Key Takeaways

- Lower funding costs, rapid portfolio securitization, and tech-led advances in digital banking are expected to drive strong, sustainable margin and net income improvement.

- Expansion into non-microfinance segments and underbanked regions positions the bank for robust, less cyclical loan growth and accelerated fee income.

- Heavy reliance on microfinance and regional concentration exposes Bandhan Bank to credit, competition, and demographic risks, threatening revenue growth, margins, and long-term stability.

Catalysts

About Bandhan Bank- Engages in the provision of banking and financial services for personal and business customers in India.

- Analyst consensus expects growth in stable retail deposits and funding cost benefits, but deposit growth has continually outpaced loan growth with retail term deposits growing 30 percent year-on-year and retail plus CASA now at 69 percent of total, indicating the bank is on track for an even lower cost of funds and a sharper improvement in net interest margin than widely forecast.

- While analyst consensus views the shift to 55 percent secured loans as a moderate NPA/credit cost benefit, the secured book has already surged to 50.5 percent of advances with secured portfolio growth far outpacing total advances, suggesting that credit costs and NIM volatility could drop sooner and to a greater degree than expected, materially lifting net margins and ROA.

- Bandhan Bank's technological transformation-encompassing cloud-native digital core upgrades, AI-driven credit decisioning, and rapid deployment of QR/banking platforms-poises the bank to leapfrog competitors in rural/semi-urban markets where digital adoption is booming, supporting aggressive customer acquisition and non-linear revenue growth.

- The bank's expansion into non-microfinance retail, MSME, and housing-segments growing at a high double-digit pace-combined with ongoing network expansion in underbanked geographies, sets the stage for materially higher sustainable advance growth rates and reduced earnings cyclicality over the next cycle.

- With improving regulatory regime for microfinance, government-led formalization, and Bandhan's leadership position in financial inclusion, the addressable customer base is likely to expand rapidly, driving faster fee income and cross-sell revenue growth, and accelerating overall earnings momentum above consensus for the foreseeable future.

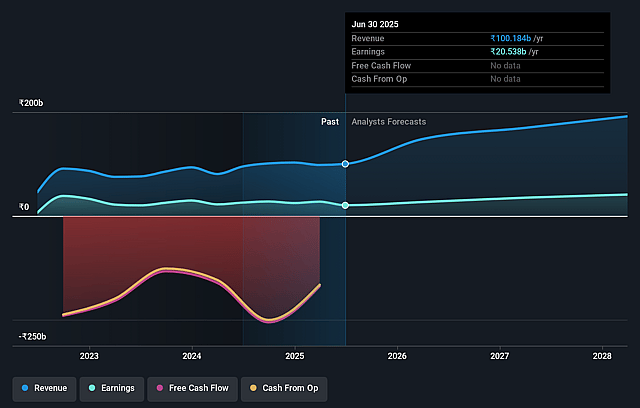

Bandhan Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Bandhan Bank compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Bandhan Bank's revenue will grow by 28.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 25.7% today to 22.6% in 3 years time.

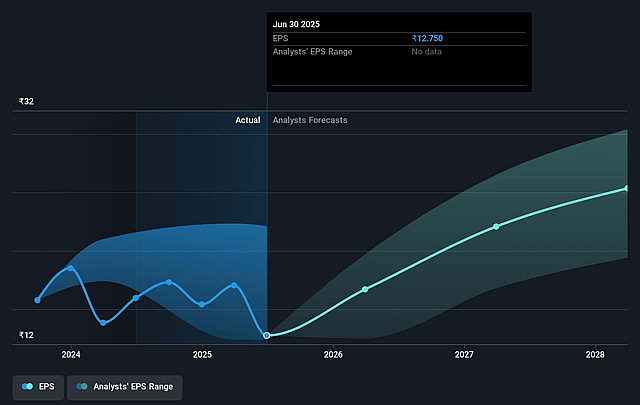

- The bullish analysts expect earnings to reach ₹51.0 billion (and earnings per share of ₹31.79) by about July 2028, up from ₹27.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.7x on those 2028 earnings, up from 10.3x today. This future PE is lower than the current PE for the IN Banks industry at 12.4x.

- Analysts expect the number of shares outstanding to grow by 0.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.57%, as per the Simply Wall St company report.

Bandhan Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increasing shift towards digital payments and fintech platforms is reducing reliance on traditional bank branches, which may constrain Bandhan Bank's historical loan growth and customer retention, ultimately pressuring future revenue streams and fee income.

- Accelerating urbanization and migration trends are shrinking the rural and low-income customer base that underpins Bandhan Bank's microfinance segment, potentially leading to slower loan disbursements and deposits, affecting both top line revenues and deposit growth.

- Bandhan Bank's high dependence on the microfinance segment keeps it vulnerable to elevated credit costs, as evidenced by persistently high GNPA and credit cost ratios; ongoing sectoral stress, regulatory guardrails, and periodic local disruptions could translate into sustained margin compression and volatile earnings.

- Despite some progress in geographic diversification, Bandhan Bank's business continues to be regionally concentrated, especially in West Bengal, which exposes it to localized political, economic, and asset quality risks that could drive higher provisioning requirements and lower net margins.

- Intensifying competition from larger private sector banks and nimble fintech players in underbanked and microloan markets is likely to erode Bandhan Bank's lending yields and customer loyalty, limiting its future profitability and net interest margin improvements.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Bandhan Bank is ₹225.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bandhan Bank's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹225.0, and the most bearish reporting a price target of just ₹130.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹225.9 billion, earnings will come to ₹51.0 billion, and it would be trading on a PE ratio of 10.7x, assuming you use a discount rate of 14.6%.

- Given the current share price of ₹175.59, the bullish analyst price target of ₹225.0 is 22.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.