Key Takeaways

- Aggressive expansion in premium segments, automation, and system-level solutions could drive structurally higher margins and significant competitive gains in alternate fuel and electrification technologies.

- Diversification via aftermarket and mechatronics divisions enhances growth resilience and positions Lumax for strong, compounding earnings and improved revenue stability.

- Reliance on traditional ICE platforms, limited technological advancement, and customer concentration expose Lumax to margin pressure, reduced demand, and lost market share amid rapid EV and OEM-insourcing trends.

Catalysts

About Lumax Auto Technologies- Manufactures and sells automotive components in India.

- Analyst consensus expects margin expansion and revenue synergies from the Greenfuel Energy Solutions integration, but the aggressive local sourcing of tube and fitting products for the first time in India, plus cross-OEM wallet share gains, could trigger far greater-than-anticipated market share capture and margin upside as Lumax becomes the de facto supplier for critical alternate fuel technologies.

- Analysts broadly agree premiumization and the Advanced Plastics business will drive higher value per vehicle, but with a 25% year-on-year growth in Advanced Plastics and strong order book visibility, the pace of shifting to high-margin, design-led components could accelerate, resulting in structurally higher net margins and sustainable asset turns as product mix rapidly shifts to premium segments.

- The company's new strategic investments in software integration and the upcoming Bengaluru SmartHub point to an imminent evolution from a Tier 1 to a Tier 0.5 solutions provider, unlocking the potential for bundled hardware-software offerings and system-level sales, which could significantly increase content per vehicle and recurring revenue through subscription or service models.

- Ongoing automation, capacity expansion, and adoption of global engineering trends via the China sourcing office set the stage for Lumax to respond at scale to large OEM launches, creating major operating leverage that can boost both revenue and margin growth ahead of sector averages, particularly as vehicle electrification and safety-content mandates expand the addressable market.

- Aftermarket and mechatronics divisions are on track for multi-year, above-industry growth rates, with aftermarket CAGRs targeted at 20-25% and mechatronics subsidiaries already doubling revenue year-over-year; this self-reinforcing diversification lowers volatility and primes both earnings and free cash flows for outsized compounding.

Lumax Auto Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Lumax Auto Technologies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Lumax Auto Technologies's revenue will grow by 16.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.8% today to 7.1% in 3 years time.

- The bullish analysts expect earnings to reach ₹4.4 billion (and earnings per share of ₹63.9) by about September 2028, up from ₹1.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 30.6x on those 2028 earnings, down from 40.6x today. This future PE is lower than the current PE for the IN Auto Components industry at 31.4x.

- Analysts expect the number of shares outstanding to decline by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.68%, as per the Simply Wall St company report.

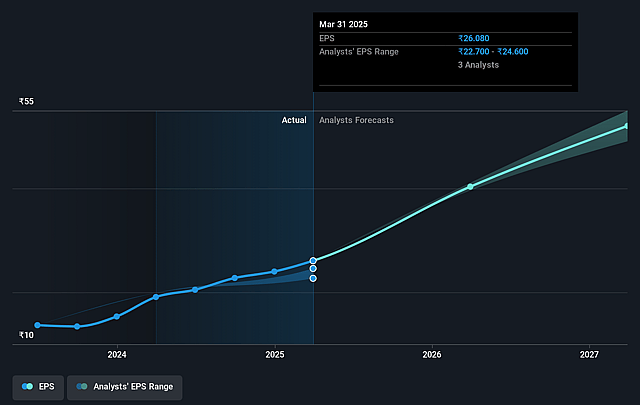

Lumax Auto Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The automotive industry's global shift to electric vehicles is accelerating, while Lumax Auto Technologies' current portfolio-though diversifying-remains significantly exposed to segments (passenger vehicles, 2

- and 3-wheelers, CVs) tied to internal combustion engine platforms; if Lumax cannot rapidly scale next-generation EV components, long-term revenues and market share could be at risk as addressable demand for ICE parts declines.

- A high dependence on a few OEMs, particularly Mahindra & Mahindra, increases bargaining asymmetry and exposes Lumax to pricing pressures, as evidenced by recent delays and negotiations in price corrections for new Mahindra BEV models; sustained client concentration could compress net margins and earnings as OEMs exert greater pricing control during industry slowdowns.

- Despite recent steps to enhance engineering capabilities and local presence in China, the company's relatively modest in-house R&D and limited direct exposure to cutting-edge technologies such as advanced driver-assistance systems and smart mobility solutions may put Lumax at risk of lagging behind more technologically advanced competitors, potentially leading to revenue stagnation and operating margin contraction if OEMs shift business to more innovative suppliers.

- The growing trend of OEMs towards component insourcing and increased localization, especially as global players set up manufacturing in India, poses a threat to Lumax's supplier relationships; this could reduce the available external market for auto components, resulting in lower future revenues.

- Persistent uncertainty in vehicle demand cycles-heightened by global economic instability-and potential industry deceleration could lead to lower production schedules and Capex from OEM clients, further amplifying risks to top-line growth and potentially eroding operating leverage, hurting profitability and earnings growth targets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Lumax Auto Technologies is ₹1300.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Lumax Auto Technologies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1300.0, and the most bearish reporting a price target of just ₹767.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹61.0 billion, earnings will come to ₹4.4 billion, and it would be trading on a PE ratio of 30.6x, assuming you use a discount rate of 14.7%.

- Given the current share price of ₹1115.8, the bullish analyst price target of ₹1300.0 is 14.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.