Key Takeaways

- Expansion in retail finance, new product launches, and entry into higher-value segments are set to structurally raise revenue and market share, especially with farm consolidation.

- Technology innovation and deeper rural penetration, supported by government policies and rising mechanization, underpin sustained growth in margins, operating leverage, and cash flow.

- Heavy exposure to shrinking rural markets, shifting technologies, and volatile subsidies heightens risks to revenue stability, margins, and long-term growth prospects.

Catalysts

About V.S.T. Tillers Tractors- Manufactures and trades agriculture machinery in India and internationally.

- Analysts broadly agree that rising retail finance penetration for small farmers could drive incremental sales, expecting it to reach 15 to 20 percent, but management now targets up to 40 percent within two years, which could unlock a step-function increase in addressable market, rapid volume growth, and a structural lift in company-wide revenue.

- Analyst consensus cites Zetor tractor scale-up, but the transformation is understated: after initial product refinements and seeding, V.S.T.'s planned ramp-up in the high horsepower segment positions it to capture disproportionate share as farm consolidation accelerates, creating potential for high-margin revenue streams and a sustained boost to earnings above current projections.

- Management's commitment to launch more than 20 new products-including electric and hybrid tillers, innovative platforms between tillers and tractors, and enhanced compact models for Indian and international markets-could materially strengthen V.S.T.'s technology leadership, expand its product mix, and drive both revenue and margin expansion over the long term.

- The accelerating mechanization of agriculture among small and marginal farmers, combined with government-backed, on-time subsidy flow, fuels a structural, multi-year surge in demand for power tillers and weeders; this dynamic, supported by deep distribution, can deliver outsized volume growth and sustainable improvement in operating leverage and profitability.

- Swift expansion into the northern Indian market-where V.S.T. is deploying the One VST project and leveraging underpenetrated rural regions-coincides with rural electrification, rising incomes, and increased farm professionalization, setting the stage for exponential growth in market share, higher working capital efficiency, and robust compounding of cash flows.

V.S.T. Tillers Tractors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on V.S.T. Tillers Tractors compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming V.S.T. Tillers Tractors's revenue will grow by 11.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.6% today to 11.8% in 3 years time.

- The bullish analysts expect earnings to reach ₹1.7 billion (and earnings per share of ₹201.98) by about September 2028, up from ₹1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 40.0x on those 2028 earnings, down from 40.2x today. This future PE is greater than the current PE for the IN Machinery industry at 31.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.53%, as per the Simply Wall St company report.

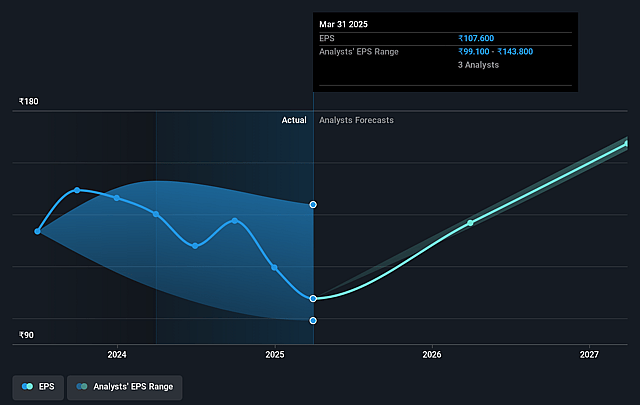

V.S.T. Tillers Tractors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating rural-to-urban migration and contraction in the small farm ownership segment could significantly reduce V.S.T. Tillers Tractors' core customer base for small tractors and power tillers, putting future revenue growth at risk if the rural market continues to shrink over the long term.

- There is strong reliance on the small farm mechanization (SFM) business and traditional products like power tillers and compact tractors, which makes the company vulnerable to market saturation, shifts towards alternative (e.g., electric or sustainable) technologies, and changing customer preferences, threatening both revenue stability and long-term earnings power.

- Climate change–related risks, including increasingly erratic monsoons, droughts, and floods, can negatively impact farm incomes, leading to reduced investment in new machinery and potential declines in both sales volumes and overall revenue.

- Intensifying competition from domestic low-cost manufacturers, global players, and new technology-driven agritech start-ups offering connected, precision, or autonomous solutions could exert downward pressure on prices and erode legacy market share, directly impacting net margins and profitability.

- The company's growing dependence on rural subsidies and government procurement for sales makes financial results highly sensitive to changes in policy or government budget allocations, which may inject significant volatility into revenue streams and overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for V.S.T. Tillers Tractors is ₹5800.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of V.S.T. Tillers Tractors's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹5800.0, and the most bearish reporting a price target of just ₹2445.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹14.8 billion, earnings will come to ₹1.7 billion, and it would be trading on a PE ratio of 40.0x, assuming you use a discount rate of 14.5%.

- Given the current share price of ₹5340.05, the bullish analyst price target of ₹5800.0 is 7.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on V.S.T. Tillers Tractors?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.