and strong capital base position the company for margin improvement, recurring revenues, and reduced financial risk.

- Persistent operational, financial, and competitive challenges threaten long-term revenue growth, profitability, and shareholder returns despite sectoral tailwinds and business expansion efforts.

Catalysts

About Inox Wind- Engages in the manufacture and sale of wind turbine generators and components for independent power producers, utilities, public sector undertakings, businesses, and private investors in India.

- Recent government policies-including the ALMM mandate for wind components and new CERC regulations enabling hybridization of solar and wind projects-provide material regulatory tailwinds for domestic wind OEMs like Inox Wind, creating an expanded addressable market and strengthening the order pipeline. This is expected to drive both top-line revenue growth and market share gains.

- India's strong, multi-year push toward decarbonization and large-scale renewable energy capacity additions through 2030 (with wind projected to grow from 5–6 GW/year currently to 8–10 GW/year) ensures sustained sector growth, supporting Inox Wind's robust order backlog, greater visibility on execution, and predictable revenue growth.

- The company's operational ramp-up-including a new fully-operational nacelle plant, transformer unit, additional blade manufacturing in South India, and in-house crane deployment-is set to enhance execution speed and supply chain security, translating into improved operating leverage and an increase in EBITDA margin guidance (now 18–19% for FY26).

- The ability to offer integrated, high-margin services (O&M, EPC, infrastructure solutions) and to capitalize on the industry's move toward hybrid/round-the-clock projects positions Inox Wind to generate growing annuity/recurring revenue streams, supporting earnings stability and long-term profitability improvement.

- Strong capital position post-rights issue, promoter commitment, and progress on asset-light initiatives (such as infrastructure business demerger and inorganic O&M portfolio expansion) reduce financial risk and provide the flexibility to fund growth, further supporting both margin resilience and long-term net earnings growth.

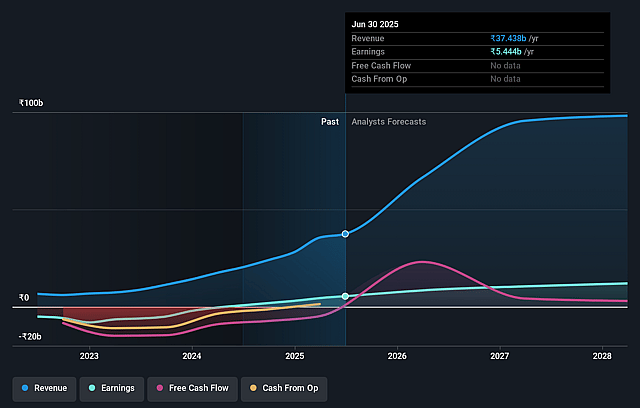

Inox Wind Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Inox Wind's revenue will grow by 52.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.5% today to 10.7% in 3 years time.

- Analysts expect earnings to reach ₹14.1 billion (and earnings per share of ₹8.22) by about September 2028, up from ₹5.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 48.1x on those 2028 earnings, up from 45.9x today. This future PE is greater than the current PE for the IN Electrical industry at 36.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.91%, as per the Simply Wall St company report.

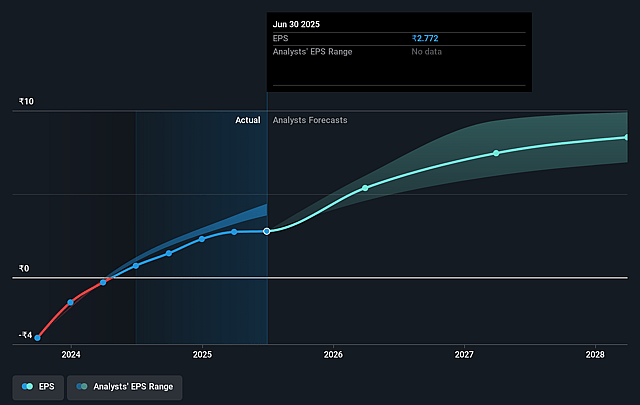

Inox Wind Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Execution risk remains a concern, as the company repeatedly faced questions about low megawatt installation growth relative to both prior quarters and some peers; persistent operational lags or inability to scale production and deployment to match order book could directly constrain revenue and earnings growth over the long term.

- High working capital and receivables days continue to be flagged by analysts and acknowledged by management-if not managed well, this could restrict cash flow, limit the ability to fund rapid expansion, or force the company to incur higher financing costs, which would compress net margins.

- The wind sector, while currently seeing positive tailwinds and government support, is exposed to technological shifts and competition from other renewables (notably solar and battery storage), with industry commentary indicating that solar+storage solutions may become increasingly cost-competitive; this can reduce the addressable market for wind and directly pressure revenue growth over a multi-year period.

- Increasing competition, with new entrants in wind EPC (as highlighted by investor questions) and the potential for global OEMs to enter or expand in India, could lead to pricing pressure, lower realizations per megawatt, and margin compression-impacting long-term profitability and earnings quality.

- Significant equity dilution from capital raises (such as rights issues) carries the structural risk that future profit growth may not proportionally translate into per-share value for shareholders, thus undermining long-term EPS growth and potentially constraining share price appreciation despite underlying business expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹206.571 for Inox Wind based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹281.0, and the most bearish reporting a price target of just ₹158.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹131.9 billion, earnings will come to ₹14.1 billion, and it would be trading on a PE ratio of 48.1x, assuming you use a discount rate of 15.9%.

- Given the current share price of ₹144.71, the analyst price target of ₹206.57 is 29.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.