Key Takeaways

- Expansion into new markets, product innovation, and distribution growth are set to drive diversification, reduce dependence on Indian agriculture, and boost future revenues.

- Technology upgrades, operational efficiencies, and premium product offerings aim to improve margins, support profitability, and strengthen long-term competitive positioning.

- Lagging innovation, margin pressures, dependence on subsidies, and export challenges could hinder growth, threaten market share, and strain long-term profitability relative to competitors.

Catalysts

About V.S.T. Tillers Tractors- Manufactures and trades agriculture machinery in India and internationally.

- The company has made substantial investments in R&D and product development, and plans to launch multiple new tractor models and small farm machine variants—especially in higher horsepower, electric, and globally competitive compact tractors—which are expected to drive both volume growth and improved realizations, directly supporting revenue growth and the potential for higher margins as value-added products scale.

- VST’s entry into and rapid expansion within new geographic markets such as North India (a historically underpenetrated region), and international markets like Europe, the U.S., and Africa, combined with an increasing distribution network, provides significant headroom for market share gains and revenue diversification, making future top-line growth less dependent on Indian rural cycles.

- The ongoing structural trend of labor shortages in agriculture, along with government policy encouraging mechanization, is increasing the demand for VST’s mechanized solutions (tillers, weeders, reapers), which, coupled with the company’s success in scaling newer categories like power weeders (63% growth) and power reapers, points to sustained or accelerating revenue growth in their core markets.

- The development and internalization of manufacturing for precision components and India-made weeders, as well as operational improvements like distributed manufacturing and backward integration, are set to reduce input costs, improve supply chain efficiency, and shield margins from volatility, supporting better net profitability and margin expansion.

- The company’s focus on technology upgrades (including electrification, digital integration, and compliance with global emission norms) positions it to capitalize on industry shifts toward sustainable and technologically advanced equipment—potentially allowing it to defend or expand margins in a landscape favoring early innovators, and to grow future earnings from premium product sales.

V.S.T. Tillers Tractors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming V.S.T. Tillers Tractors's revenue will grow by 14.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.3% today to 11.8% in 3 years time.

- Analysts expect earnings to reach ₹1.8 billion (and earnings per share of ₹203.78) by about July 2028, up from ₹929.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.4x on those 2028 earnings, down from 39.7x today. This future PE is lower than the current PE for the IN Machinery industry at 34.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.29%, as per the Simply Wall St company report.

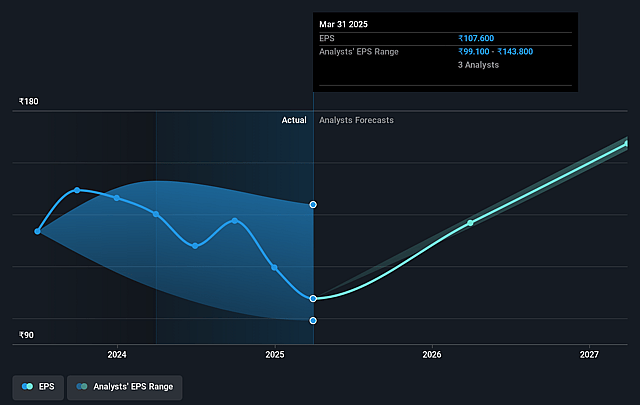

V.S.T. Tillers Tractors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Export growth remains challenged by ongoing logistical uncertainties and international trade disruptions, particularly affecting key markets like Europe, and U.S. tariffs are impacting near-term export volumes, which could constrain revenue diversification and dampen overall top-line growth if not resolved.

- The core small-horsepower tractor segment in India has seen little structural growth in recent years, while market expansion is concentrated in higher horsepower ranges; V.S.T. currently lags larger competitors in these segments, risking slower-than-industry growth rates and potential market share loss; this may lead to stagnant revenues or underperformance relative to sector peers.

- Margin pressures are evident: despite commodity price benefits, gross margin declined due to a less favorable geographic/product mix and price controls linked to government subsidies in certain regions; rising operational and R&D investments are also compressing net margins and could place downward pressure on earnings if not offset by strong volume or pricing improvements.

- High dependence on government subsidy schemes (e.g., SPARSH) and their timely implementation exposes the company to policy execution risks; delays or disruptions have already impacted cash flow, led to an increase in receivables, and contributed to working capital challenges, potentially affecting near-term liquidity and profitability.

- The company's product launches targeting export markets and higher HP segments are staggered over multiple years (some not launching until FY27), while rapid technological advancement and competition from global giants require substantial ongoing investment; delays or execution risks here could cause V.S.T. to fall further behind, eroding competitive advantage, compromising future revenue visibility, and impacting long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹3886.25 for V.S.T. Tillers Tractors based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹5000.0, and the most bearish reporting a price target of just ₹2445.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹14.9 billion, earnings will come to ₹1.8 billion, and it would be trading on a PE ratio of 26.4x, assuming you use a discount rate of 14.3%.

- Given the current share price of ₹4266.1, the analyst price target of ₹3886.25 is 9.8% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.