Last Update09 Oct 25Fair value Increased 15%

Analysts have raised their fair value price target for V.S.T. Tillers Tractors from ₹4,353 to ₹4,989, citing updated assumptions around discount rates and future price-to-earnings multiples.

What's in the News

- V.S.T. Tillers Tractors launched the FENTM Tractor Series, featuring five new compact, fuel-efficient, high-torque models for modern farmers (Key Developments).

- The FENTM series offers models ranging from 18.5 to 29 HP with both 2 Wheel Drive and 4 Wheel Drive options. The focus is on versatility, productivity, and long-term value (Key Developments).

- Core features of the FENTM lineup include enhanced pulling power at lower RPM, high-capacity engines, and rapid field coverage for greater productivity (Key Developments).

- The Board of V.S.T. Tillers Tractors scheduled a meeting on August 11, 2025, to consider and approve the unaudited financial results for the quarter ending June 30, 2025 (Key Developments).

Valuation Changes

- The consensus analyst price target has increased from ₹4,353 to ₹4,989, reflecting a moderate upward revision.

- The discount rate has risen slightly from 14.53% to 14.72%, indicating a minor increase in the risk assumption.

- The revenue growth projection remains unchanged at 11.89%.

- The net profit margin projection is stable at 12.08%.

- The future P/E multiple has increased from 28.45x to 32.77x, suggesting higher expected earnings valuation.

Key Takeaways

- Reliance on sustained demand, government support, and rapid innovation creates downside risk if policy, market momentum, or execution falters.

- Export ambitions and diversification efforts face headwinds from logistics, competition, and uncertain overseas demand, limiting long-term growth prospects.

- Strategic retail financing, diverse product launches, geographic expansion, operational efficiency, and industry trends position the company for sustained revenue growth and margin improvements.

Catalysts

About V.S.T. Tillers Tractors- Manufactures and trades agriculture machinery in India and internationally.

- The stock appears to embed expectations of a sustained, steep growth trajectory for power tillers and weeders, supported by ongoing mechanization of Indian agriculture, rural income growth, and increasing availability of retail finance. While secular demand drivers are strong, record quarterly growth (90%+ in tillers, 60%+ in weeders) may not be repeatable, raising risks of near-term revenue disappointment if the current momentum moderates post-monsoon or retail financing penetration plateaus.

- Valuations seem to assume that government support (subsidies, smoother utilization, rural development policies) will remain robust and non-volatile, underpinning margins and sales volumes. However, if there is any policy rationalization, reduction in subsidy outlay, or slow subsidy disbursement, especially amidst fiscal pressures, both revenue growth and margin expansion could stall.

- The market may be overestimating export growth potential and diversification benefits, despite management's push into Europe, U.S., and with the Zetor brand. Export tractor volumes declined 20% this quarter, with unresolved logistics, rotation of capital, and tariff uncertainties-indicating that long-term revenue contribution from exports could disappoint, particularly if economic or regulatory headwinds persist.

- Implied growth and profitability expectations may not fully account for intensifying competition from global OEMs and low-cost Chinese entrants, increasing risk of price wars, market share erosion, and margin compression-especially if V.S.T.'s rapid product launches (including electric, digital, and higher HP products) face delays or do not sufficiently differentiate from rivals.

- Current pricing reflects optimistic assumptions about the company's ability to rapidly innovate and execute a complex new product pipeline (20+ launches in 24 months), scale aftersales/service infrastructure, and manage operational efficiency improvements; execution risks remain high, and any delays, quality issues, or inability to capture recurring revenue streams could negatively impact both EBITDA margins and long-term earnings growth.

V.S.T. Tillers Tractors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming V.S.T. Tillers Tractors's revenue will grow by 11.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.6% today to 12.1% in 3 years time.

- Analysts expect earnings to reach ₹1.8 billion (and earnings per share of ₹189.25) by about September 2028, up from ₹1.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.5x on those 2028 earnings, down from 38.5x today. This future PE is lower than the current PE for the IN Machinery industry at 32.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.53%, as per the Simply Wall St company report.

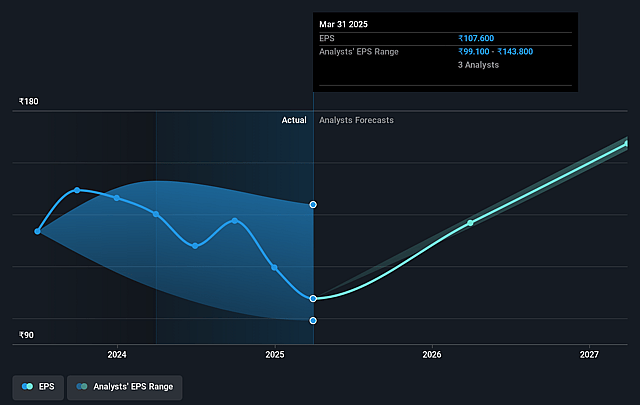

V.S.T. Tillers Tractors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Expansion of retail financing for power tillers from nearly 0% to a target of 30–40% in the next two years, along with increased participation from major financial institutions (e.g., Bajaj Finserv, Cholamandalam, Shriram), will greatly enhance affordability and accessibility for small and marginal farmers-driving strong demand, higher sales volumes, and supporting revenue growth.

- Aggressive product launch pipeline of more than 20 new products (including electric tillers, weeders, compact tractors, and new Zetor models) over the next two years positions V.S.T. to capture emerging demand trends in both IC engine and electric platforms, allowing for robust topline growth and potential market share gains while also supporting profit margins through product innovation.

- Entry and ramp-up in new geographies-especially ongoing "One VST" expansion in the northern Indian markets (like Uttar Pradesh) and efforts to resolve European export logistics by setting up a base there-will diversify revenue streams, reduce dependence on any single market, increase addressable market, and mitigate earnings volatility.

- Continued operational leverage shown by a jump in operational EBITDA margins (from 7% to 13.3% YoY) and focused efforts on cost control and efficient supply chain (such as TOC methodology in distribution) bolster net margin expansion and profitability resilience, supporting sustainable improvement in bottom-line earnings.

- Structural tailwinds from favorable macro trends-such as rising rural incomes, increasing mechanization needs of a large base of small/marginal farmers, and government support (timely subsidy flows)-indicate a secular growth trajectory for farm mechanization, underpinning robust long-term demand for V.S.T.'s core products and providing visibility for consistent revenue and earnings growth over the next several years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹4353.0 for V.S.T. Tillers Tractors based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹5800.0, and the most bearish reporting a price target of just ₹2445.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹15.2 billion, earnings will come to ₹1.8 billion, and it would be trading on a PE ratio of 28.5x, assuming you use a discount rate of 14.5%.

- Given the current share price of ₹5108.1, the analyst price target of ₹4353.0 is 17.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.