Key Takeaways

- Shrinking rural labor and climate volatility threaten future demand and revenue growth, exposing reliance on vulnerable farmer incomes and government policies.

- Aggressive niche product launches and international expansion face market saturation, competition, logistics obstacles, and policy risks, potentially compressing margins and stalling topline growth.

- Increased retail financing, innovative product launches, and expansion into new domestic and international markets are set to drive sustained growth and margin protection.

Catalysts

About V.S.T. Tillers Tractors- Manufactures and trades agriculture machinery in India and internationally.

- The shrinking rural labor force in India, driven by rapid urbanization and an aging population, threatens to contract the company's core market of smallholder farmers over the long term, likely leading to stagnating or declining revenue growth once the current short-term financing-fueled sales momentum fades.

- Intensifying climate volatility, with more frequent droughts, floods, and unpredictable monsoons, will reduce agricultural output and farmer incomes, creating structural headwinds for future sales of affordable mechanization products and undermining sustainable demand.

- Planned aggressive product launches, with over 20 new models in the next two years largely centered on small farm machines and compact tractors, may oversaturate a niche market that is increasingly vulnerable to competition from larger, more diversified players, resulting in margin compression and underutilized R&D spend.

- Heavy reliance on government subsidies, favorable interest rates, and improved financing penetration for marginal customers exposes V.S.T. Tillers Tractors to significant policy risk; any reduction or withdrawal of these programs could trigger sharp drops in both volumes and receivables quality, eroding future earnings.

- International expansion efforts remain hindered by persistent logistics bottlenecks, regulatory uncertainty, and trade barriers such as U.S. tariffs and European shipping delays; with product launches and scale-up timelines already delayed and competitive disadvantage versus global peers accelerating, international revenue contribution is at risk of underperforming expectations, thereby limiting long-term top-line growth.

V.S.T. Tillers Tractors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on V.S.T. Tillers Tractors compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming V.S.T. Tillers Tractors's revenue will grow by 10.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 10.6% today to 11.7% in 3 years time.

- The bearish analysts expect earnings to reach ₹1.7 billion (and earnings per share of ₹201.45) by about September 2028, up from ₹1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 16.9x on those 2028 earnings, down from 38.5x today. This future PE is lower than the current PE for the IN Machinery industry at 32.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.53%, as per the Simply Wall St company report.

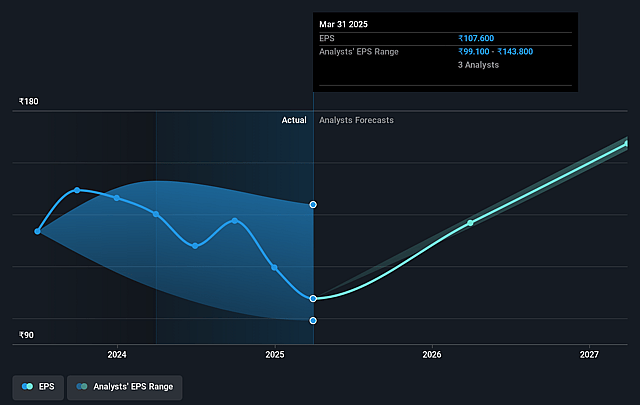

V.S.T. Tillers Tractors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's rapid expansion in retail financing availability for small and marginal farmers could unlock significant pent-up demand for mechanization, enhancing V.S.T. Tillers Tractors' long-term revenues as financing penetration targets rise from 10 percent now to potentially 30–40 percent in the next two years.

- Product innovation momentum, highlighted by the upcoming launch of more than 20 new products-including electric and technologically advanced tillers, weeders, and compact tractors-is likely to strengthen the company's portfolio and support higher margin growth through a differentiated offering.

- Entry into major underpenetrated regional markets such as Northern India and continued efforts to scale the weeder and reaper business could broaden the company's addressable market, sustaining healthy top-line revenue growth for several years.

- Plans for international expansion with a dedicated operations base in Europe and potential entry into the United States position V.S.T. Tillers Tractors to diversify its revenue streams and reduce over-reliance on domestic Indian demand, supporting more resilient long-term earnings.

- Rising government support-in the form of timely subsidy flows and policy incentives for farm mechanization-along with the company's improving supply chain and distribution strategy, are likely to underpin sustained demand and protect EBITDA margins in volatile environments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for V.S.T. Tillers Tractors is ₹2445.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of V.S.T. Tillers Tractors's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹5800.0, and the most bearish reporting a price target of just ₹2445.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹14.8 billion, earnings will come to ₹1.7 billion, and it would be trading on a PE ratio of 16.9x, assuming you use a discount rate of 14.5%.

- Given the current share price of ₹5108.1, the bearish analyst price target of ₹2445.0 is 108.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on V.S.T. Tillers Tractors?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.