Key Takeaways

- Unique positioning to benefit from farm mechanization and rapid expansion in underpenetrated markets is expected to drive recurring revenue and premium margin gains long-term.

- Strategic moves in product innovation, integrated distribution, and exports are set to diversify revenues and push profitability beyond cyclical agricultural equipment sales.

- Overdependence on shrinking domestic markets and lagging adaptation to industry trends may constrain growth, margins, and expose V.S.T. Tillers Tractors to heightened earnings volatility.

Catalysts

About V.S.T. Tillers Tractors- Manufactures and trades agriculture machinery in India and internationally.

- Analyst consensus expects strong growth from new product launches and government spending in Q4 FY '25, but this likely understates the long-term structural demand as V.S.T. is uniquely positioned to capitalize on accelerating farm mechanization in India, which is set to deliver outsized volume growth and recurring revenue gains as small/marginal farmers mechanize nationwide over multiple years.

- While the consensus highlights the expansion of the VST ZETOR high HP line, the market may not fully appreciate the speed at which V.S.T. is ramping up distribution and product variants-once its Northern and Western dealer networks mature, the company could gain significant market share, sharply boosting tractor revenues and improving blended gross margins due to higher ASPs in premium segments.

- Rapid penetration into untapped Northern Indian markets using the One VST integrated dealer model, alongside a five-pronged approach of awareness, finance, training, product accessibility and distribution, positions the company to generate exponential growth in tiller and weeder sales; this can lead to a step change in revenue growth and higher working capital efficiency, as seen by rising financed sales.

- Sustained investments in domestic precision component manufacturing, combined with a China Plus One export strategy, may unlock a significant high-margin external revenue stream that diversifies away from cyclical agri-equipment sales and provides durable uplift to company-level EBITDA margins and earnings quality.

- V.S.T.'s aggressive ramp in localized, electric-powered and small-farm machine product categories addresses the dual tailwinds of rising land fragmentation and government modernization incentives, setting the stage for durable, premium-margin leadership in next-generation agri-equipment-expanding both addressable market size and long-term profitability.

V.S.T. Tillers Tractors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on V.S.T. Tillers Tractors compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming V.S.T. Tillers Tractors's revenue will grow by 16.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.3% today to 12.0% in 3 years time.

- The bullish analysts expect earnings to reach ₹1.9 billion (and earnings per share of ₹219.39) by about July 2028, up from ₹929.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.5x on those 2028 earnings, down from 44.3x today. This future PE is lower than the current PE for the IN Machinery industry at 34.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.3%, as per the Simply Wall St company report.

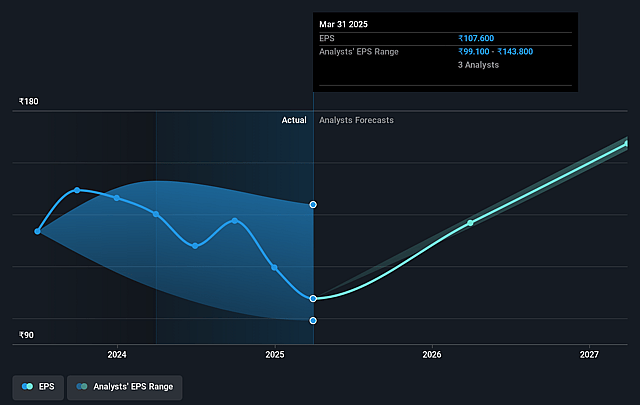

V.S.T. Tillers Tractors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- As rural-urban migration accelerates and India's rural population declines, the traditional small and marginal farmer customer base for V.S.T. Tillers Tractors could shrink, putting long-term downward pressure on domestic sales volumes and thus weakening future revenue growth.

- The company is experiencing only limited success in higher horsepower segments, with management noting penetration challenges and potential for slower growth than the overall tractor industry, which points to a risk that V.S.T. could miss out on faster-growing, more profitable market segments and face margin stagnation.

- Export markets pose ongoing risks, as seen in the company's declining European tractor volumes and continued logistical/geopolitical headwinds, and with V.S.T. still lacking deep global diversification, this heightens exposure to Indian agricultural cyclicality and results in potentially volatile and unpredictable earnings.

- A heavy reliance on entry-level, low-horsepower tillers and compact tractors, combined with industry trends favoring larger, more advanced and electrified equipment, threatens to erode V.S.T.'s market position, restrict average selling price growth, and limit net margin expansion over the long term.

- Compliance costs and the need for accelerated R&D spending are likely to rise due to tightening emission regulations and the industry's shift towards electric and autonomous equipment; V.S.T.'s disclosed slow product expansion and delayed launch timelines could leave it trailing better-capitalized competitors, with negative implications for both margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for V.S.T. Tillers Tractors is ₹5000.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of V.S.T. Tillers Tractors's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹5000.0, and the most bearish reporting a price target of just ₹2445.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹15.8 billion, earnings will come to ₹1.9 billion, and it would be trading on a PE ratio of 31.5x, assuming you use a discount rate of 14.3%.

- Given the current share price of ₹4766.15, the bullish analyst price target of ₹5000.0 is 4.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.