Key Takeaways

- Diversifying into non-microfinance segments and strengthening the deposit base are reducing risk, stabilizing earnings, and supporting higher net interest margins.

- Digital innovations and a favorable macro environment are driving operational efficiencies, supporting growth in revenue, fee income, and long-term profitability.

- Elevated credit risk in microfinance, margin pressure, intense competition, geographic concentration, and legacy portfolio stress threaten profitability, growth, and stability.

Catalysts

About Bandhan Bank- Engages in the provision of banking and financial services for personal and business customers in India.

- The ongoing recovery and expected normalization in the microfinance (EEB) portfolio, aided by disciplined implementation of new industry guardrails and improving asset quality, should restore above-industry loan growth from Q3 FY26 onwards-supporting topline revenue and loan growth.

- Continued strong growth in the bank's non-EEB segments-especially secured retail, housing, and wholesale banking loans (growing 27%+ YoY)-and further asset mix diversification are likely to reduce concentration risk and credit costs, leading to more stable earnings and improved net interest margins.

- Robust growth in retail term deposits (up 34% YoY) and the strategic shift towards a more granular, stable deposit base, alongside targeted efforts to boost CASA, are expected to lower funding costs, improving net interest margins and supporting profitability.

- Investments in digital collections (e.g., WhatsApp communication, QR-based customer payments), process automation, and advanced analytics are poised to drive further operational efficiencies, reduce cost-to-income ratios, and enhance overall net margins.

- The supportive macro environment-marked by resilient GDP growth, falling interest rates, government-backed financial inclusion efforts, and rising per capita incomes-should fuel greater demand for formal credit, deposit products, and fee-based services, benefitting revenue and fee income streams and underpinning long-term earnings power.

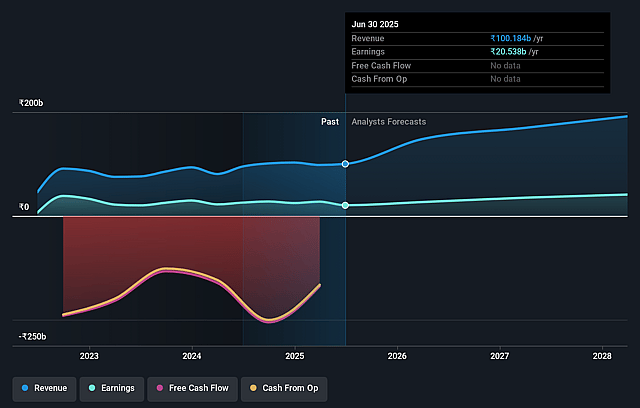

Bandhan Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bandhan Bank's revenue will grow by 28.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 20.5% today to 19.3% in 3 years time.

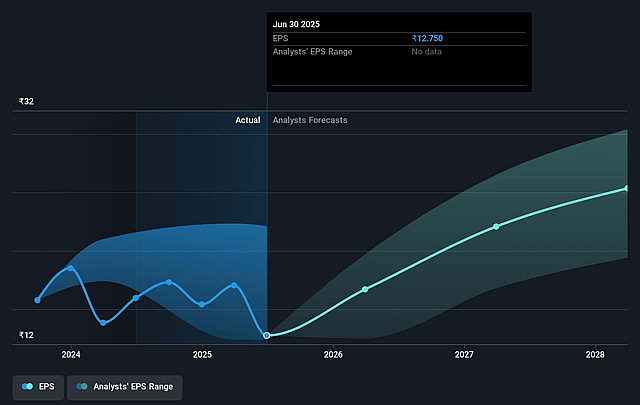

- Analysts expect earnings to reach ₹40.9 billion (and earnings per share of ₹24.53) by about August 2028, up from ₹20.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹49.0 billion in earnings, and the most bearish expecting ₹31.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.5x on those 2028 earnings, down from 13.0x today. This future PE is lower than the current PE for the IN Banks industry at 12.2x.

- Analysts expect the number of shares outstanding to decline by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.95%, as per the Simply Wall St company report.

Bandhan Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistently high credit risk in the microfinance (EEB) portfolio-evidenced by elevated slippages, high NPA ratios, ongoing technical write-offs, and management's expectation that EEB challenges will persist at least into the next quarter-could lead to continued elevated provisioning and impairments, which may weigh on net margins and earnings.

- Margin (NIM) compression is likely to continue in the near to medium term due to a combination of asset mix shift towards lower-yielding secured loans, declining microfinance yields (with no scope for rate hikes), and moderating cost reductions; this reduces profitability potential even if overall loan growth resumes.

- Intense competition and tightening regulatory guardrails in core microfinance geographies and segments have led to higher rejection rates (16-18% of loan applicants now ineligible), regional growth challenges (e.g., muted growth in Tamil Nadu and Karnataka), and constrain both volume and pricing power, impeding revenue growth and customer acquisition.

- Bandhan Bank remains highly geographically concentrated in eastern India (West Bengal and Bihar representing substantial portions of assets and liabilities), making it particularly vulnerable to local economic shocks, policy interventions, or political disruptions, elevating risk to asset quality and causing earnings volatility.

- The bank's old vintage unsecured and group lending portfolios are increasingly showing stress-with NPA ratios in aged books and some retail and housing portfolios rising-indicating that incomplete asset mix diversification and legacy portfolio issues may continue to drag on normalized profitability and pose risks to long-term revenue and margin recovery.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹192.417 for Bandhan Bank based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹225.0, and the most bearish reporting a price target of just ₹130.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹212.5 billion, earnings will come to ₹40.9 billion, and it would be trading on a PE ratio of 11.5x, assuming you use a discount rate of 14.9%.

- Given the current share price of ₹166.13, the analyst price target of ₹192.42 is 13.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.