Last Update 10 Nov 25

LUMAXTECH: Steady Revenue Will Likely Limit Further Share Upside

Narrative Update on Lumax Auto Technologies

Analysts have maintained their price target for Lumax Auto Technologies at ₹1,162.25. They cited slight adjustments in profit margin and discount rate projections, but expect steadier revenue growth to temper upside potential.

What's in the News

- The 'Smart Hub for Innovation and Future Trends' (SHIFT), a new technology centre in Bengaluru focused on electronics engineering and next-generation automotive solutions, has been inaugurated (Key Developments).

- A board meeting was held on November 8, 2025, to consider and approve unaudited financial results for the second quarter and half year ended September 30, 2025, as well as the re-appointments of top executives (Key Developments).

- The relocation of the Accessory business to a new location within Pant Nagar, Uttarakhand has been approved (Key Developments).

Valuation Changes

- Consensus Analyst Price Target remains unchanged at ₹1,162.25.

- Discount Rate increased slightly from 14.76% to 15.48%.

- Revenue Growth lowered from 13.24% to 11.71%.

- Net Profit Margin improved marginally from 7.35% to 7.46%.

- Future P/E decreased slightly from 28.23x to 27.78x.

Key Takeaways

- Strong positioning in electric and alternate fuel components, coupled with localization and advanced manufacturing, supports long-term growth and margin expansion.

- Diversification across products and customers, along with a strategic aftermarket push, stabilizes revenues and boosts higher-margin, non-cyclical income streams.

- Dependence on a few local clients, slow EV adoption, weak export push, and high competition expose the company to significant revenue and margin risks.

Catalysts

About Lumax Auto Technologies- Manufactures and sells automotive components in India.

- The company's sizable order book (₹1,500 crores) with 40% anchored in future and clean mobility solutions (EVs, green fuel, advanced electronics) positions Lumax to benefit from India's rapid shift to electric and alternate fuel vehicles, directly supporting long-term revenue growth and higher-margin business.

- Ongoing premiumization in vehicles and growing wallet share per vehicle (e.g., integration of advanced plastics, mechatronics, and interior electronics) enables Lumax to ride the industry tailwind of rising demand for high-value, technology-intensive components, improving both topline and EBITDA margins over time.

- Strategic localization initiatives and investments in new manufacturing facilities, technology centers (Bangalore SmartHub), and R&D in China align with the "Make in India" drive, enhancing operational efficiency, product competitiveness, and providing future operating leverage that should support sustained margin expansion.

- Diversification across product lines (aftermarket, mechatronics, green fuel) and customers (notably beyond Mahindra, including Tata, Maruti Suzuki, Honda, HMSI, Royal Enfield) reduces dependence on a single OEM or market, insulating revenue streams and providing more stable long-term earnings growth.

- Aggressive focus on the aftermarket, with management targeting 20–25% CAGR in this segment and introducing new localized products (such as tubes and fittings for green fuel), adds non-cyclical revenue sources with higher EBITDA margin potential, contributing positively to future net earnings.

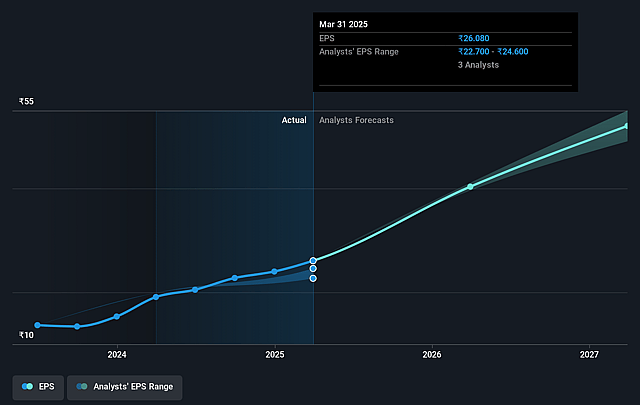

Lumax Auto Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lumax Auto Technologies's revenue will grow by 12.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.8% today to 7.5% in 3 years time.

- Analysts expect earnings to reach ₹4.2 billion (and earnings per share of ₹54.98) by about September 2028, up from ₹1.9 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.3x on those 2028 earnings, down from 38.1x today. This future PE is lower than the current PE for the IN Auto Components industry at 29.3x.

- Analysts expect the number of shares outstanding to decline by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.67%, as per the Simply Wall St company report.

Lumax Auto Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on a few large domestic OEMs-especially Mahindra & Mahindra and Tata Motors-implies high customer concentration risk, making future revenues and earnings vulnerable if Lumax loses major contracts or faces reduced order flow, especially as OEMs consolidate supplier bases.

- Company's primary growth strategy and order book emphasize the domestic market, with limited focus on scaling direct exports or diversifying internationally, which may lead to revenue stagnation or earnings volatility if domestic auto growth underperforms long-term expectations.

- The current product diversification is concentrated in traditional plastics, mechatronics, and alternate fuels, and although EV and clean mobility are mentioned, Lumax's slow and limited penetration in high-growth, EV-specific platforms could erode market share and constrain revenue/margin expansion as vehicle electrification accelerates.

- High industry competition and limited pricing power-evidenced by recent price corrections from customers-could continue to pressure net margins, especially as input prices for materials and electronics rise, eroding profitability in the long term.

- Investments in innovation centers, technology upgrades, and global benchmarking may not be sufficient to match the rapid pace of automation and technological shifts seen in larger global players and EV-specialist suppliers, risking future operational efficiency, cost competitiveness, and margin resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1043.0 for Lumax Auto Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1300.0, and the most bearish reporting a price target of just ₹767.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹56.1 billion, earnings will come to ₹4.2 billion, and it would be trading on a PE ratio of 25.3x, assuming you use a discount rate of 14.7%.

- Given the current share price of ₹1048.0, the analyst price target of ₹1043.0 is 0.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.